Key Takeaways

- Heightened regulatory hurdles and focus on operational safety are likely to delay international expansion and the pace of recurring revenue growth.

- Heavy reliance on the Chinese market and persistent high expenses expose EHang to domestic risks and raise questions about path to profitability.

- Heavy reliance on China, slow international progress, rising costs, and regulatory hurdles threaten revenue growth, diversification, and profitability in the near to medium term.

Catalysts

About EHang Holdings- Operates as an urban air mobility (UAM) technology platform company in the People’s Republic of China, East Asia, West Asia, North America, South America, West Africa, and Europe.

- While global urbanization and demand for sustainable electric transport continue to offer a tailwind for eVTOL adoption, EHang's commercial scaling is likely to be hampered by intensifying international regulatory scrutiny, which could delay airworthiness certifications and limit near-term revenue uplift from overseas markets.

- Although EHang's early mover advantage and strong relationships with local governments position it well to expand in China's rapidly developing low-altitude economy, the company's strategic decision to slow deliveries and prioritize operational safety over aggressive sales growth signals that public and regulator acceptance is a prolonged process, delaying the realization of expected recurring revenue streams and margin improvement.

- While advancements in autonomous flight technology and expanded strategic partnerships are accelerating product innovation, ongoing high R&D and operating expenses-coupled with persistent net losses-raise concerns about the company's ability to achieve sustainable profitability, especially if order conversion rates or commercial use cases underwhelm.

- Despite securing a robust order backlog and government support, EHang remains heavily reliant on a concentrated China customer base and policy environment; rising geopolitical risks and the possibility of trade restrictions may limit market diversification, creating unpredictability in future revenue and increasing vulnerability to domestic economic fluctuations.

- Although the global eVTOL and urban air mobility industry is projected to grow rapidly, slower-than-expected infrastructure development for vertiports and air traffic management systems could result in industry-wide headwinds that curtail EHang's addressable market and depress long-term earnings growth.

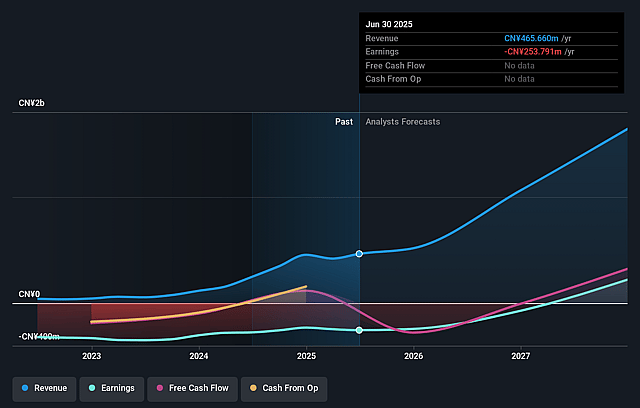

EHang Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on EHang Holdings compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming EHang Holdings's revenue will grow by 45.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -54.5% today to 9.6% in 3 years time.

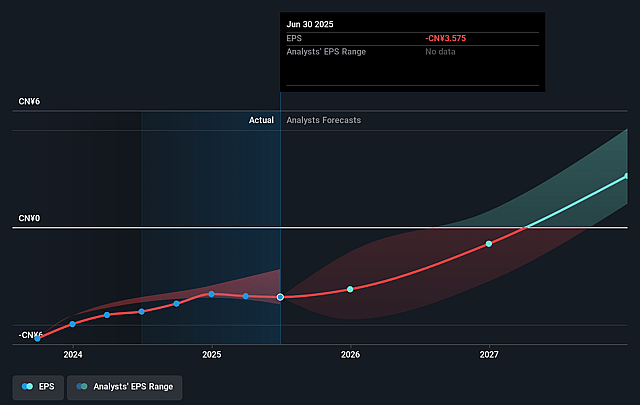

- The bearish analysts expect earnings to reach CN¥137.1 million (and earnings per share of CN¥1.7) by about September 2028, up from CN¥-253.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 104.5x on those 2028 earnings, up from -31.5x today. This future PE is greater than the current PE for the US Aerospace & Defense industry at 34.4x.

- Analysts expect the number of shares outstanding to grow by 5.03% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.29%, as per the Simply Wall St company report.

EHang Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's material reduction in full-year revenue guidance for 2025, despite robust demand, signals a strategic slowdown in order deliveries and a shift towards focusing on supporting existing customers in achieving safe and regular operations; this muted revenue growth could dampen both top-line expansion and investor sentiment in the medium term.

- The heavy concentration of sales in the domestic Chinese market, with 90% of recent orders and nearly all deliveries going to local clients, exposes EHang to China-specific economic downturns, regulatory changes, and capital access limitations, which could create volatility and hinder diversification of the revenue base.

- Progress with international market entry remains in early, experimental phases, with overseas orders accounting for just 10% and commercial operations only at the trial stage in regions like Japan, Thailand, Southeast Asia, and the Middle East; sluggish global rollout or delays in obtaining foreign regulatory approvals could constrain long-term revenue and scale.

- Persistent increases in operating expenses, largely driven by expanding headcount and aggressive R&D, are eroding operating leverage-if revenue growth does not accelerate meaningfully, these cost pressures could eventually weigh on net margins and reduce earnings growth.

- The company's reliance on the regulatory evolution of the low-altitude aviation sector-highlighted by the slow pace of commercial certification and the need for rigorous safety demonstrations-presents a risk that evolving international and domestic safety standards may extend commercialization timelines, delay revenue realization, and increase compliance-related costs.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for EHang Holdings is $19.04, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of EHang Holdings's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $27.77, and the most bearish reporting a price target of just $19.04.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be CN¥1.4 billion, earnings will come to CN¥137.1 million, and it would be trading on a PE ratio of 104.5x, assuming you use a discount rate of 8.3%.

- Given the current share price of $15.58, the bearish analyst price target of $19.04 is 18.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.