Last Update27 Aug 25Fair value Decreased 13%

The significant drop in EHang Holdings’ future P/E ratio alongside a slight reduction in forecast revenue growth indicates lowered expectations for profitability and growth, resulting in the consensus analyst price target decreasing from $27.32 to $25.55.

What's in the News

- EHang revised its 2025 revenue guidance to approximately RMB 500 million and announced a major investment agreement with the Hefei government, establishing a comprehensive VT35 eVTOL product hub with total investment estimated at RMB 1 billion and governmental support valued at RMB 500 million to accelerate R&D, manufacturing, certification, and operations in East China (Key Developments).

- EHang’s VT20 logistics eVTOL successfully completed intercity cargo flights between Zhuhai and Guangzhou, validating long-range drone logistics and paving the way for the development of an "Air Postal Network" in the Greater Bay Area, significantly improving efficiency for time-sensitive cargo (Key Developments).

- EHang received an order for 50 EH216-S eVTOLs from Guizhou Scenic Tourism Development and reached a cooperation with the Anshun Economic and Technological Development Zone to drive low-altitude tourism, logistics, and emergency services, supporting Guizhou’s broader low-altitude economy initiatives (Key Developments).

- In Changchun, EHang signed a strategic agreement with Jingyue Hi-tech Zone for a demonstration zone, including an order for 41 EH216-S eVTOLs for emergency, sightseeing, and traffic operations, and will benefit from policy, funding, and infrastructure support as it develops cold-weather and composite material technologies (Key Developments).

- The company expanded its partnership with Gotion High-Tech to jointly develop advanced battery systems for the EH216 series and future eVTOL models, aiming to enhance flight range and operational safety, strengthen its UAM and logistics network capabilities, and improve its competitive position in global low-altitude transportation (Key Developments; Periodicals, Reuters highlights EHang among prominent publicly traded drone companies with heightened sector attention in the U.S. defense budget proposal).

Valuation Changes

Summary of Valuation Changes for EHang Holdings

- The Consensus Analyst Price Target has fallen from $27.32 to $25.55.

- The Future P/E for EHang Holdings has significantly fallen from 62.81x to 7.78x.

- The Consensus Revenue Growth forecasts for EHang Holdings has fallen slightly from 70.9% per annum to 68.4% per annum.

Key Takeaways

- Expansion into urban air mobility and strong government partnerships enhance regulatory acceptance, infrastructure integration, and long-term revenue growth potential.

- Innovations in battery technology and a dual business model foster market differentiation, recurring revenue, and margin improvement through operational services and proven safety records.

- Heavy reliance on China, rising costs, and certification delays pose risks to growth and profitability as EHang prioritizes operational stability over aggressive expansion.

Catalysts

About EHang Holdings- Operates as an urban air mobility (UAM) technology platform company in the People’s Republic of China, East Asia, West Asia, North America, South America, West Africa, and Europe.

- The ongoing expansion of urban air mobility use cases-especially driven by government initiatives in smart cities, emergency response, and low-altitude economic ecosystems-positions EHang's autonomous aerial vehicles as foundational infrastructure, which is likely to sustain robust long-term demand and revenue growth as cities increasingly adopt eVTOL solutions.

- The company's deepening partnerships with municipal governments (such as Hefei's RMB 500 million support for the VT35 hub) and involvement in setting regulatory and safety standards enhances regulatory acceptance and ecosystem integration, supporting wider market entry, improved top-line growth, and improved long-term earnings visibility.

- Significant advancements in battery R&D-including solid-state battery integration and partnerships aimed at improving flight range, safety, and eco-friendliness-strengthen EHang's differentiation in green air mobility; this aligns with growing regulatory and societal demands for carbon reduction, which should drive both sales volumes and the ability to command higher margins due to performance leadership.

- Transitioning to a dual business model that combines eVTOL manufacturing with high-value operational services (maintenance, software, training, and operations management) is expected to unlock recurring revenue streams and meaningfully improve overall net margins and earnings resilience as the installed base scales.

- EHang's first-mover advantage in passenger-carrying pilotless eVTOL commercialization, validated by a proven safety record and accelerating order conversion, underpins sustained pricing power, competitive differentiation, and high customer switching costs, which should contribute to long-term margin expansion and earnings growth as volumes ramp.

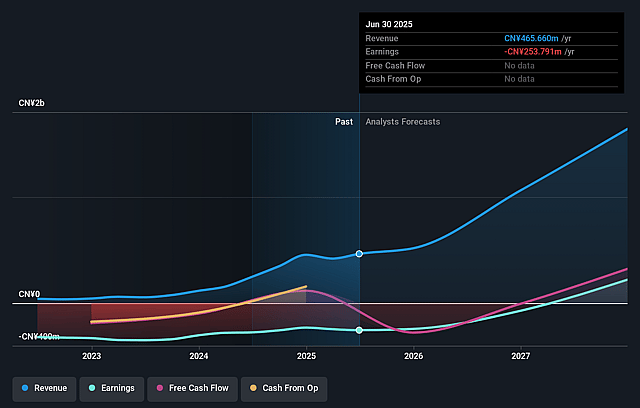

EHang Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming EHang Holdings's revenue will grow by 63.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from -54.5% today to 15.5% in 3 years time.

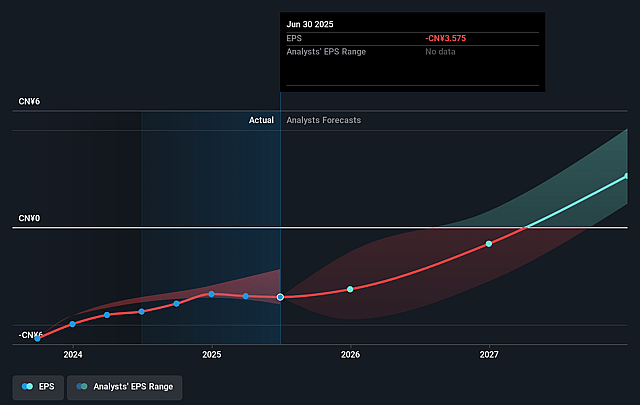

- Analysts expect earnings to reach CN¥314.3 million (and earnings per share of CN¥3.82) by about September 2028, up from CN¥-253.8 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as CN¥99.4 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 56.8x on those 2028 earnings, up from -32.2x today. This future PE is greater than the current PE for the US Aerospace & Defense industry at 34.4x.

- Analysts expect the number of shares outstanding to grow by 5.03% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.29%, as per the Simply Wall St company report.

EHang Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- EHang's lowered revenue guidance for 2025 and its strategy to moderate the pace of order deliveries in favor of focusing on operational readiness and safety signal that the company is prioritizing long-term stability over short-term sales growth; this transition may lead to slower revenue growth and increases the risk that scaling will be delayed, impacting near-future top-line revenues.

- International expansion remains in early stages, with 90% of current sales and backlog concentrated in China; limited overseas certification and very modest overseas deliveries so far raise concerns about the company's ability to diversify revenue and increase its addressable market, making future earnings vulnerable to domestic regulatory or economic headwinds.

- EHang's continued high operating expenses-largely due to accelerated R&D investment and workforce expansion-are outpacing gross profit growth, which could put persistent pressure on net margins and profitability, particularly if operational ramp-up or commercial adoption is slower than anticipated.

- Heightened competition from larger, global aerospace and eVTOL players with more resources could erode EHang's technological lead, dampen pricing power, and compress both revenues and margins if multinational rivals gain certifications or market traction faster, both domestically and internationally.

- Delays or stricter standards in achieving large-scale regulatory certifications for new aircraft models, batteries, and international operations could impede commercial deployments, slow revenue recognition, and limit market expansion-exposing EHang's long-term growth to regulatory and operational execution risks.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $23.713 for EHang Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $27.77, and the most bearish reporting a price target of just $19.04.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CN¥2.0 billion, earnings will come to CN¥314.3 million, and it would be trading on a PE ratio of 56.8x, assuming you use a discount rate of 8.3%.

- Given the current share price of $15.91, the analyst price target of $23.71 is 32.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.