Last Update 06 Nov 24

Fair value Increased 5.21%The Latest on Ford

Earnings Call Highlights

- Ford Pro Segment (Commercial):

- Q3 2024 revenue of $15.66B, up 13.2% compared to $13.83B in Q3 2023.

- EBIT comes in at 1.81B, at a margin of 11.6%. A slight drop in EBIT margin from 12% a year ago due to reduced rental business and plant shutdowns, demand remains robust for key products like Super Duty and Transit.

- Ford Model e Segment (EVs):

- Q3 2024 revenue of $1.25B, down 37.2% compared to $2.0B in Q3 2023.

- The Model e segment reported an EBIT loss of $1.2 billion. While Ford achieved $500 million in year-over-year cost improvements, these were offset by industry pricing pressures and an 11% decline in global wholesales.

- Ford Blue Segment (ICE vehicles):

- Q3 2024 revenue of $26.2B, up 3% compared to $25.6B in Q3 2023.

- Revenue increased by 3%, despite a 2% decline in wholesales due to the discontinuation of low-margin ICE passenger vehicles.

- EBIT stood at $1.6 billion with a margin of 6.2%, both down year-over-year due to adverse exchange rates and higher manufacturing costs.

- Ford Credit:

- Generated earnings before taxes of $544 million, up $186 million year-over-year, driven by improved financing margins and higher receivables.

Ford’s EV Strategy Requires some work

- Ford is rejigging its EV plans in North America after a bump start to their electrification push. Ultimately, Ford decided to reduce its capital expenditure on pure electric vehicles from 40% to 30%, reallocating resources towards hybrid models and cost-effective EV solutions.

- Ford has scrapped plans for its next lineup of all-electric SUVs, replacing them with hybrid models. While it’s great to be agile enough to make these decisions to improve profitability, there are still some negative impacts and the decision resulted in a write-down of manufacturing equipment worth at least $400 million, with total costs potentially exceeding $1.5 billion.

- The production of the next-generation “T3” electric pickup truck - the successor to the F150 Lighting has been delayed by about 18 months, now slated for the second half of 2027. While neither good nor bad, it’s perhaps a sign that Ford feels the need to develop the platform further before bringing it to the market to ensure more commercial success.

- Ford’s shift in strategy seems to be in response to them understanding that they’ve missed the beat with their EV rollouts. Their initial push failed to connect with consumers and the new strategy acknowledges that customers are increasingly price-conscious and range-anxious, hence why focussing hybrid offerings is their primary concern. So far so good as well, with hybrid sales increasing by 30% in the quarter. Ford plans to carry this focus forward through to 2030, hoping to deliver hybrid options across its entire North American lineup by then.

Things of Note

- Ford’s next EV entry will be an electric commercial van in 2026, capitalizing on the success of its “Pro” commercial vehicle and fleet business.

- A specialized team in California is developing a new small EV platform, with a midsize electric pickup expected to launch in 2027.

- Ford plans to allocate resources towards areas where it has a competitive advantage, focusing on segments with higher adoption rates for EVs and hybrids.

My Latest Thoughts

Assumed challenges in EV penetration seem to be playing out

- The adjustments in Ford’s EV strategy seem to be in a direct response to factors that I assumed would bog down their rollout. Ford’s acknowledgment that the EV market isn’t growing as rapidly as anticipated aligns with my original assumption that consumers are hesitant to adopt EVs due to higher costs, range anxiety, and underdeveloped infrastructure. The shift towards hybrids indicates that pure EV adoption is lagging, which seems to confirm my thought that EV sales growth will be limited in the near term.The real question now is whether this is the right move long-term. Ford has bitten the bullet to shift away from a pure EV play, but this could come with issues down the road. While I think today’s consumers are more comfortable with hybrid vehicles, this could quickly change if concerns about range, cost and infrastructure are addressed. The end result here could be Ford massively behind other competitors once the tides shift towards EVs, as they will have lost ground on competitors who solely focussed on delivering an EV that met the needs of consumers.

Rising competition is still on Ford’s mind

- Ford’s shows continued concern about rising competition from Chinese automakers like BYD. While the company touted consumer concerns as part of the reason they shifted to a hybrid focus, it’s hard to assume that it wasn’t also partially a response to competitive pressures, especially from manufacturers who can produce cost-effective vehicles.Ford CEO James Farley indirectly hinted at Ford conceding defeat to BYD with respect to battery hardware, stating, “we think companies like BYD have an incredible advantage on affordability of batteries. So we have to make that up where our opportunity is on the EV component side, inverters, gearboxes, motors, et cetera.”While this isn’t a crazy new revelation, it seems to point to the fact that Ford is running from a fight a little bit and seems to confirm my initial thoughts.

The impacts of rising labour costs are being felt

- While the UAW strikes have all but subsided, the increased focus on cost reductions and efficiency improvements suggests that Ford is feeling the pressure of rising operational costs. The earnings call acknowledged higher manufacturing costs and the need for aggressive cost-cutting measures, which seem to point to the fact that increased labour costs have had an overall impact on costs, one of the key assumptions that I had made with respect to labour costs and their impact on EBIT margins. It’ll be interesting to see how Ford continues on its cost-cutting warpath. Affordability is front-of-mind for a lot of consumers right now, so if they can cut costs efficiently, I can start to see a bit of demand pick up slightly in the near term if they can deliver affordable hybrids to consumers.

Adjustments in Assumptions

Given these developments, I am inclined to adjust my assumptions:

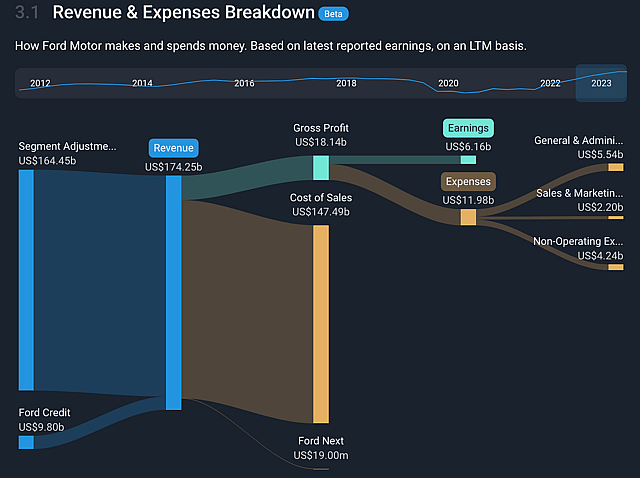

- Firstly, I have rebased my narrative using the last 12 months of figures. That means my valuation uses $182.74B as a current revenue figure and $3.53B as a current earnings figure.

- With Ford scaling back its pure EV ambitions and focusing more on hybrids, I anticipate that the sales volumes may not decline as sharply as initially thought. However, the pivot indicates a strategic retreat rather than a position of strength, so I remain cautious about significant growth in automotive revenues. Over the next 5 years to 2029, I will assume a 3.5% revenue growth for Ford, accounting for an uptick in the near-term but a plateauing closer to the 5-year mark. This results in $217B in revenue in 2029.

- The aggressive cost-cutting measures and focus on capital efficiencies might help mitigate some margin pressures. Yet, the cancellation and delay of key EV projects could result in sunk costs and write-downs, negatively impacting overall profitability. Ford is currently operating at a 1.93% net profit margin in the midst of their current strategic shifts, so I could reason with this improving slightly to 3% by 2029, which assumes that they’re still investing a significant amount in developing battery technology. Given my revenue projections, this 3% net profit margin would result in $6.5B in earnings in 2029.

- I’m going to assume that Ford’s PE will recede slightly. Ford is currently trading at around a 12x PE margin, but owing to the fact that I see them slipping behind competitors with respect to their EV projects that will become important after 2029, I can see them trading at a multiple closer to 10x.

- The changes to my valuation results in a new fair value of $9.70

Key Takeaways

- Ford’s failure to launch a meaningful EV campaign will see them lose out in Europe and Asia.

- Increase labor costs following Union strikes will put pressure on Automotive EBIT margins

- Strict credit conditions over the next few years will hurt Ford’s sales volumes and financing margins

Catalysts

Rising Competition In EV Market Will Limit Sales Growth Trajectory

Ford was one of the many manufacturers that have had to realign their focus with climate action in mind. The Paris Agreement outlined a goal for the world to achieve ‘Net Zero’ by 2050 and to limit the rise in global temperatures.

One of the more ambitious goals set out by the agreement was to limit global temperature rise to no more than 1.5 °C above pre-industrial averages. To achieve this, global carbon emissions need to be cut by roughly 50% by 2030, hence why automakers fell into the crosshairs.

To put this into context, achieving this goal would require that 75-95% of all global new car sales in 2030 would have to be electric vehicles, according to Climate Action Tracker.

This highlighted the need for auto manufacturers to fundamentally shift their operations to align with an electrified future, and to do so with the utmost urgency.

Ford’s aggressive push into EVs has not come without its challenges, though. While Ford knew it was already facing an uphill battle against established EV manufacturer Tesla, its growth trajectory has been curtailed by several factors.

Poor EV penetration in North America

The problem with electric vehicles is convincing consumers to become early adopters of a new technology. While you do get to expereince the latest technology, early adoption often means dealing with various painpoints that have yet to be ironed out in the manufacturing process. For EVs that could mean poor reliablility, poor longevity, higher ongoing costs and a underdeveloped infrastructure for charging.

The severity of these pain-points is also dependent of the region you’re in. Typically, European drivers don’t travel as far as American drivers due to the geography and layout of their metropolitan areas. This means that European drivers will be less impacted by longevity concerns with early adoption as their average trip length is well covered by EV ranges.

Fuel costs also factor into EV sales penetration. It’s easier to justify the costs of switching to EV when the fuel price is quite high. In the US, fuel prices are hovering between $3-4 per gallon. Compare this to much of Europe, where fuel prices are closer to $8 per gallon and it’s easy to see why EV sales penetration within the US is lagging behind Europe, despite large EV manufacturers like Tesla committing to building out the local infrastructure.

EVs simply have a very marginal ongoing benefit in the US compared to traditional ICE vehicles which are cheap to run, fit the need of the population with respect to trip range and are already plentiful.

EV sales in the US are so lacklustre in fact, that the Wall Street Journal had recently reported that Ford was considering cancelling one of three shifts at the Michigan plant building their F-150 Lightning electric truck citing slowing demand, and indicated that the company was looking to build more gasoline-powered trucks instead.

Competition from Eastern Auto Manufacturers

It’s already established that EVs are having a tough time penetrating the North American market, but how would Ford’s EVs sell overseas? If we look across the pond, or even look to the Asia-Pacific region, things are still quite precarious for Ford who face strict competition from the Volkswagen Auto Group (VW, Porsche, Audi, Skoda, Seat etc.), Fiat, Toyota, Hyundai, Kia and SAIC.

Ultimately to be successful with their EV goals, Ford is going to have to compete on a global scale, but this is easier said than done. Ford was the 11th most popular car brand by sales in Europe in the first half of 2023 and with many of the most popular manufacturers offering their own EV solutions that cater to European consumers. I see continued hardship for Ford, particularly if they continue to ramp down EV production in response to North American demand.

The situation for Ford isn’t any better in the Asia-Pacific region, which has been dominated by emerging Chinese auto manufacturers like BYD and SAIC. In fact, Chinese automakers sold 75% of EVs in Southeast Asia in first quarter.

Macroeconomic Difficulties Deterring Buyers

Ultimately, the biggest determinant of new car sales - irrespective of drivetrain - is the ability for people to buy new vehicles. If economic conditions mean people cannot afford to buy new vehicles, then sales figures will begin to suffer.

At this stage, electric vehicles still carry a a noticeable premium to ICE vehicles, largely due to increased manufacturing costs compared to their petrol-powered counterparts. While this isn’t necessarily a problem with luxury manufacturers, whose customers are less impacted by cost of living pressures, Ford’s customer base could be deterred from adopting new EVs by their higher costs.

With high borrowing costs and economic uncertainties making consumers hesitant, Ford may face challenges in achieving its EV sales targets.

Labor Cost Pressures

The United Auto Workers Union (UAW) have recently begun a series of strikes at several of Ford’s major plants, demanding a raise in pay to meet the cost of living increases. While negotiations are still ongoing, a preliminary offer was made for a 25% increase in pay over five years.

The cost to the automakers isn’t just limited to the labor cost, with Ford mentioning recently that the ongoing strikes and shutdowns organised by the UAW have cost the company $1.3 billion in lost revenue due to the cancellation of over 80,000 vehicle orders.

While it isn’t only Ford that’s having to deal with the strikes - with GM and Stellantis matching Ford’s offer - it’s in Ford’s best interest to get this wrapped up quickly, as Ford is suffering more from the strikes than its competitors. In a recent note, J.P. Morgan analyst Ryan Brinkman forecast that Ford is now losing $44 million each day, compared to the $21 million per day for GM.

News of the wage increase is great for the workers, but it weighs heavy on Ford, as a surge in labor costs represents a substantial competitive disadvantage in an already tight market. This is felt particularly within their EV segment, where Ford is in close competition with the likes of Tesla and foreign automakers like Hyundai and Toyota, whose workforces are non-unionized.

Although the impact to consumers cannot yet be quantified, Ford itself has projected that the new labor deal could add $850-900 to the manufacturing cost of each vehicle, which will likely translate into a price increase in the thousands should Ford want to keep their margins similar. This would undoubtedly be an unwelcome change among new car buyers in the midst of a cost of living crisis and could likely cause a shift in demand away from Ford.

The negotiations and increasing labor costs, particularly with the transition to EV production, could significantly impact Ford's operational efficiency and profit margins, posing a long-term challenge to its cost structure and its ability to invest in growth pathways like new drivetrain technologies.

Ford’s Credit Risk Exposure Could Be Detrimental In This Macro Market

Ford is known as an automaker first and foremost, but few people know it has a sizeable financing subsidiary in Ford Credit. Ford Credit provides financing and leasing solutions to and through Ford dealers. The credit arm has two main portfolios: consumer and non-consumer, with the former encompassing financing activities to individuals and businesses, and the latter providing wholesale leasing options to partnered dealerships.

While Ford Credit has been a historically strong EBIT performer for the business, it has begun to show cracks induced by an unfavourable macroeconomic environment. Ford’s credit segment has been impacted in three key ways:

Lower Borrowing Margins

Ford Credit’s operations are funded primarily through debt, which has worked great in the recent period of historically low interest rates over the last 10–15 years, but does not work too well in periods of rapidly rising interest rates. In the most simple terms, Ford Credit’s ability to generate money hinges on their ‘Financing Margin’ or the difference between the cost of debt used to fund the segment, and the amount they generate from the loans to individuals, businesses and dealers.

In periods of high interest rates, this financing margin tends to erode. Inevitably, as interest rates rise, the cost of Ford borrowing to fund the credit arm increases and this increase is passed on to customers through higher car loan rates. But this isn’t a linear relationship, if Ford raise their rates too high, consumers will be deterred from financing new vehicles and Ford Credit’s business suffers as a result. So to mitigate that risk, Ford has to absorb some of the higher interest rates, at the cost of their financing margin.

Greater Credit Delinquency Risk

In periods of high inflation and high interest rates, the risk of debtors missing payments rises. While TransUnion’s 2023 Credit Forecast seems to think that serious auto loan delinquency rates are expected to slightly decline to 1.9% in 2023, more recent figures show that the percentage of subprime borrowers at least 60 days past due on their loans rose to 6.11% in September 2023 - the highest in data going back to 1994.

Additionally, US auto loans delinquent by 90 or more days stand at 3.91%, which is higher than the long-term average of 3.47%. This rise in delinquency is occurring in an environment where the average interest rate for a 60-month new car loan has significantly increased to 7.48% in Q1 2023 from 4.52% the year before. These factors combined indicate that Ford Credit is at much greater risk now of incurring significant credit losses, which would unequivocally harm the overall business.

Stricter Credit Conditions

Credit is an incredibly important part of Ford’s business. Consider that nearly 80% of all new car sales are financed, any potential headwinds could impact the number of new car sales. Elevated interest rates mean two things for prospective car buyers. Their monthly repayments are now higher, occupying a larger chunk of monthly budgets, and that credit is now less accessible for the bulk of the population. Ultimately, this should imply that new car sales will drop as a result.

Ford Credit's amended policies, such as longer loan terms to subprime customers, heighten the risk of credit losses amidst rising auto loan defaults. This financial vulnerability could affect the company's balance sheet resilience and earnings stability.

Assumptions

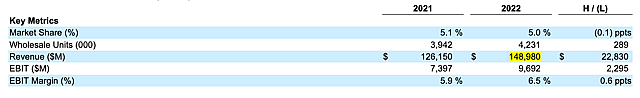

Increasing Labor Costs Will Cause EBIT Margins To Tighten And Auto Sales To Falter

Ford and the UAW have to an agreement after 40 days of strikes. Details of the agreement are still unclear, but UAW President Shawn Fain and Vice President Chuck Browning claimed the Ford deal was a “record contract” and “the most lucrative agreement per member since Walter Reuther was president” back in 1941.

I’m going to assume that the deal inked between Ford and its plant workers is around a 30% raise, leading to a per vehicle increase of around $900 in labor costs alone.

In 2022, Ford Wholesale sold 4,231,000 vehicles, and for annual revenues in the automotive segment of $148B, this corresponds to an average wholesale price per vehicle of $35,211. Given a 6.5% EBIT margin, a rough estimate on the cost per vehicle would be close to $32,981 per vehicle, which includes raw materials costs, labor costs, factory overhead etc.

If the average cost per vehicle were to climb $900 as per my assumption, that would result in a per-vehicle cost to Ford of $33,881 and a resulting EBIT margin of 3.7%. Now, I believe Ford will be reactionary here and increase the average wholesale price of their vehicles to approach a 5% margin in the near-term, but this will come at the cost of pure sales, as dealer mark-ups will lead Ford to be priced quite high, particularly in comparison to its non-unionized counterparts.

.jpg)

Tracking Ford Global Vehicle Sales and Market Share - Stockdividendscreener.com

Ford’s sales have actually been declining globally over the past few years, independent of the recent macroeconomic troubles, and this is a trend I see continuing. The EU’s ban on the sale of ICE vehicles is still a number of years away, but I suspect that the impacts will be seen quite soon for Ford. In 2024, Britain will require that 22% of a manufacturer's vehicles sold to British customers be EVs, or the manufacturer risks facing harsh penalties. Ford would be among the hardest hit due to poor EV sales in the region.

I’ll assume that Ford’s global wholesale sales in 2028 will be a touch under where it is today, coming in at around 4 million vehicles, pressured downwards due to Ford’s rising costs to consumers in response to the UAW agreement and due to losing out in Europe to European and Asian car manufacturers who have a better EV offering.

I see Ford’s average wholesale price per vehicle rising to $40,000 and EBIT margins falling to around 4.5% due to increased materials costs of EV vehicles. This equates to $160 Billion in automotive sales across Ford’s Blue, Model e and Pro segments. At an EBIT margin of 4.5% operational profit from the automotive segment will be $7.2 Billion.

Stricter Credit Conditions And Greater Delinquencies Hurt Ford Credit

Ford’s Credit business acts as a barometer for the rest of the company. When interest rates are low, Ford Credit’s finance margins tend to be buoyant, car sales are plentiful and delinquencies are low. However, in times like the present, Ford Credit’s operations are much leaner.

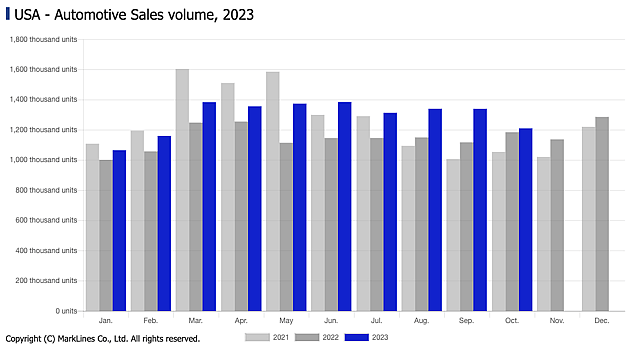

I anticipate several years of ongoing difficulty for Ford Credit. Taking a look at automotive sales volume by month from MarkLines Co, we can see that 2023’s car sales have been higher than 2022 at every month this year. Now this seems paradoxical as interest rates are higher and so too is the cost of living. However, I am chalking this up to a delay in the impacts of the tightening monetary policy on car sales.

As seen in the economic data, inflation rates globally are being quite stubborn, which is attributed to relatively high savings balances. However, as Bank of America pointed out, this isn’t uniform across the population. Most of the savings are held by baby boomers, while younger Millennials and Generation Zers are beginning to struggle. This should be quite concerning for Ford over the next few years, as these are the people who are actively working, growing their families and will be needing to upgrade their cars as a result - and most likely using credit to do so.

As outlined above, I think macroeconomic condition and competitive pressures will Ford’s sales volumes decrease over the next five years. Particularly, if the 'higher for longer' interest rate narrative plays out, we may be entering a period where loan volumes are much lower than they were over the previous decade as stricter credit conditions raise the barrier to entry for vehicle ownership.

I think Ford’s Credit business will be generating $9.2 billion in revenue in 2028. This is slightly higher than last year's figure of $8.978 billion, which I mainly attribute to increases in the price to the end consumers following labor increases and an increase in higher priced EV sales, but offset partially by lower total sales volumes. As a result of higher interest rates, I think lower finance margins and greater credit losses will see segment EBIT drop to $1.5 Billion in 2028, significantly lower than the $2.657 Billion the segment earned in 2022.

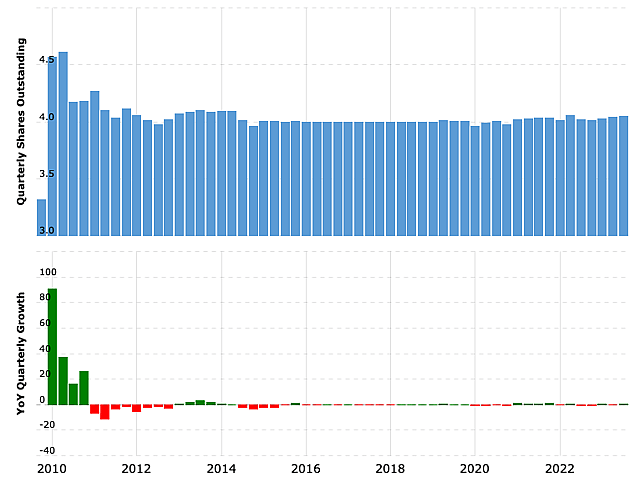

Shareholder Dilution To Continue

Ford’s shares outstanding has been remarkably stable over the past 10–15 years, with much of the dilution due to vesting RSUs and exercised options being offset by share buybacks.

With this in mind, I’ll use the current 4.03 billion shares outstanding figure as a fair estimate for shares outstanding in 2028 for the purposes of a future PE valuation.

Interest Expense to grow, Effective Tax Rate to Remain

For the purpose of adjusting EBIT to an useable Earnings figure, I’ll make a few short assumptions:

- Interest Expense to grow to $1.8 Billion, up from $1.282 Billion in 2022.

- Effective tax rate to remain at around 16% of EBT.

- Non-operating Expenses will total $600 Million, consistent with current levels.

- Ford Next will see begin to see a positive EBIT gain of $500 Million in 2028, owing to minor success with Ford’s self-driving initiatives. Revenue for the 2028 year will reach $4.5 Billion following some significant advancements and commercialisation deals.

- Ford’s Corporate Other EBIT losses will remain consistent at around $1.5 Billion through to 2028.

Risks

Successful EV Strategy Execution Leads To Sales Boom

In this narrative, I’ve been quite pessimistic over Ford’s EV push. I’m of the firm belief that they’ll struggle in carving out market share in the EV space while European and Asian manufacturers continue to snatch up market presence.

However, once North America begins to warm to the idea of electric vehicles more - perhaps due to new battery advancements allowing longer ranges and a wider thermal window - Ford’s brand power and presence in the North American market could mean that it successfully capitalizes on its EV investments.

If this were to happen, my assumptions for future automotive revenues could be severely understated.

Improved Credit Conditions And More Efficient Management Could Nullify Credit Risks

If the macroeconomic environment were to undergo a reversal, and we begin seeing interest rates head towards the previous lows of the past 5 years, many of the risks associated with Ford Credit's loan portfolio could be mitigated.

Lower interest rates generally would lead to higher sales volumes due to easier credit availability, less credit losses due to delinquencies lowering and ultimately a rapidly growing loan portfolio.

If this were to eventuate, I would have to revise my assumptions for Ford’s Credit segment upwards.

How well do narratives help inform your perspective?

Disclaimer

Simply Wall St analyst Bailey holds no position in NYSE:F. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.