Last Update07 May 25Fair value Decreased 2.64%

Key Takeaways

- Slow transition to electric vehicles amid regulatory and consumer shifts threatens Ford’s market relevance, margins, and growth prospects as legacy sales weaken and battery costs remain high.

- Heightened competition, supply chain disruptions, and recurring quality issues risk eroding brand value, increasing costs, and constraining long-term profitability.

- Strong U.S. manufacturing, cost-cutting, growing software revenue, and expansion in electric and hybrid vehicles reinforce Ford’s resilience, growth potential, and strategic market positioning.

Catalysts

About Ford Motor- Develops, delivers, and services Ford trucks, sport utility vehicles, commercial vans and cars, and Lincoln luxury vehicles worldwide.

- The accelerating global regulatory push for electric vehicles and decarbonization poses a significant long-term risk for Ford, as the company continues to rely heavily on its legacy internal combustion engine truck and SUV sales. If Ford cannot execute a profitable, large-scale transition to EVs quickly enough, it faces declining revenue and compressing net margins as legacy models lose favor and profitability is eroded by high battery costs.

- Younger consumers are increasingly drawn to urban mobility platforms, ride-sharing, and alternative transportation, shrinking the overall market for traditional car ownership. Over time, this structural shift threatens to lower Ford's addressable market, stagnate unit sales, and ultimately pressure long-term revenue and earnings growth.

- Ford's capital-intensive late-stage investments in battery plants and EV production facilities may not deliver the necessary scale or cost advantage in the face of intensifying price competition from lower-cost foreign automakers, especially Chinese EV manufacturers. This increases the risk of persistent industry-wide price wars, undermining Ford's ability to sustainably improve net margins and returns on invested capital.

- Recurring quality and recall issues could further erode brand trust, escalate warranty and reserve expenses, and elevate selling, general, and administrative costs. The inability to consistently deliver vehicles with industry-leading dependability may result in customer attrition, diminishing future revenue streams and affecting earnings stability.

- The industry faces chronic supply chain disruptions due to geopolitical tensions, raw material shortages, and shifting tariff policies. For Ford, this creates ongoing risk of production delays, cost inflation, reduced operating efficiency, and increased capital expenditure—all factors that could materially constrain free cash flow and depress long-term profitability.

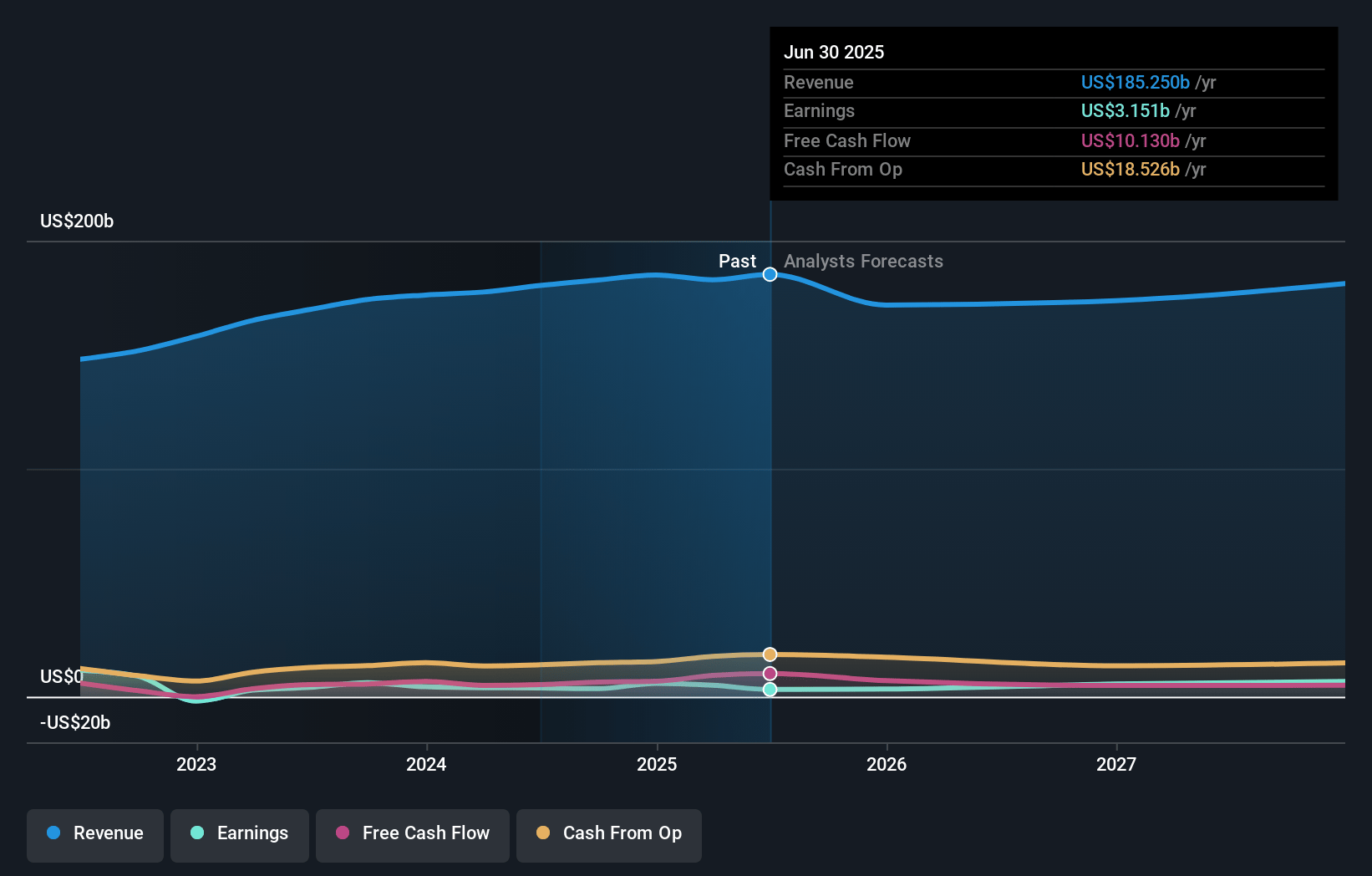

Ford Motor Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Ford Motor compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Ford Motor's revenue will decrease by 5.9% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 2.7% today to 1.9% in 3 years time.

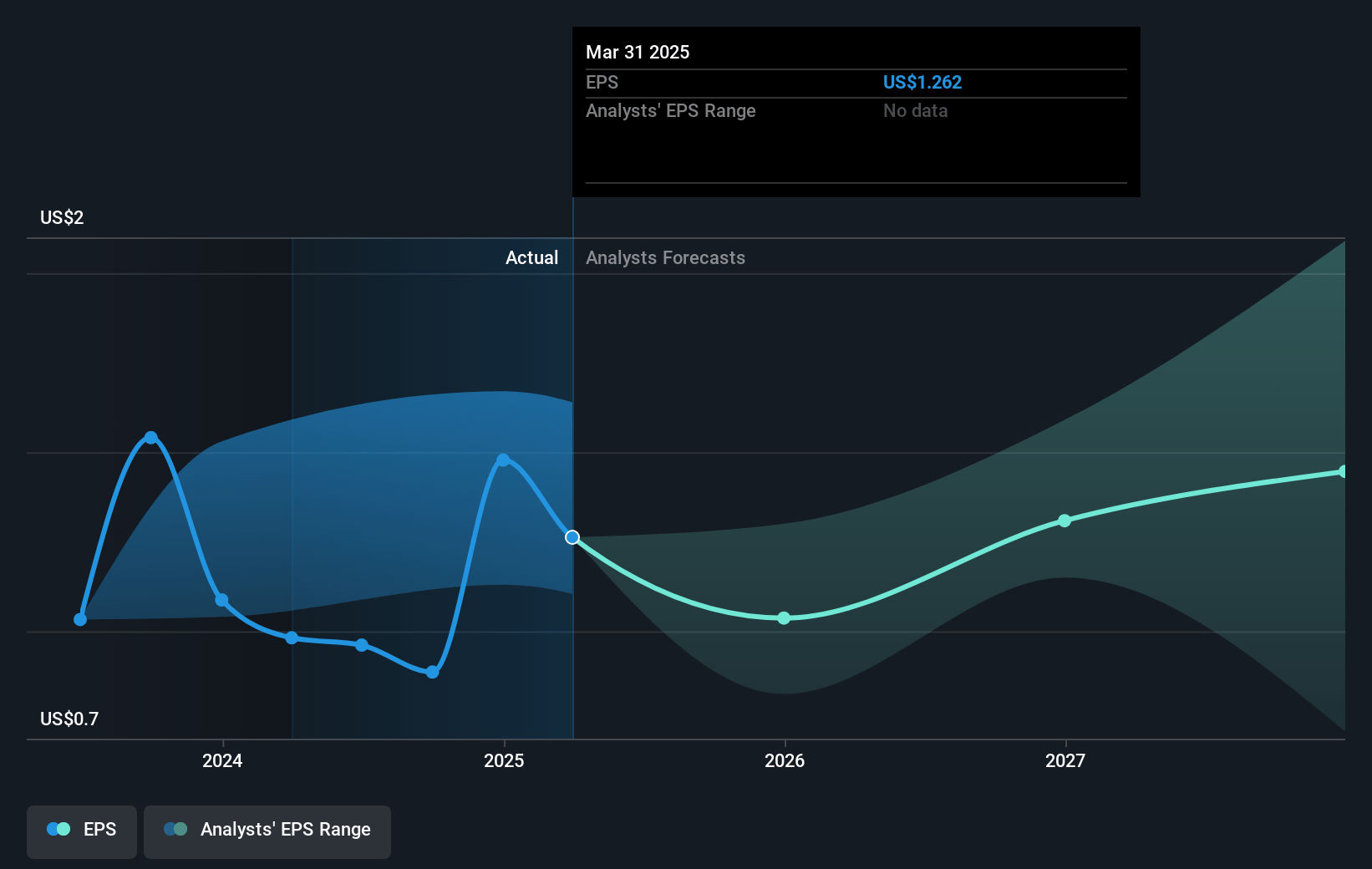

- The bearish analysts expect earnings to reach $2.9 billion (and earnings per share of $0.72) by about May 2028, down from $5.0 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 13.2x on those 2028 earnings, up from 8.1x today. This future PE is lower than the current PE for the GB Auto industry at 13.9x.

- Analysts expect the number of shares outstanding to decline by 0.4% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.41%, as per the Simply Wall St company report.

Ford Motor Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ford’s strong and expanding U.S. manufacturing footprint positions it to capitalize on tariff-induced industry shifts, potentially enabling it to gain market share from foreign-based competitors and driving an increase in unit sales and net pricing, which could positively impact revenue and margins over the long run.

- The company is delivering consistent progress on cost reductions and operational efficiency, with $1 billion in net cost improvements targeted for the year, enhancing Ford’s ability to improve gross and net margins even in a challenging macro environment.

- Ford Pro is experiencing robust growth in recurring high-margin software and service revenues, as paid subscriptions and fleet telematics income increase significantly, providing a stable and growing revenue stream less dependent on cyclical vehicle demand.

- Ford’s aggressively expanding and profitable EV and hybrid portfolio—including launches like the all-electric Puma, the Ranger Plug-In Hybrid, and sustained Mach-E sales—suggests that the company is well placed to benefit from secular trends towards electrification and decarbonization, supporting both revenue growth and long-term market share.

- With a strong balance sheet, substantial liquidity, and continued investments in flexible domestic manufacturing and battery capacity, Ford is in a resilient position to invest opportunistically in growth and withstand near-term industry volatility, supporting ongoing shareholder distributions and financial durability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Ford Motor is $7.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Ford Motor's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $17.0, and the most bearish reporting a price target of just $7.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $152.3 billion, earnings will come to $2.9 billion, and it would be trading on a PE ratio of 13.2x, assuming you use a discount rate of 11.4%.

- Given the current share price of $10.28, the bearish analyst price target of $7.0 is 46.9% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.