Last Update 15 Nov 25

Fair value Decreased 26%UPST: Mixed Financials Will Be Offset By Expanding Personal Loan Partnerships

Upstart Holdings’ analyst price target has been revised downward from approximately $75 to $55. Analysts cite mixed quarterly results and rising delinquency trends as key factors in the reassessment.

Analyst Commentary

Analysts provided mixed commentary on Upstart Holdings’ performance and outlook in light of the recent price target revisions and operating results. Their assessments highlighted both supportive factors and areas of elevated concern for the company’s future.

Bullish Takeaways

- Bullish analysts maintain positive long-term ratings despite reducing price targets. This suggests continued confidence in Upstart's underlying technology and business model.

- Some analysts believe that the company’s recent earnings report, while mixed, still contains elements that support potential growth and execution improvements over the next few quarters.

- The firm’s ability to secure an Overweight rating from a major brokerage points to perceived resilience in Upstart’s competitive positioning within the lending technology market.

Bearish Takeaways

- Bearish analysts were openly surprised by the acceleration in delinquency rates observed in recent months, especially in older loan vintages. This raises questions about portfolio quality.

- Concerns remain about the potential for consensus transaction volume estimates to be overstated, given current credit trends and broader asset class challenges.

- Persistently high delinquency levels, even if not unique to Upstart’s underwriting, may pressure the company's growth prospects and lead some analysts to adopt a more cautious outlook on valuation.

- Mixed quarterly results continue to weigh on sentiment and underscore uncertainty in Upstart’s execution and near-term growth trajectory.

What's in the News

- Pathward Financial, Inc. has partnered with Upstart to offer personal loans through Upstart's lending marketplace, expanding access to innovative financial products and promoting inclusion. (Client Announcements)

- Upstart Holdings provided guidance for the fourth quarter and full year 2025, projecting quarterly revenue of approximately $288 million and full-year revenue of $1.035 billion, with expected GAAP net income of $17 million for the quarter and $50 million for the year. (Corporate Guidance, New/Confirmed)

- Peak Credit Union joined the Upstart Referral Network, granting more consumers access to personal loans and offering a streamlined, branded lending experience for qualified applicants. (Client Announcements)

- Corporate America Family Credit Union partnered with Upstart to provide personal loans, HELOCs, and auto refinance loans, and began purchasing home equity lines of credit portfolios from Upstart's affiliate. (Client Announcements)

- Cornerstone Community Financial Credit Union began lending as an Upstart Referral Network partner to deliver more inclusive personal loan options to consumers. (Client Announcements)

Valuation Changes

- Consensus Analyst Price Target (Fair Value): Decreased significantly from $74.69 to $55.38. This reflects more cautious expectations for share performance.

- Discount Rate: Increased slightly from 8.75% to 9.08%. This indicates a higher perceived risk profile for Upstart Holdings.

- Revenue Growth: Lowered from 27.01% to 19.62%. This implies that analysts now expect slower expansion in upcoming periods.

- Net Profit Margin: Reduced from 18.74% to 16.55%. This suggests a modest decrease in profitability projections.

- Future P/E Ratio: Declined from 31.67x to 29.76x. This signals a tempered view toward future earnings multiples.

Key Takeaways

- Improvements in underwriting, automation, and personalization enhance loan approval rates, lower costs, and reduce default risks, positively impacting revenue and net margins.

- Strategic HELOC growth, backed by strong banking relationships, alongside expanded borrower base, sets stage for future revenue growth and earnings support.

- High default rates and macroeconomic volatility threaten revenue stability, while maintaining model accuracy and managing profitability amid these conditions are critical challenges.

Catalysts

About Upstart Holdings- Operates a cloud-based artificial intelligence (AI) lending platform in the United States.

- The implementation of Model 19, featuring the Payment Transition Model (PTM), has improved underwriting accuracy, which is likely to enhance loan approval rates and reduce default risks, positively impacting revenue and net margins.

- Upstart's HELOC product growth, driven by conversion improvements, cross-selling, and state expansion, positions it well for future revenue growth and margins with the potential to leverage its strong relationships with banks and credit unions for cost-effective funding.

- Improvements in small dollar relief loans, such as reduced origination costs, have expanded Upstart's borrower base and are expected to contribute to revenue growth, while the integration of small dollar repayment data will enhance the accuracy of underwriting models.

- Increased automation and personalization in servicing operations have reduced costs and improved borrower outcomes, which will likely improve net margins through operational efficiencies and lower default rates.

- Enhanced lending partner confidence, due to strong platform performance and capital market engagements, strengthens funding capabilities and sets the stage for increased origination volume, supporting earnings growth in the medium term.

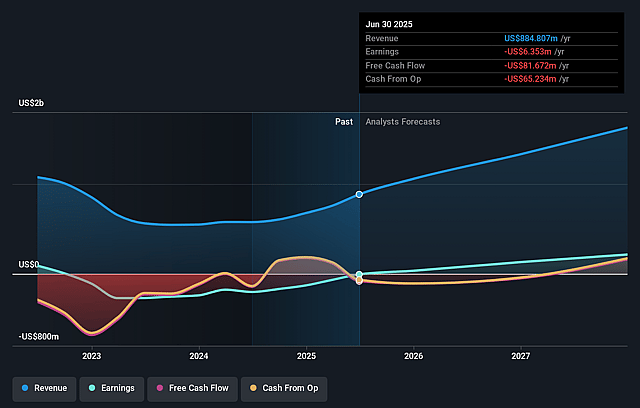

Upstart Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Upstart Holdings's revenue will grow by 27.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from -0.7% today to 18.5% in 3 years time.

- Analysts expect earnings to reach $337.2 million (and earnings per share of $1.54) by about September 2028, up from $-6.4 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 34.1x on those 2028 earnings, up from -976.3x today. This future PE is greater than the current PE for the US Consumer Finance industry at 10.6x.

- Analysts expect the number of shares outstanding to grow by 5.47% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.32%, as per the Simply Wall St company report.

Upstart Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company has faced periods of underperformance due to high default rates during macroeconomic volatility, potentially impacting future revenue and profit stability.

- There are concerns about maintaining consistent model accuracy, which is crucial for managing risk and ensuring profitability, due to potential gaps between predicted and actual default rates.

- The company's profitability is sensitive to macroeconomic changes, such as interest rate movements and macro indices (e.g., the Upstart Macro Index), which could affect earnings and net margins if conditions worsen.

- Although the company plans to reduce loans on its balance sheet, potential funding constraints could delay these efforts, affecting liquidity and net income.

- Investments in new product categories and marketing could pressure operating margins and net income if not managed properly against growth expectations.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $80.846 for Upstart Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $105.0, and the most bearish reporting a price target of just $20.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.8 billion, earnings will come to $337.2 million, and it would be trading on a PE ratio of 34.1x, assuming you use a discount rate of 8.3%.

- Given the current share price of $64.46, the analyst price target of $80.85 is 20.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.