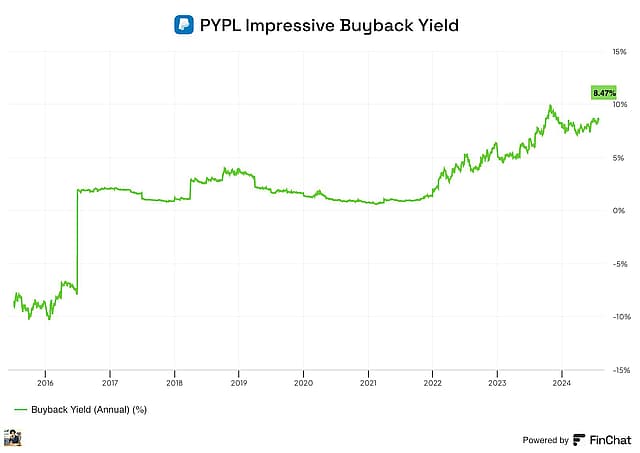

PayPal exhibits a robust financial position with a substantial cash reserve and consistent profitability. The company's strong balance sheet enables investments in growth initiatives, irrespective of the prevailing economic conditions. Additionally, allocating significant capital towards stock buybacks is expected to augment earnings per share.

Its two-sided platform facilitates comprehensive data collection and enhances fraud detection. With the rise of AI, the security of payment systems has become more relevant in recent years. Furthermore, the company benefits from a robust network effect, fostering a mutually beneficial relationship between merchants and consumers.

Highlights

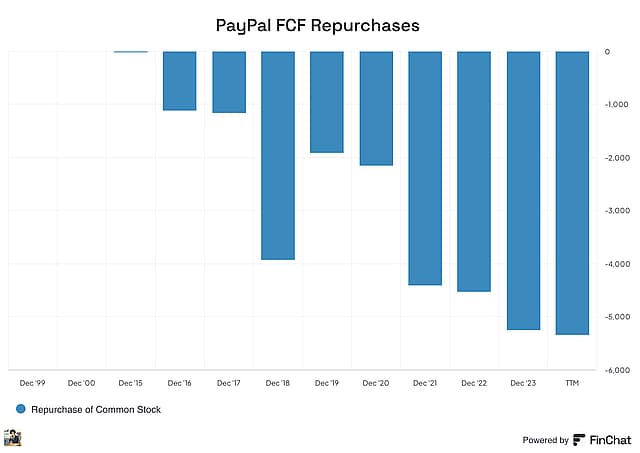

- PayPal is a cash flow machine with margins above 15%.

- Strong buybacks from their FCF.

- No debt.

- Capital efficiency. They are fixing their business, eliminating what doesn't work, and improving those with higher potential.

- AI Investments The ugly part is their terrible stock-based compensation, representing 30% of its income.

Now some interesting facts:

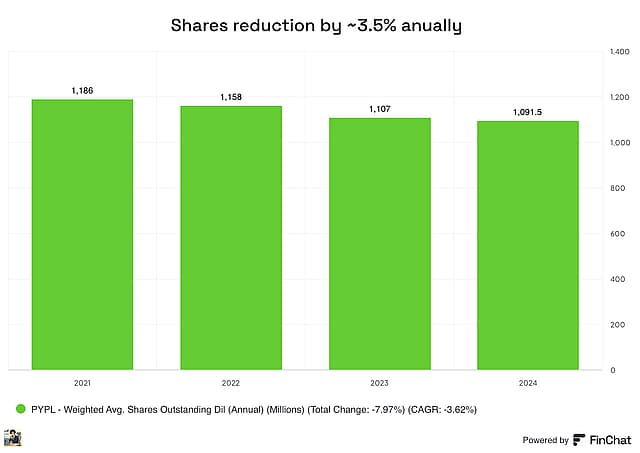

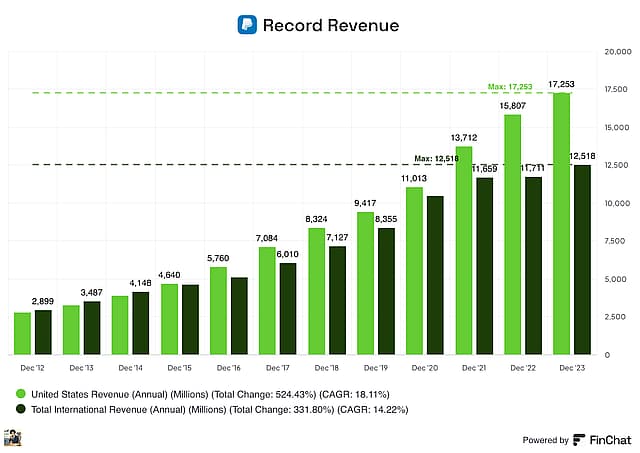

PayPal has consistently increased share buybacks over the years and maintained a steady growth rate in its buyback program.

In 2024, there will be at least $5 billion in share buybacks, which, depending on the purchase price, could represent ~5% of the outstanding shares.

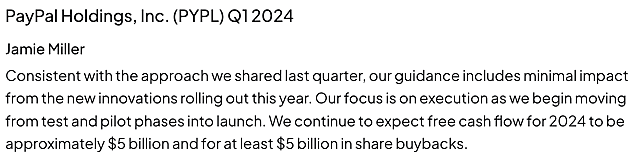

The TPV is still growing at reasonable rates. Although the stock price has declined, the company's business is still strong.

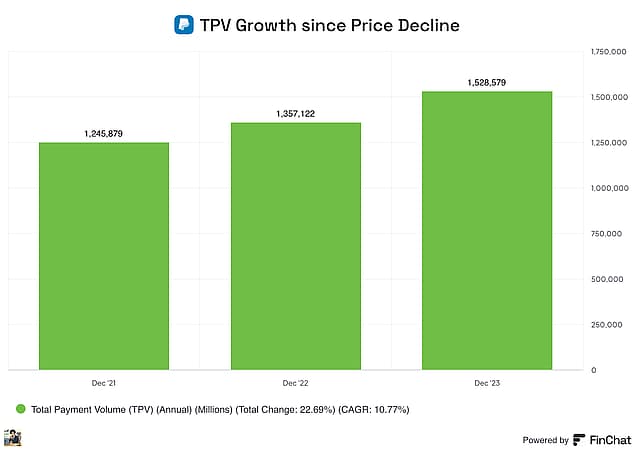

Both the international and US revenues are at record levels.

Rates Cut

Lower interest rates are a boon for Fintech companies seeking to innovate and streamline financial services. Amidst a dynamic tech landscape, several standout fintech stocks are set to benefit from the Fed's recent 50-basis point rate cut.

PayPal’s steady growth trajectory is looking increasingly solid, driven by its pivotal role as a leading transaction facilitator for both consumers and businesses. The stock has rebounded sharply this year, up nearly 20% in 2024.

Analysts are increasingly bullish, citing PayPal’s expanding partnerships and focus on innovation.

Key Partnerships

- Fiserv (FI): A collaboration designed to enhance checkout experiences for merchant clients in the U.S.

- Uber (UBER): A multi-year partnership leveraging Uber's global reach to expand PayPal's presence in international markets.

- Apple (AAPL): An expanded partnership integrating PayPal into Apple's payment ecosystem, including Apple Pay and Venmo (VMEO). Notably, PayPal has enriched Venmo's feature set for small business owners.

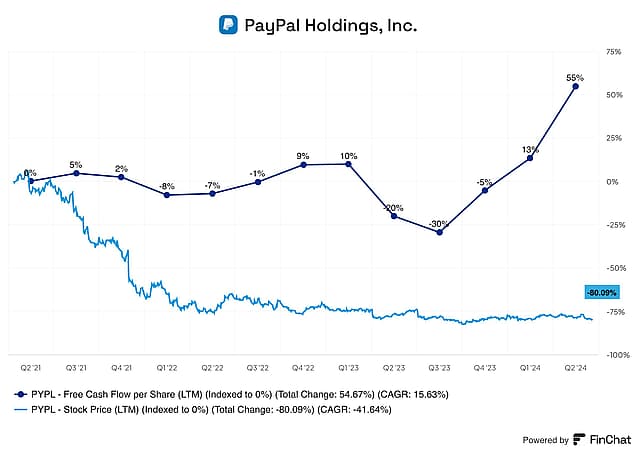

Over the last 3-4 years:

- FCF/Share +55% vs Stock Price -80%

- 9-10% reduction in shares.

How well do narratives help inform your perspective?

Disclaimer

The user SuEric has a position in NasdaqGS:PYPL. Simply Wall St has no position in any of the companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The author of this narrative is not affiliated with, nor authorised by Simply Wall St as a sub-authorised representative. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimates are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.