Last Update07 May 25Fair value Increased 3.42%

Key Takeaways

- Rapid expansion in electric vehicles and connectivity services positions the company for strong, recurring revenue growth and enhanced profitability as the industry shifts to clean mobility.

- Strategic investments in manufacturing, cost optimization, and commercial vehicle leadership improve resilience, margin leverage, and long-term shareholder value.

- Persistent supply chain risks, expensive EV transition, intense competitive pressure, high legacy costs, and ongoing international setbacks threaten Ford’s profitability and financial stability.

Catalysts

About Ford Motor- Develops, delivers, and services Ford trucks, sport utility vehicles, commercial vans and cars, and Lincoln luxury vehicles worldwide.

- Ford’s expanded and rapidly growing electric and hybrid vehicle portfolio, including strong Model e retail sales (+15% in Q1) and successful launches such as the all-electric Puma and Ranger Plug-In Hybrid, position the company to capitalize on the accelerating transition toward clean mobility. This is expected to drive significant long-term revenue growth as the global market for electric vehicles expands.

- The focus on advanced vehicle connectivity and subscription-based services—evidenced by a 20% year-over-year increase to 675,000 paid Ford Pro software subscribers and a 40% increase in average revenue per unit in higher margin offerings like fleet telematics—lays the groundwork for new recurring high-margin revenue streams and sustainable growth in earnings and net margins.

- Integrated investments in U.S. manufacturing, battery capacity, and supply chain localization are enhancing Ford’s resilience to external disruptions (such as tariffs on imported parts/vehicles) while improving cost leverage. This advances the company’s ability to expand operating margins and protect long-term profitability.

- Leveraging Ford’s commanding leadership in commercial vehicles and the Ford Pro ecosystem, the company continues to grow its higher-value, recurring software and service business, driving up both top-line revenue and profitability. Achieving the goal of 20% of Pro EBIT from software and services would be a structural margin tailwind.

- Ongoing cost-structure optimization through platform consolidation, process automation, and supply chain enhancements has already led to a third consecutive quarter of year-over-year cost improvement and sustained warranty savings. This trajectory supports higher net income and robust free cash flow, directly benefiting long-term shareholder returns.

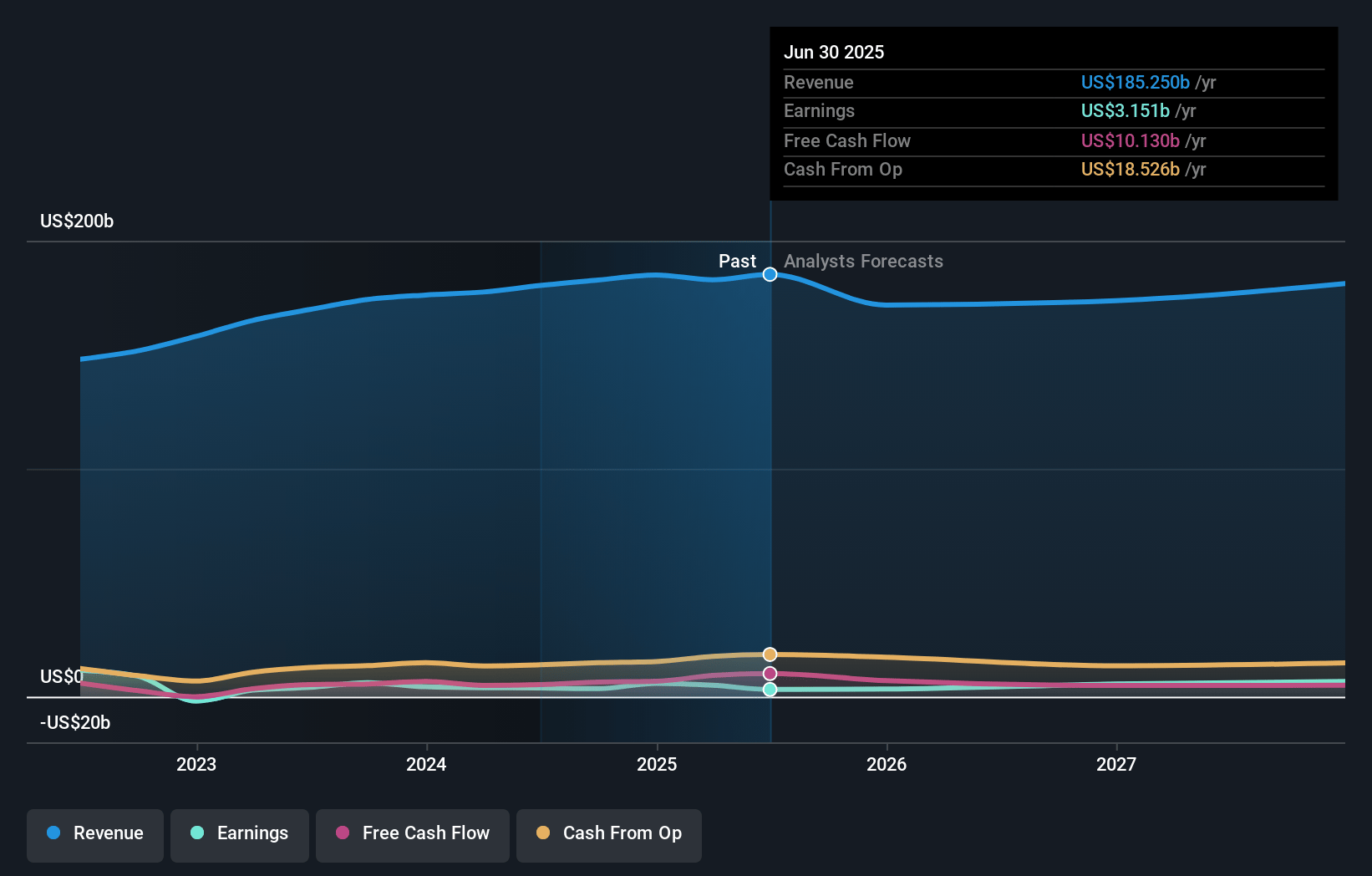

Ford Motor Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Ford Motor compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Ford Motor's revenue will grow by 2.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 2.7% today to 4.3% in 3 years time.

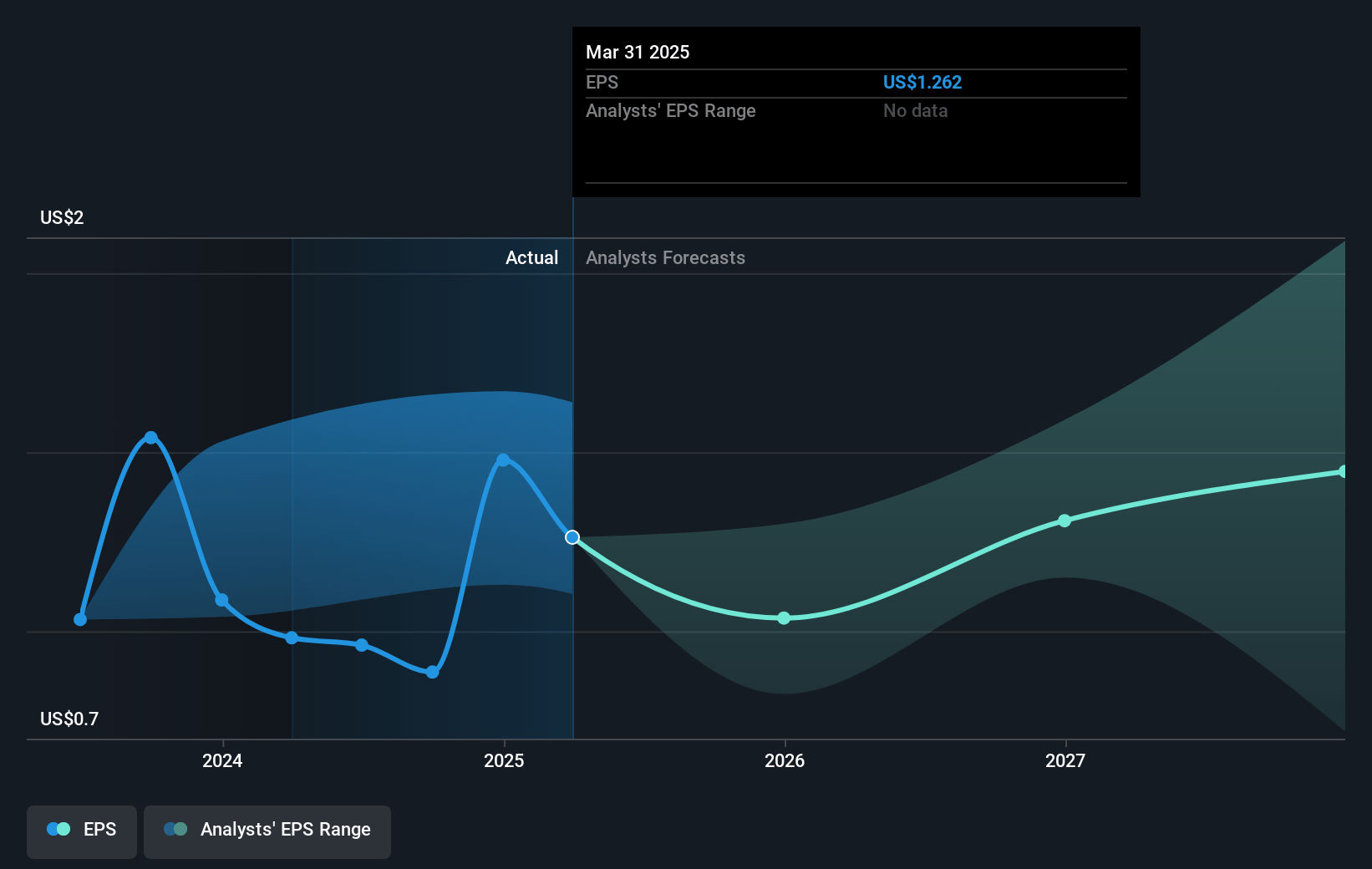

- The bullish analysts expect earnings to reach $8.4 billion (and earnings per share of $2.09) by about May 2028, up from $5.0 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 9.6x on those 2028 earnings, up from 8.3x today. This future PE is lower than the current PE for the GB Auto industry at 13.9x.

- Analysts expect the number of shares outstanding to decline by 0.61% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.41%, as per the Simply Wall St company report.

Ford Motor Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent supply chain vulnerabilities, including potential disruptions from volatility in global tariff policy, ongoing semiconductor and raw material shortages, and complications with rare earth imports—especially from China—could constrain Ford’s production capacity and delivery reliability, putting revenues and overall earnings at risk.

- The heavy capital investment required for the transition to electric vehicles, including $50 billion in manufacturing and battery capacity, may strain Ford’s free cash flow and lead to reduced net margins if the company fails to scale EV production profitably or if EV adoption does not accelerate as projected.

- Intensifying competition from both new EV entrants and lower-cost Asian automakers, coupled with the rapid evolution of technology in autonomous and connected vehicles, could erode Ford’s pricing power, reduce market share, and put downward pressure on future revenues and margins.

- Ford’s ongoing pension and healthcare obligations for retirees continue to weigh on the company’s cost structure, limiting financial flexibility and increasing the risk to net income, particularly in the event of economic or industry downturns.

- Underperformance and restructuring challenges in international markets, especially in China and South America, expose Ford to prolonged losses, foreign exchange headwinds, and additional restructuring expenses, which could drag on consolidated revenue growth and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Ford Motor is $14.94, which represents two standard deviations above the consensus price target of $10.09. This valuation is based on what can be assumed as the expectations of Ford Motor's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $17.0, and the most bearish reporting a price target of just $7.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $194.6 billion, earnings will come to $8.4 billion, and it would be trading on a PE ratio of 9.6x, assuming you use a discount rate of 11.4%.

- Given the current share price of $10.44, the bullish analyst price target of $14.94 is 30.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.