Last Update 06 Dec 25

Fair value Increased 4.43%AA: Low Carbon Initiatives And Portfolio Reshaping Will Define Future Performance

Analysts have modestly raised their price target on Alcoa from approximately 39.54 dollars to 41.29 dollars, citing higher long term revenue growth expectations and a richer future earnings multiple, despite a lower projected profit margin and slightly higher discount rate.

What's in the News

- Alcoa, Ball and Unilever unveiled the first consumer packaging using ELYSIS carbon free smelting technology in low carbon aerosol cans ahead of COP30, highlighting a major step toward decarbonized aluminum supply chains (Key Developments).

- Management signaled a more active but disciplined M&A strategy at Alcoa Investor Day 2025, emphasizing deals driven by industrial synergies, cultural fit and long term value creation for shareholders (Key Developments).

- Alcoa reached a 10 year renewable power contract with the New York Power Authority and committed about 60 million dollars to modernize the anode baking furnace at its Massena smelter, reinforcing the site as a long term, low carbon production hub (Key Developments).

- The company advanced plans for a gallium plant at the Wagerup alumina refinery in Western Australia, backed by the United States, Australian and Japanese interests, to supply 100 metric tons annually of this critical semiconductor and defense mineral from 2026 onward (Key Developments).

- Alcoa decided to permanently close its aging Kwinana alumina refinery in Western Australia, removing 2.2 million metric tons of annual refining capacity while preparing the site for future redevelopment and reshaping its global footprint (Key Developments).

Valuation Changes

- The fair value estimate has risen modestly from approximately 39.54 dollars to 41.29 dollars per share.

- The discount rate has inched higher from about 8.65 percent to 8.67 percent, reflecting a slightly higher perceived risk profile.

- Revenue growth has increased significantly, moving from roughly 1.63 percent to about 3.28 percent annually in the long-term model.

- The net profit margin has fallen materially from around 7.73 percent to approximately 4.46 percent, indicating lower expected profitability per dollar of sales.

- The future P/E multiple has expanded sharply from about 12.6 times to roughly 21.7 times, implying a richer valuation on projected earnings.

Key Takeaways

- Rising use of recycled aluminum and competitive lightweight materials, plus global supply growth, threaten Alcoa's long-term demand and the reliability of growth projections.

- Ongoing tariff volatility, regulatory pressures, operational bottlenecks, and limited production flexibility could compress margins and elevate future costs.

- Decarbonization trends, supply constraints, and sustainable product innovation position Alcoa for stronger pricing, improved margins, and resilient long-term growth amid shifting global demand.

Catalysts

About Alcoa- Engages in the bauxite mining, alumina refining, aluminum production, and energy generation business in Australia, Brazil, Canada, Iceland, Norway, Spain, the United States, and internationally.

- Growing adoption of recycled aluminum and substitute lightweight materials in automotive and construction could erode long-term demand growth for primary aluminum, making future revenue growth expectations for Alcoa optimistic and possibly contributing to overvaluation.

- Persistent tariff-related market volatility, combined with Alcoa's contractual obligations limiting its ability to flexibly redirect Canadian production, may compress net margins for several quarters, especially if regional price premiums fail to fully offset heightened costs.

- Delays in securing new mine approvals in Western Australia could increase operational risk and future production costs if existing reserves are depleted faster than anticipated, potentially weighing on long-term earnings growth.

- Stagnation or further decline in aluminum prices due to global supply increases from China, India, and the Middle East, coupled with uncertain recovery in key end markets like automotive, challenges the sustainability of current revenue and EBITDA projections.

- Increasing regulatory and environmental compliance requirements, alongside aging asset maintenance-without sufficient downstream diversification-raise the risk of elevated long-term costs, potentially pressuring net margins and deteriorating free cash flow.

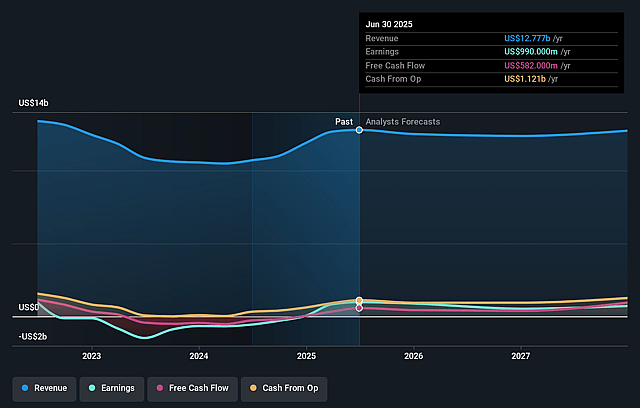

Alcoa Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Alcoa's revenue will grow by 2.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 7.7% today to 4.4% in 3 years time.

- Analysts expect earnings to reach $592.1 million (and earnings per share of $2.5) by about September 2028, down from $989.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $847.3 million in earnings, and the most bearish expecting $368 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.5x on those 2028 earnings, up from 8.1x today. This future PE is lower than the current PE for the US Metals and Mining industry at 22.7x.

- Analysts expect the number of shares outstanding to grow by 0.22% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.97%, as per the Simply Wall St company report.

Alcoa Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Strong long-term demand drivers-including the global push for decarbonization, accelerating adoption of electric vehicles, infrastructure investments, and growth in renewable energy-are expected to significantly boost aluminum demand, supporting Alcoa's future revenues and reducing downside risk to long-term top-line growth.

- Alcoa's successful development and commercialization of its EcoLum low-carbon aluminum products and the ELYSIS zero-carbon smelting process position the company to capture premium pricing and greater market share as customers and regulators increasingly prioritize sustainability, which could sustain or expand profit margins over time.

- Tightening global aluminum supply, driven by production curtailments in China, disruptions in bauxite supply (particularly in Guinea), and new capacity constraints, may improve pricing power and reduce risk of persistent overcapacity and margin pressure-thereby supporting higher ASPs, revenues, and earnings for Alcoa.

- Alcoa's ongoing operational initiatives-such as upstream portfolio optimization, cost control programs, and contingency plans for mining approvals-are expected to improve efficiency and cushion EBITDA margins and free cash flow, providing greater resilience against near-term market volatility.

- Positive long-term geographic shifts, with North America and emerging markets projected to have higher aluminum demand growth rates than China, provide Alcoa with robust opportunities to grow shipment volumes, increase utilization of its assets, and support stronger revenue and profit recovery.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $33.545 for Alcoa based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $42.0, and the most bearish reporting a price target of just $27.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $13.6 billion, earnings will come to $592.1 million, and it would be trading on a PE ratio of 18.5x, assuming you use a discount rate of 8.0%.

- Given the current share price of $31.11, the analyst price target of $33.55 is 7.3% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Alcoa?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.