Key Takeaways

- Visa is a very high-quality business with an enviable market share and margins.

- New initiatives like Visa Direct will offset the loss of momentum from legacy growth drivers

- EPS growth will be driven by ‘higher for longer’ inflation, slightly wider margins, and buybacks.

- Visa will also benefit when the B2B payments space is eventually disrupted by fintech platforms.

Catalysts

Company Catalysts

Consumer Spending Won’t Drive As Much Revenue Growth As It Has Before

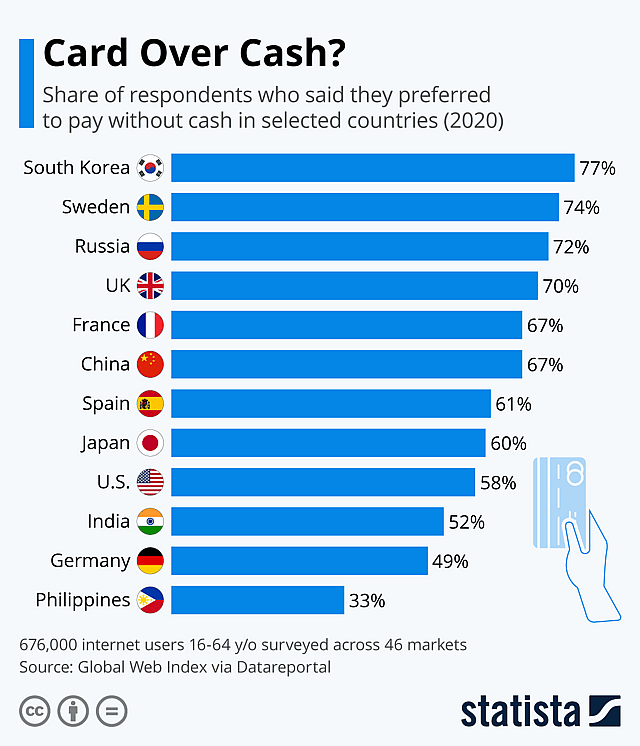

The primary driver of revenue growth for payment networks is global consumer spending and economic growth. The networks also benefit from increased ecommerce and the trend towards cashless societies. More recently they have benefited from inflation too.

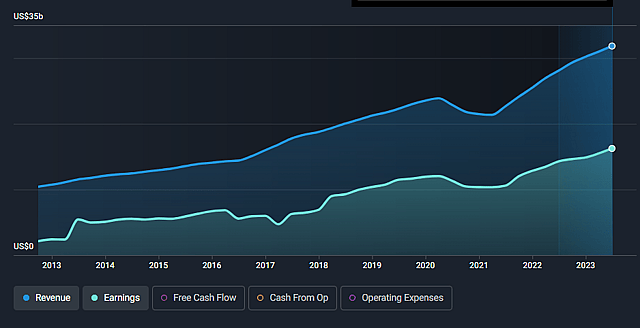

Visa’s top line growth is strongly correlated to global consumer spending, but it also increases more rapidly due to the other factors listed above. Over the last 10 years, global consumer spending increased by 3% a year, while Visa’s revenue increased by 9% a year (and MasterCard’s increased by 11%) a year.

Going forward, economists expect global consumer spending to increase at 6% a year through 2030 - which based on the last 10 years would imply annual revenue growth of 18% for Visa. I think there are several headwinds that would make that very unlikely for a base case:

- I think 6% growth in consumer spending seems optimistic compared to economic growth forecasts closer to 3%.

- Visa has limited exposure to China (which is maturing anyway) and India (where local networks are favored.)

- The transition aways from cash has very little way to go in developed economies. Some of the developing economies where cash is still widely used have their own payment networks which are given preferential treatment - India and Brazil in particular.

- With less cash being used for in person payments, growth in ecommerce is less of a benefit to payment networks.

Given the above points I think the catalysts that have driven growth in the last decade will have far less impact going forward.

Source: Statista

Inflation and Marginal Improvements from Visa’s New Initiatives Will Rescue Top Line Growth

While I think the legacy catalysts will face some headwinds, there are some positive catalysts that I think will add marginal improvements to the revenue growth rate.

- Tap to pay (with phone and card) has increased the use of credit and debit accounts for smaller payments.

- Click to pay, which allows e-commerce shoppers to make purchases without a lengthy checkout process, has proven to increase sales for e-tailers when it's available.

- Tokenization, which protects customer data when a credit card is used to make online purchases, improves confidence in the online purchase process.

- Visa Direct allows real time payments between Visa accounts, including cross border transactions. In 2022 these transactions only represented ~3% of Visa’s transactions, but I do believe this service has potential to be a significant growth driver in the future.

I also think inflation will remain a little higher than it was prior to 2022 - and this will have the biggest positive impact on revenue growth. I think Visa’s gross payment volumes will see 2.5% annual increases from inflation alone.

Dividend and EPS Growth Will Continue to Benefit From Operational Leverage and Share Buybacks

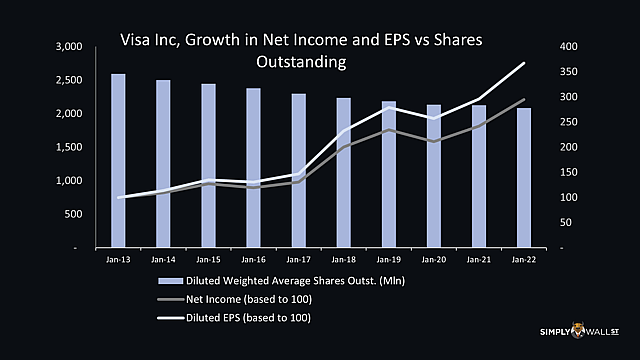

Visa’s massive scale has helped the company improve its net profit and free cash flow margins to 51%. It’s used to buy back around 2% of outstanding shares each year. This has contributed to growth in earnings and dividends per share.

Given Visa’s scale there is no reason for operating costs to increase at the same rate as revenue, so I believe the cash flow margin will continue to increase at ~0.5% a year on average. This number would be higher, but as I mentioned I think inflation will remain elevated which will affect costs.

I expect the share buybacks to continue, and increase if the company deems the share price to be significantly undervalued.

Industry Catalysts

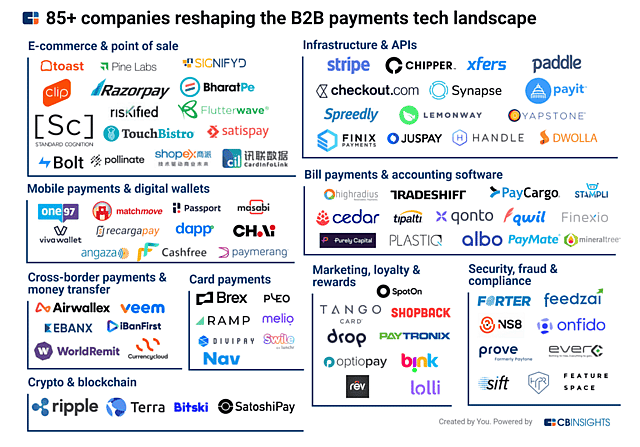

Payment Networks will Provide the Rails for Fintech Disruption - Eventually

A commonly cited risk for Visa is potential disruption by fintech platforms like Paypal and Block - and possibly by cryptocurrencies too. I do believe that at some point in the next decade we will see a major disruption of the banking industry - but I believe Visa will benefit from this, rather than be disrupted.

The fees charged by payment networks are a small fraction of each transaction. It will be easier and cheaper for fintech platforms to use payment networks as the ‘rails’ for their transactions, than trying to bypass the networks. To do so, fintech platforms will have to go to the expense of building alternative channels, and then try to get other parties to use them. This is where the network effect comes into play for Visa.

Security is also a major issue for the payments industry. I believe Visa’s massive investments will be another drawcard for fintech platforms. I can’t see these platforms taking the risk of trying to reinvent the wheel on security (at great expense) when Visa already has some of the best security protocols in place.

BNPL (buy now pay later) services like Affirm, and cross border payment platforms like Wise already use Visa’s network, and I think future fintech solutions will do the same.

The even bigger opportunity for Visa, is that fintech platforms could bring more B2B transactions to the Visa network. Visa currently accounts for about 5% of what it believes to be a $20 trillion ‘cardable B2B market.’ For reference, Visa’s payment volumes in 2022 were $11.6 trillion, so even 10% of that $20 trillion would be a big deal for Visa.

Source: CB Insights

I see this B2B market as Visa’s next growth opportunity. However I think Visa needs fintech platforms to create the products and solutions that make it happen. Visa isn’t in the business of offering end user solutions, and to do so would require them to compete with their customers, the banks.

I think the big wins for Visa will occur when B2B fintech solutions gather momentum. But this isn’t happening in a meaningful way - yet. However, this aspect of Visa’s future creates significant optionality to the investment case if the current valuation is reasonable.

Assumptions

Inflation and Marginal Growth From New Initiatives will Offset Headwinds

I believe that Visa’s annual revenue growth due to legacy drivers will slow to 7%, compared to 9% over the last decade. However I think inflation will add an average of 2.5% to that and new initiatives will add another 1.5% over the next five years.

So I believe Visa’s annual revenue will grow at 11% a year and reach $53.4 billion for FY 2028, up from $29.3 billion for FY2022.

Source: Simply Wall St

Margins will Continue To Improve Due To Visa’s Vast Scale

I think Visa’s scale will allow it to keep improving the net profit margin by 0.5% a year (on average), which would then reach 53.5% in 2028.

This will result in a net profit of $28.5 billion for FY2028, compared to $15 billion in 2022.

EPS will Continue to Benefit from Improving Margins and Share Buybacks

I expect share buy backs to continue at a rate of 2% a year, and outstanding shares will decline from 2.08 billion in 2022 to 1.84 billion in 2028.

Based on my assumptions of 1.84 billion shares and $28.5 billion in 2028, EPS will be $15.46, up 91% from FY2022.

I’m assuming the dividend yield will remain at around 0.7% and the payout ratio will be 20-25% of net income.

Risks

There are a few risks to my narrative, mainly:

- The potential for regulatory action against Visa and Mastercard’s oligopoly is a major risk. In the US, the Credit Card Competition Act, which would force banks to offer merchants alternatives to Visa and Mastercard, was recently reintroduced. The bill is controversial as it would likely impact rewards programs for consumers, and I believe it will ultimately be watered down.

- Regulators are also preventing Visa from making acquisitions. I expect this to continue and Visa’s growth will have to be organic.

- In some large markets - China, India and Brazil in particular, local payment networks are favored by policymakers. This limits Visa's potential in these markets. The US has also introduced a government run payment network, FedNow - though this has been treated with suspicion by many consumers.

- Fintech platforms and cryptocurrencies do pose a threat to Visa, but as mentioned I think payment networks will become the infrastructure for fintech solutions.

- The possibility of global deflation is also a considerable risk for Visa which typically benefits from transaction values rising due to inflation.

How well do narratives help inform your perspective?

Disclaimer

Simply Wall St analyst Richard_Bowman holds no position in NYSE:V. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.