Key Takeaways

- PayPal's partnerships and strategic shifts aim to drive revenue growth through increased conversion rates and expanded commerce capabilities.

- Expanding PayPal Complete Payments and evolving Venmo suggest enhanced market share and positive earnings impact.

- A shift to profit over volume may slow revenue growth short-term, with risks from innovation reliance and potential margin impacts from interest changes and new strategies.

Catalysts

About PayPal Holdings- Operates a technology platform that enables digital payments on behalf of merchants and consumers worldwide.

- PayPal's transformation from a payments company to a commerce platform, highlighted by partnerships with major players like Fiserv, Adyen, Amazon, Global Payments, and Shopify, indicates a strategic shift that could enhance revenue growth in the future.

- The improvements in branded checkout experiences, particularly on mobile, aim to increase conversion rates significantly, which can boost transaction volumes and revenue.

- The introduction of Fastlane and PayPal Everywhere initiatives is designed to increase conversion rates, driving revenue growth as more merchants adopt these features.

- Expansion of PayPal Complete Payments into new geographies and increased integration with platforms like Shopify and Amazon could lead to higher revenues and market share in the SMB sector.

- Venmo's strategic shift from a P2P service to a broader financial solution, through initiatives like Venmo debit card and Pay with Venmo, is expected to increase monetization, impacting earnings positively.

PayPal Holdings Future Earnings and Revenue Growth

Assumptions

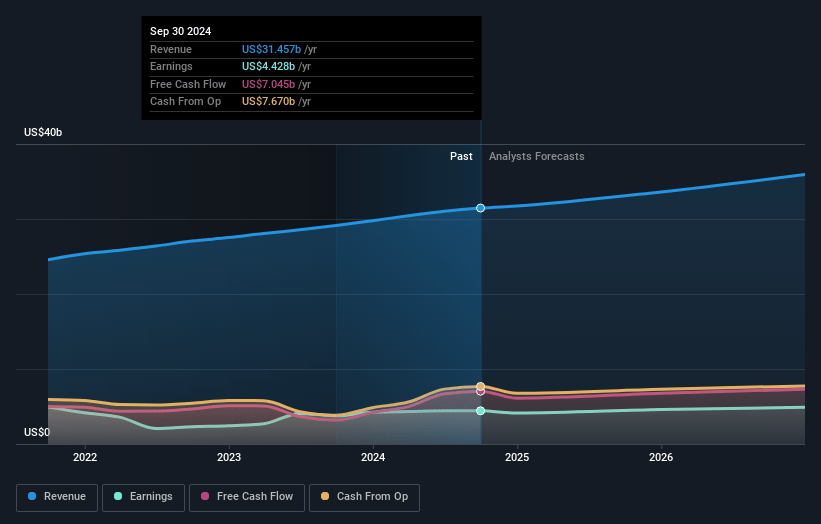

How have these above catalysts been quantified?- Analysts are assuming PayPal Holdings's revenue will grow by 5.9% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 14.1% today to 13.9% in 3 years time.

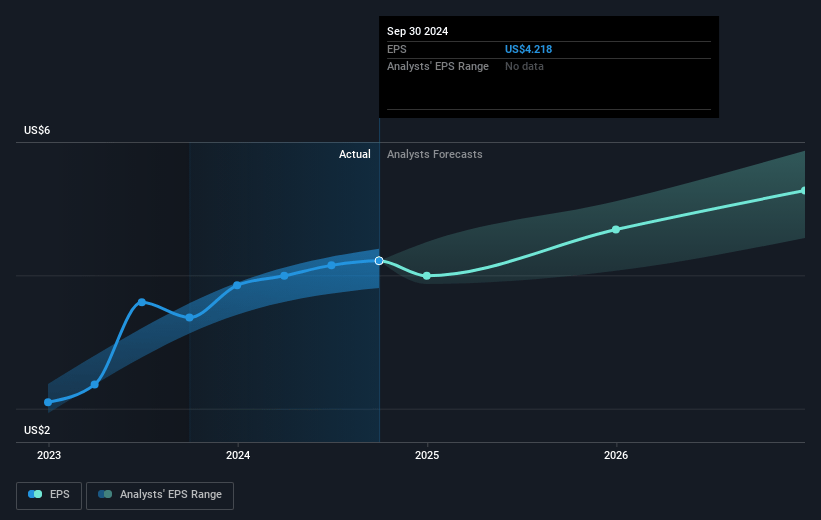

- Analysts expect earnings to reach $5.2 billion (and earnings per share of $5.79) by about January 2028, up from $4.4 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $4.6 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.3x on those 2028 earnings, up from 20.0x today. This future PE is greater than the current PE for the US Diversified Financial industry at 18.5x.

- Analysts expect the number of shares outstanding to decline by 3.7% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.98%, as per the Simply Wall St company report.

PayPal Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The shift from focusing on high proportions of payment processing volume to more profitable margins could lead to reduced revenue growth in the short term, as reflected in the deliberate slowing of Braintree’s volume and revenue growth. This change prioritizes healthier margins but may impact top-line growth.

- Interest income, which contributed significantly to transaction margin dollar growth in previous quarters, is expected to become a minimal tailwind and potentially a headwind by 2025 due to anticipated interest rate cuts, thus negatively affecting net margins and earnings.

- The heavy reliance on new products and innovations like Fastlane, PayPal Everywhere, and branded checkout improvements introduces execution risk. If these innovations do not drive the expected consumer adoption and transaction volume growth, it might slow future revenue growth.

- The increasing focus on reinvesting cost efficiencies into growth initiatives, such as marketing and product rollouts, could lead to higher non-transaction operating expenses in the short term, potentially impacting net profit margins if revenue does not increase as anticipated.

- PayPal’s decision to renegotiate enterprise agreements and emphasize broader strategic deals, such as with Braintree and Venmo, could slow immediate transaction volume growth if partners do not adopt or integrate these changes quickly, thereby affecting short-term revenue projections.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $96.19 for PayPal Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $125.0, and the most bearish reporting a price target of just $70.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $37.3 billion, earnings will come to $5.2 billion, and it would be trading on a PE ratio of 20.3x, assuming you use a discount rate of 7.0%.

- Given the current share price of $88.19, the analyst's price target of $96.19 is 8.3% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

ST

Equity Analyst and Writer

Ecommerce, Emerging Markets And Security Will Drive Revenues Higher

Key Takeaways PYPL can persevere as an industry leader and hold onto its market share above 40%. Healthy balance sheet and cash reserves, will allow growth through acquisitions, if needed.

View narrativeUS$147.99

FV

47.5% undervalued intrinsic discount2.00%

Revenue growth p.a.

103users have liked this narrative

0users have commented on this narrative

20users have followed this narrative

about 1 month ago author updated this narrative

NA

NateF

Community Contributor

PYPL Market Outlook

PayPal Holdings, Inc. (PYPL) has demonstrated a significant recovery in 2024, with its stock price rising approximately 48% year-to-date, outperforming the S&P 500.

View narrativeUS$116.26

FV

33.2% undervalued intrinsic discount8.51%

Revenue growth p.a.

1users have liked this narrative

0users have commented on this narrative

2users have followed this narrative

about 2 months ago author updated this narrative

YI

yiannisz

Community Contributor

Why PayPal’s Growth Story Isn’t Over

As PayPal (PYPL) solidifies its position in the digital payments landscape, it presents a promising opportunity driven by transaction growth, profitability, and an attractive valuation. This analysis delves into how each of these areas contributes to PayPal’s robust potential as an investment.

View narrativeUS$90.00

FV

13.7% undervalued intrinsic discount0.31%

Revenue growth p.a.

6users have liked this narrative

0users have commented on this narrative

10users have followed this narrative

3 months ago author updated this narrative

SU

SuEric

Community Contributor

Buybacks, Cash Flow, and Growth Potential Amidst Rate Cuts

PayPal exhibits a robust financial position with a substantial cash reserve and consistent profitability. The company's strong balance sheet enables investments in growth initiatives, irrespective of the prevailing economic conditions.

View narrativeUS$189.96

FV

59.1% undervalued intrinsic discount11.13%

Revenue growth p.a.

30users have liked this narrative

0users have commented on this narrative

35users have followed this narrative

5 months ago author updated this narrative