Key Takeaways

- High, sustained capital investments and demographic shifts will constrain revenue growth, raise funding risks, and depress earnings as debt burdens increase.

- Rising competition from alternative transport, network saturation, and climate disruptions will limit passenger growth and elevate operational and maintenance costs.

- Diversified income from rail and property, international expansion, strong finances, and focus on smart and green initiatives position MTR for resilient, long-term growth.

Catalysts

About MTR- Engages in railway design, construction, operation, maintenance, and investment in Hong Kong, Australia, Mainland China, Macao, Sweden, and the United Kingdom.

- MTR faces an imminent decade-long peak in capital expenditure, with over HK$165 billion allocated to new railway projects and asset renewal. This heavy and prolonged outlay exposes the company to significant funding risk, reducing free cash flow available for dividends and raising the likelihood of increased debt burdens-this is expected to pressure net margins and depress earnings growth well into the next cycle.

- Demographic changes, including the accelerating shift toward remote work and an aging population, are likely to structurally reduce daily railway patronage in Hong Kong and other core markets. This long-term shift limits the pace of ridership recovery and places a ceiling on farebox revenue growth, undermining assumptions baked into current valuations.

- Operational saturation of the existing Hong Kong rail network severely restricts meaningful organic passenger growth, while extensive new capacity projects face uncertain incremental demand due to changing urban mobility preferences. This dynamic is expected to cap long-term revenue expansion and increase the risk of overbuilding.

- The increasing adoption of alternatives such as electric vehicles and micro-mobility options is expected to erode modal share for MTR's traditional rail offerings over the coming years, further limiting user growth and recurring transport revenues, while fixed costs remain high.

- Climate-induced disruptions-including flooding, typhoons, and extreme weather events-are anticipated to become more frequent and severe, driving up maintenance and repair costs. The resulting increase in downtime and operational uncertainty is expected to weigh on MTR's cost structure, further pressuring net profit margins and eroding return on invested capital.

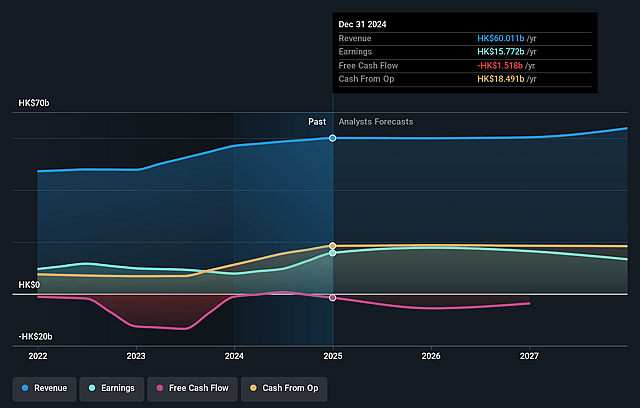

MTR Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on MTR compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming MTR's revenue will decrease by 1.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 26.3% today to 16.6% in 3 years time.

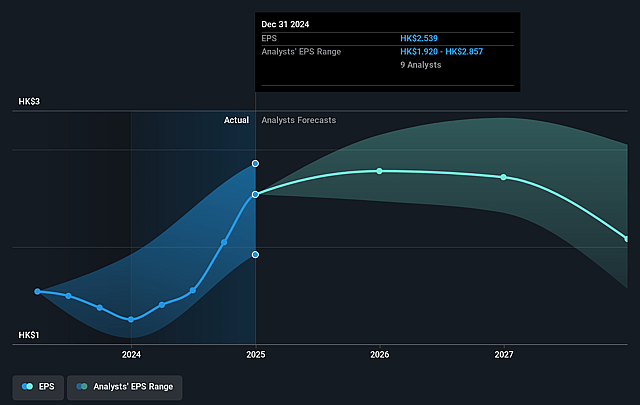

- The bearish analysts expect earnings to reach HK$9.6 billion (and earnings per share of HK$1.54) by about July 2028, down from HK$15.8 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 18.0x on those 2028 earnings, up from 11.1x today. This future PE is greater than the current PE for the HK Transportation industry at 13.5x.

- Analysts expect the number of shares outstanding to grow by 0.12% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.63%, as per the Simply Wall St company report.

MTR Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- MTR's Rail plus Property integrated development model continues to deliver substantial and diversified income streams that fund ongoing railway construction and asset renewal, ensuring resilient revenue growth and supporting healthy net profit margins over multiple property cycles.

- The corporation demonstrated world-class operational reliability with 99.9 percent on-time performance and recorded year-on-year revenue growth from both domestic and cross-boundary railway services, pointing to robust recurring income and improving earnings visibility in the long term.

- Substantial expansion both domestically (with five major new rail projects totaling HK$100 billion) and internationally (e.g., new lines in Sydney, Shenzhen, and expanding into more Mainland Chinese cities) positions MTR to benefit from long-term secular trends such as urbanization, mobility integration, and rising demand for mass transit, which can drive topline revenue and geographical diversification.

- MTR maintains a strong balance sheet with low net debt-to-equity of 31.6 percent, solid interest coverage, and access to diverse and cost-effective funding including green and sustainability-linked financing, significantly reducing financial risk and safeguarding both earnings and dividends through future investment cycles.

- The company's proactive adoption of smart mobility technologies, ESG-aligned investments, and green financing not only enhance operational efficiency and passenger loyalty, but also position MTR to capture upside from global climate policy support and societal decarbonization movements, supporting margin improvement and revenue durability over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for MTR is HK$21.6, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of MTR's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of HK$32.0, and the most bearish reporting a price target of just HK$21.6.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be HK$57.8 billion, earnings will come to HK$9.6 billion, and it would be trading on a PE ratio of 18.0x, assuming you use a discount rate of 8.6%.

- Given the current share price of HK$28.2, the bearish analyst price target of HK$21.6 is 30.6% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.