Key Takeaways

- EHang's leadership in shaping national regulations and local government alliances provides a durable competitive moat and privileged access to urban air mobility networks in China.

- Advanced battery technology adoption and broadening use cases support outsized, recurring revenue growth through diversification and multi-year operational leverage.

- Heavy domestic reliance, slow international traction, and rising expenses expose EHang to revenue risks, potential cash shortfalls, and intense competition that could hinder future growth.

Catalysts

About EHang Holdings- Operates as an urban air mobility (UAM) technology platform company in the People’s Republic of China, East Asia, West Asia, North America, South America, West Africa, and Europe.

- Analyst consensus views the expansion to 1,000-unit production capacity as a critical growth driver, but this may understate the magnitude: with multiple new facilities planned in different regions and a robust order book, EHang could exceed even the upgraded targets in coming years, catalyzing outsized revenue growth relative to current forecasts.

- While analyst consensus sees regulatory milestones like operator certificates as opening new revenue streams, EHang's leadership in shaping national safety, training, and airspace standards gives it an unassailable competitive moat in China, potentially enabling the company to capture a disproportionate market share and sustain industry-leading gross and net margins.

- EHang is leveraging rapid advancements in battery technology-including being the first worldwide to conduct actual eVTOL flights powered by solid-state batteries with over 1 hour of flight time-positioning the company at the forefront of green transportation and enabling it to pursue high-utilization, longer-range commercial applications that can unlock higher-margin recurring operational service revenue.

- The broadening of use cases such as emergency response, high-rise firefighting, and aerial logistics, alongside EHang's ecosystem partnerships and operational readiness across diverse climates and terrains, dramatically increases long-term demand visibility and supports stable multi-year revenue growth through business model diversification.

- EHang's strong alliances with local governments (including direct co-investment and infrastructure support) and established smart city pilots give it privileged access to urban air mobility networks, ensuring early and sustained integration into the backbone of future smart city infrastructure-amplifying recurring service revenues and enhancing the company's operational leverage over the next decade.

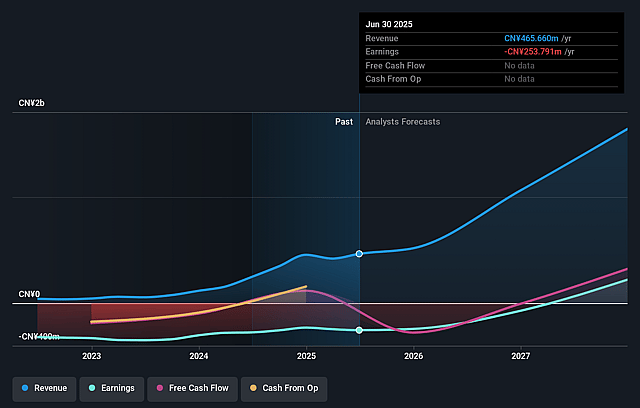

EHang Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on EHang Holdings compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming EHang Holdings's revenue will grow by 74.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -54.5% today to 19.0% in 3 years time.

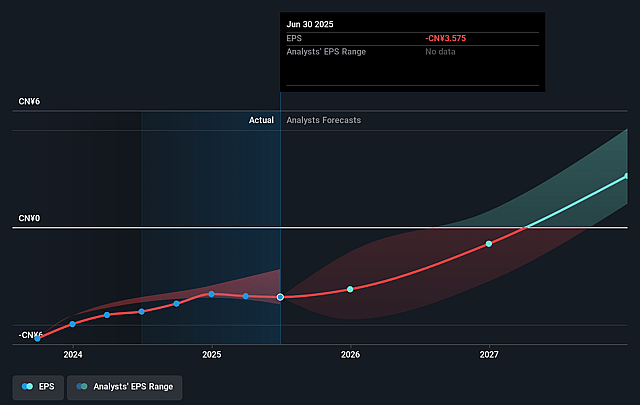

- The bullish analysts expect earnings to reach CN¥472.9 million (and earnings per share of CN¥7.09) by about September 2028, up from CN¥-253.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 44.2x on those 2028 earnings, up from -32.6x today. This future PE is greater than the current PE for the US Aerospace & Defense industry at 34.4x.

- Analysts expect the number of shares outstanding to grow by 5.03% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.28%, as per the Simply Wall St company report.

EHang Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company continues to generate 90% of its sales from domestic Chinese clients despite highlighting growing international interest, meaning lack of international diversification leaves EHang vulnerable to revenue downturns or regulatory changes within China that could significantly impact its future topline growth.

- Management's decision to strategically slow deliveries and lower full-year revenue guidance, prioritizing sustainable commercial operations over near-term expansion, suggests that operational execution challenges or regulatory hurdles may prevent rapid scaling and could lead to muted revenue growth in the coming years.

- Persistent increases in operating expenses, particularly driven by escalating R&D costs, hiring, and production expansion, continue to put pressure on net margins, and if not matched by proportional revenue growth, may result in ongoing negative free cash flow and future capital raises that could dilute earnings per share.

- The limited conversion of overseas demonstration projects into firm purchase agreements, combined with global regulatory uncertainty and slow progress obtaining airworthiness for new models internationally, means that EHang's ability to accelerate global sales and capture new markets faces significant long-term risks that could stall future revenue growth.

- Intensifying competition from other advanced eVTOL producers, both in China and in international markets, many of whom have greater R&D and marketing resources, poses a risk to EHang's pricing power and market share, potentially compressing future revenues and gross margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for EHang Holdings is $27.77, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of EHang Holdings's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $27.77, and the most bearish reporting a price target of just $19.04.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be CN¥2.5 billion, earnings will come to CN¥472.9 million, and it would be trading on a PE ratio of 44.2x, assuming you use a discount rate of 8.3%.

- Given the current share price of $16.1, the bullish analyst price target of $27.77 is 42.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.