Key Takeaways

- Escalating regulatory, environmental, and geopolitical pressures are driving up costs and threatening Alcoa's margins, with limited ability to offset these burdens through pricing or operational flexibility.

- Industry overcapacity, trade barriers, and approval delays challenge Alcoa's market access and growth prospects, resulting in persistent revenue and earnings instability.

- Strategic focus on sustainability, operational efficiency, and portfolio optimization positions Alcoa to capitalize on strong aluminum demand and maintain competitive advantage amid evolving industry trends.

Catalysts

About Alcoa- Engages in the bauxite mining, alumina refining, aluminum production, and energy generation business in Australia, Brazil, Canada, Iceland, Norway, Spain, the United States, and internationally.

- Intensifying carbon regulations and rising global initiatives to decarbonize heavy industry threaten to drive up Alcoa's long-term operational and compliance costs, especially since aluminum smelting is extremely energy-intensive. Even as Alcoa invests in green aluminum, failure to achieve technology breakthroughs or keep pace with global emissions standards could force expensive retrofits or production curtailments, compressing operating margins and raising capital expenditures over time.

- Gradual deglobalization and increasing trade protectionism-exemplified by sharply higher Section 232 tariffs and the risk of additional U.S. import restrictions from Brazil-are structurally fragmenting aluminum markets. Alcoa faces persistent difficulty redirecting shipments, and a significant portion of its Canadian volume is locked into U.S. sales by long-term contracts. This rigidity is likely to drive further margin erosion and revenue instability as tariff-related costs consistently outpace pricing benefits.

- Alcoa's exposure to raw material and energy cost volatility remains acute, with ongoing high bauxite prices due to geopolitical disruptions in Guinea and continued elevated energy costs. Its ability to pass these cost increases to customers is increasingly limited by competitive and contractual constraints, resulting in structurally lower net margins and more frequent earnings shortfalls.

- Ongoing delays and rising social and regulatory opposition to critical mine approvals in Western Australia cast doubt on Alcoa's ability to maintain or grow its resource base over the long term. With the approvals process already slipping beyond the original 2026 timeframe and mounting risk of further delays, future volume growth and the company's revenue base could be severely constrained.

- Persistent global aluminum overcapacity, especially from state-supported Chinese producers willing to operate at losses to maintain employment, is likely to suppress LME aluminum prices for years. This environment makes it increasingly difficult for Alcoa to sustain pricing power or improve profitability, leading to muted revenue growth and ongoing pressure on cash generation.

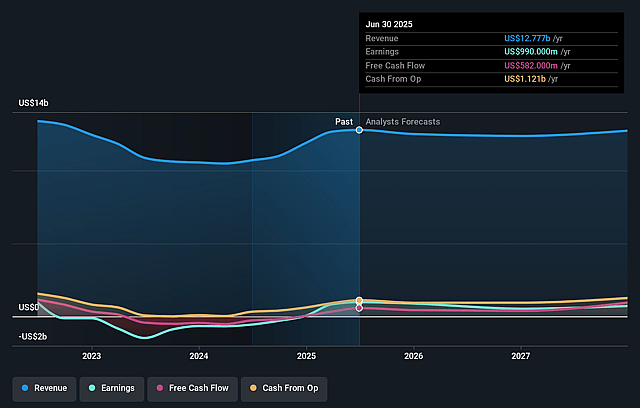

Alcoa Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Alcoa compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Alcoa's revenue will decrease by 2.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 7.7% today to 2.7% in 3 years time.

- The bearish analysts expect earnings to reach $325.6 million (and earnings per share of $2.78) by about September 2028, down from $989.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 27.1x on those 2028 earnings, up from 8.1x today. This future PE is greater than the current PE for the US Metals and Mining industry at 22.5x.

- Analysts expect the number of shares outstanding to grow by 0.22% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.97%, as per the Simply Wall St company report.

Alcoa Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Robust long-term global demand for aluminum, driven by secular trends such as growth in electric vehicles, renewable energy, grid modernization, and infrastructure spending, could support higher aluminum sales and stable or increased revenues for Alcoa over time.

- Alcoa's continued focus on operational efficiency, cost structure improvements, and adoption of low-carbon technology-including the development and sale of its EcoLum low-carbon aluminum product-positions the company to command premium pricing and healthier net margins as customers increasingly seek sustainable materials.

- Strategically redirecting aluminum volumes and dynamically optimizing trade flows in response to volatile tariff environments allows Alcoa to preserve or improve net earnings, with the ability to pass through most tariff costs to customers via higher premiums, thereby mitigating margin compression.

- Active progress on portfolio optimization, including asset sales such as the Ma'aden joint venture, coupled with effective working capital management and positive free cash flow generation, enhances Alcoa's ability to deleverage, invest in growth, and return capital to shareholders-ultimately supporting earnings and shareholder value.

- Industry trends favor established, ESG-focused producers like Alcoa: tightening global environmental regulations and a shift toward regional supply chains could reinforce Alcoa's competitive position, helping the company gain market share and sustain or grow profitability despite broader market disruptions.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Alcoa is $27.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Alcoa's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $42.0, and the most bearish reporting a price target of just $27.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $11.9 billion, earnings will come to $325.6 million, and it would be trading on a PE ratio of 27.1x, assuming you use a discount rate of 8.0%.

- Given the current share price of $31.11, the bearish analyst price target of $27.0 is 15.2% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.