Key Takeaways

- Ambitious network expansion, advanced technology adoption, and property integration are expected to drive long-term revenue, margin, and ridership growth.

- Diversification into new regions, climate-driven ridership gains, and advancements in efficiency position MTR for more stable earnings and enhanced growth potential.

- Heavy reliance on property profits, rising capital needs, slow ridership recovery, regulatory pressures, and weak retail trends threaten earnings stability and revenue diversification.

Catalysts

About MTR- Engages in railway design, construction, operation, maintenance, and investment in Hong Kong, Australia, Mainland China, Macao, Sweden, and the United Kingdom.

- Analysts broadly agree that the HK$100 billion investment in new railway projects will strain finances, but the scale and efficiency of MTR's project management-including integration of innovative technology-suggests these expansions will yield superior long-term revenue growth and margin uplift as network effects, enhanced connectivity, and integration with property drive higher ridership and commercial returns.

- While analyst consensus anticipates one-off property development profits to be volatile, the current pipeline and ongoing urbanization will likely result in recurring, above-trend contributions as MTR continues to execute on multiple harvest-phase projects, underpinning sustained earnings and cash flow to offset CapEx.

- Sustained policy momentum for climate action is accelerating modal shift from road to mass transit, positioning MTR for significant multi-year ridership gains and fare revenue growth, while new green financing products lower the cost of capital and deepen access to funding for future expansion.

- Advancements in smart mobility, digital ticketing, and operational automation are set to drive step-changes in cost efficiency, passenger convenience, and service quality, improving operating leverage and net margins over time.

- Expansion of Greater Bay Area and Mainland China operations-coupled with increased international business and station commercialization-will diversify and increase top-line growth, reducing earnings volatility and driving higher long-term EPS growth.

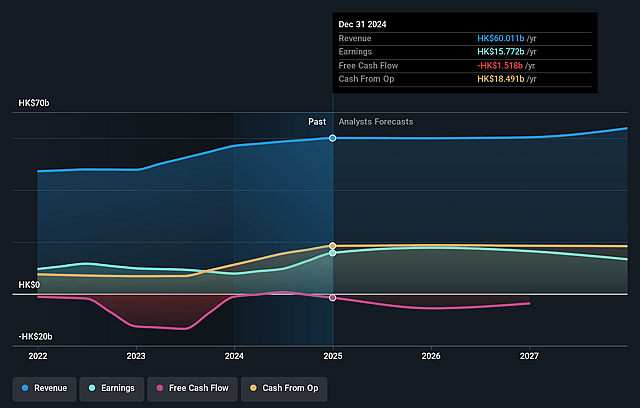

MTR Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on MTR compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming MTR's revenue will grow by 3.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 26.3% today to 27.5% in 3 years time.

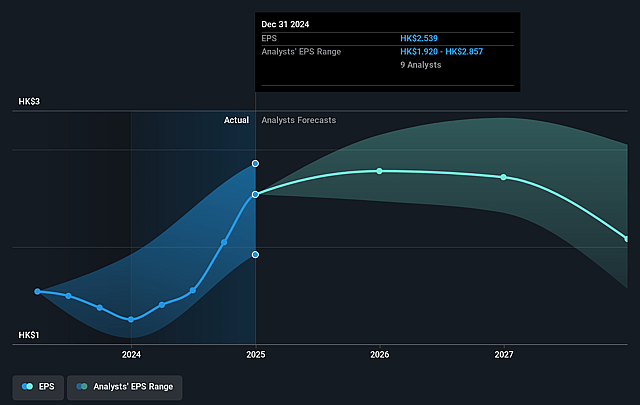

- The bullish analysts expect earnings to reach HK$18.5 billion (and earnings per share of HK$2.98) by about July 2028, up from HK$15.8 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 13.8x on those 2028 earnings, up from 11.1x today. This future PE is greater than the current PE for the HK Transportation industry at 13.5x.

- Analysts expect the number of shares outstanding to grow by 0.12% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.63%, as per the Simply Wall St company report.

MTR Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- MTR faces heightened volatility in property development income due to its reliance on the Rail plus Property model, and management repeatedly highlights that these profits are one-off and fluctuate year-to-year; this unpredictability could undermine long-term earnings stability and funding for new projects if property market cycles turn negative.

- The company is entering a peak CapEx phase, with over HK$165 billion in investment commitments for new railways, asset renewal, and upgrades in the coming decade, but acknowledges that these expenditures are long term and constant while property development profits are lumpy; this mismatch could pressure net margins and create recurring financing challenges, particularly if borrowing costs rise or access to capital tightens.

- MTR's core transport operations continue to face slower recovery in ridership, with management conceding that Airport Express and cross-boundary services patronage has not yet returned to pre-pandemic levels, citing increased competition from other transport modes, evolving travel patterns, and the new normal in commuter behavior; this long-term trend could constrain fare revenue growth and impact recurring revenues.

- The corporation is exposed to rising regulatory, political, and environmental expectations: fares and expansion plans are subject to public and government intervention, and the company anticipates substantial capital requirements to meet decarbonization targets by 2030 and 2050, which could further erode profitability and require large, ongoing cash outflows.

- Ongoing challenges in the retail sector and demographic shifts in Hong Kong mean that negative rental reversions for station kiosks and changing consumption patterns persist, with management noting challenged retail markets and an aging population; over time, this could limit ancillary income growth from station commercial and mall businesses, dampening overall revenue and reducing the diversification benefits of non-rail segments.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for MTR is HK$32.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of MTR's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of HK$32.0, and the most bearish reporting a price target of just HK$21.6.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be HK$67.3 billion, earnings will come to HK$18.5 billion, and it would be trading on a PE ratio of 13.8x, assuming you use a discount rate of 8.6%.

- Given the current share price of HK$28.2, the bullish analyst price target of HK$32.0 is 11.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.