Key Takeaways

- Expanding demand for low-carbon and renewable aluminum, combined with Alcoa's green technology investments, positions the company for sustained volume growth and stronger margins.

- Policy tailwinds and financial strength enable Alcoa to benefit from wider premiums, enhanced cash flow, and potential for increased shareholder returns.

- Regulatory, market, and environmental hurdles threaten Alcoa's profitability, margin stability, and ability to fund growth amid global overcapacity, volatile costs, and rising decarbonization demands.

Catalysts

About Alcoa- Engages in the bauxite mining, alumina refining, aluminum production, and energy generation business in Australia, Brazil, Canada, Iceland, Norway, Spain, the United States, and internationally.

- Analyst consensus sees profitability from the San Ciprián restart beginning after full ramp-up in mid-2026, but if power grid enhancements in Spain succeed and aluminum prices recover quicker, Alcoa could achieve positive EBITDA from this asset much sooner, accelerating cash flow and earnings growth.

- Analysts broadly agree Alcoa's ability to offset tariffs through Midwest premium increases and export flexibility is roughly net neutral, yet with ongoing U.S. policy support for domestic supply chains, stickier tariffs and a structurally higher premium could drive outsized margin expansion in North America, materially lifting net income over the next several years.

- Surging global adoption of renewable energy, electric vehicles, and grid modernization is set to dramatically raise aluminum intensity per dollar of GDP, positioning Alcoa for structurally higher volumes and pricing power that could sustainably elevate revenues and operating margins well above pre-2024 levels.

- Alcoa's accelerating investments in its proprietary ELYSIS low-carbon smelting process and other "green aluminum" initiatives could allow it to capture premium pricing and large volumes from ESG-focused customers, unlocking significant long-term margin expansion and a higher quality of earnings.

- Alcoa's strong balance sheet, improving free cash flow, and upcoming deleveraging create near-term potential for large-scale share repurchases or special dividends, translating robust operating improvement directly into double-digit EPS growth and enhanced shareholder returns.

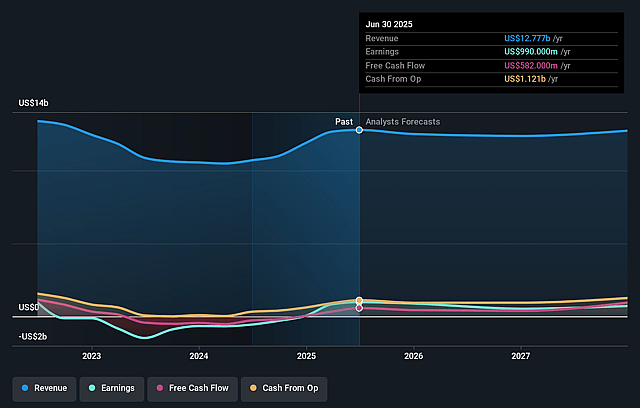

Alcoa Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Alcoa compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Alcoa's revenue will grow by 2.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 7.7% today to 5.4% in 3 years time.

- The bullish analysts expect earnings to reach $741.2 million (and earnings per share of $2.97) by about September 2028, down from $989.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 18.6x on those 2028 earnings, up from 8.2x today. This future PE is lower than the current PE for the US Metals and Mining industry at 22.5x.

- Analysts expect the number of shares outstanding to grow by 0.22% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.09%, as per the Simply Wall St company report.

Alcoa Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Increasing decarbonization pressures and complex mine approval processes in Western Australia could lead to significantly higher capital expenditures, prolonged permitting delays, and the risk of operational disruption, directly threatening Alcoa's long-term profitability, margin stability, and ability to secure future bauxite sources for their alumina refineries.

- Sustained overcapacity in the global aluminum market, especially from cost-advantaged producers in China and other emerging regions, presents an ongoing risk of depressed aluminum prices, limiting Alcoa's revenue growth and compressing margins through persistent price competition.

- High and structurally volatile energy and input costs, including those driven by the energy transition, pose a mounting threat to Alcoa's production cost structure, which is largely fixed and energy intensive, increasing the risk of pronounced margin contraction in a weak price environment.

- Exposure to tariff risk and the complexity of global trade flows, along with the fact that a significant portion of Alcoa's smelter output remains contractually bound to higher-tariff markets, may limit the company's ability to pass through cost increases or redirect volume, creating continued margin pressure and unpredictability in net earnings.

- Legacy environmental and remediation liabilities, in combination with intensifying ESG scrutiny and capital market shifts toward low-carbon investment, could require ongoing material cash outflows and complicate access to competitively priced financing, eroding Alcoa's free cash flow and limiting capital available for growth or shareholder returns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Alcoa is $42.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Alcoa's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $42.0, and the most bearish reporting a price target of just $27.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $13.7 billion, earnings will come to $741.2 million, and it would be trading on a PE ratio of 18.6x, assuming you use a discount rate of 8.1%.

- Given the current share price of $31.27, the bullish analyst price target of $42.0 is 25.5% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.