Narratives are currently in beta

Key Takeaways

- Open Lending is boosting customer acquisitions and certified loan growth, expected to enhance revenue growth through targeted technology investments and automation initiatives.

- Credit tightening and new pricing strategies aim to improve loan stability, while assisting lenders with capital access to increase loan volumes.

- Elevated loan delinquencies, credit tightening, and high loan-to-share ratios challenge Open Lending’s revenue growth, profitability, and investor confidence amidst ongoing auto loan and broader economic pressures.

Catalysts

About Open Lending- Provides lending enablement and risk analytics solutions to credit unions, regional banks, finance companies, and captive finance companies of automakers in the United States.

- Open Lending is actively driving new customer acquisitions and certified loan growth, with a record 21 new customer signings in Q3 2024, which is expected to enhance revenue growth.

- The company is making targeted investments in technology to improve lender and borrower experiences, such as the recent automation of the proof of income verification process. This initiative is projected to increase closure rates and overall loan volume, positively impacting future revenues.

- Through credit tightening actions and enhanced pricing strategies, including leveraging a new proprietary scorecard, Open Lending aims to optimize loan performance and stability, which should improve net margins by lowering future loan defaults and delinquencies.

- Open Lending is assisting lenders with accessing alternative sources of capital, facilitating participation transactions that enhance lending capacity, potentially increasing loan volumes and revenue opportunities.

- Market conditions such as improving inventory levels and retail automotive sales trends indicate a recovery in the automotive sector, which could lead to higher sales volumes and subsequently more loans, boosting future revenues.

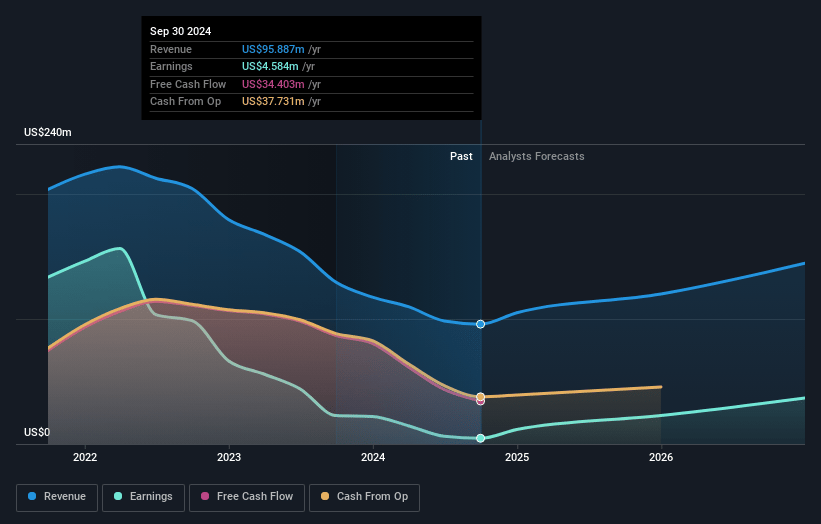

Open Lending Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Open Lending's revenue will grow by 18.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.8% today to 33.6% in 3 years time.

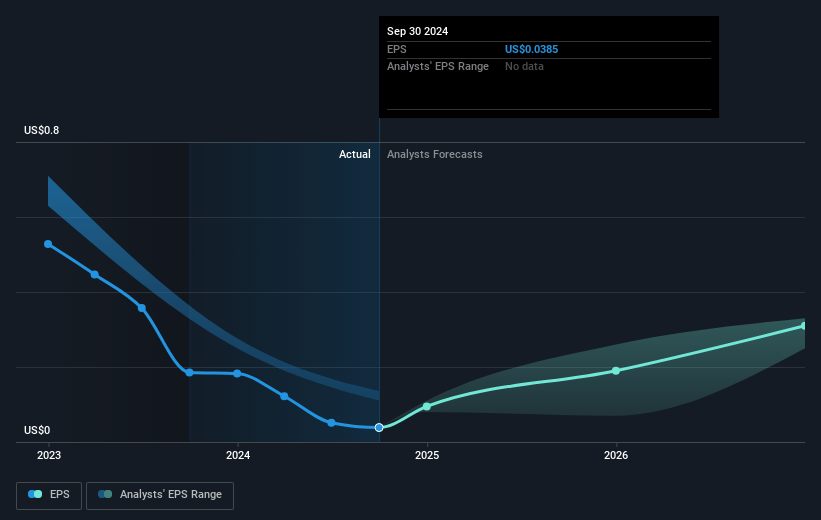

- Analysts expect earnings to reach $54.0 million (and earnings per share of $0.46) by about January 2028, up from $4.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.0x on those 2028 earnings, down from 146.8x today. This future PE is lower than the current PE for the US Capital Markets industry at 23.1x.

- Analysts expect the number of shares outstanding to decline by 0.3% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.3%, as per the Simply Wall St company report.

Open Lending Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Elevated delinquencies and defaults from 2021 and 2022 loan vintages have negatively impacted profit share estimates, reflecting a risk to revenue stability and net margins.

- The additional credit tightening actions, such as increased insurance premiums and raising the minimum score cutoff, are expected to lower approval rates and have a negative impact on certified loan volume, potentially affecting overall revenue and growth.

- Continued elevated auto loan interest rates, despite recent Fed rate cuts, along with vehicle affordability challenges, could constrain loan demand and affect future revenue growth for Open Lending.

- Historic high loan-to-share ratios among core credit union customers hinder lending capacity, limiting credit unions' ability to issue new loans and potentially impacting Open Lending's volume and earnings.

- The persistent need to make profit share revisions due to prior underestimations creates financial volatility, leading to unpredictable revenue streams and net income, and could impact investor confidence.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $7.43 for Open Lending based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $10.0, and the most bearish reporting a price target of just $5.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $160.6 million, earnings will come to $54.0 million, and it would be trading on a PE ratio of 20.0x, assuming you use a discount rate of 7.3%.

- Given the current share price of $5.64, the analyst's price target of $7.43 is 24.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives