Key Takeaways

- Large financial commitments toward railway expansion and asset maintenance may pressure net margins and limit future revenue generation.

- Reliance on fluctuating property profits and competition in transport could impact earnings stability and shareholder returns.

- MTR's diverse revenue streams, innovative financing, and successful property development bolster financial stability and future growth amid expansion in international markets.

Catalysts

About MTR- Designs, constructs, operates, maintains, and invests in railways in Hong Kong, Australia, Mainland China, Macao, Sweden, and the United Kingdom.

- MTR has committed to investing HK$100 billion in several new railway projects, which presents a financial strain that might impact future revenue generation and increase operating expenses as these projects are costly and complex.

- The company is entering an investment peak period, with heavy spending required for both railway expansion and long-term asset maintenance totaling HK$165 billion over several years, potentially compressing net margins due to escalating costs.

- MTR's reliance on the one-off nature of property development profits, which may fluctuate significantly year-on-year, could affect the stability of earnings, especially if these gains do not coincide with high expenditure periods.

- Challenges in returning cross-boundary railway services to pre-pandemic levels and increased competition in transport could hinder projected ridership growth, affecting future revenue streams.

- With significant financial commitments and fluctuating property profits, MTR's future dividend payments may remain flat, impacting shareholder returns and potentially leading to a lower EPS growth outlook.

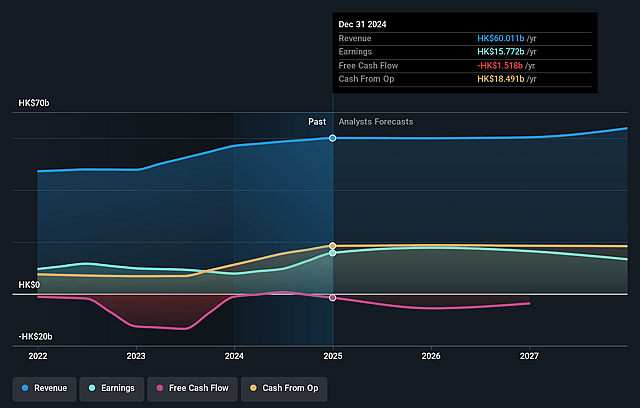

MTR Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming MTR's revenue will grow by 1.7% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 26.3% today to 20.8% in 3 years time.

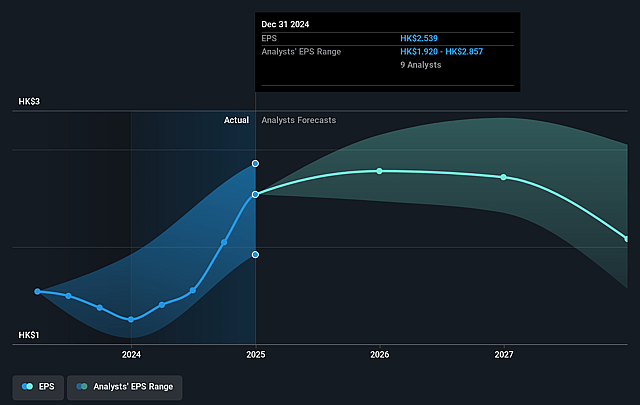

- Analysts expect earnings to reach HK$13.1 billion (and earnings per share of HK$2.03) by about August 2028, down from HK$15.8 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting HK$17.3 billion in earnings, and the most bearish expecting HK$9.8 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.1x on those 2028 earnings, up from 11.0x today. This future PE is greater than the current PE for the HK Transportation industry at 13.2x.

- Analysts expect the number of shares outstanding to grow by 0.12% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.82%, as per the Simply Wall St company report.

MTR Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- MTR's extensive property development business, crucial for funding railway projects, has entered a harvest phase with significant profits from several completed projects, boosting overall earnings and providing a strong asset base to support future investments. (Earnings)

- The company's ongoing expansion efforts in Mainland China and international markets, including concessions and commercial advancements, present opportunities for diversified revenue streams and reduced dependency on local market conditions. (Revenue)

- MTR's successful green bond issuance and competitive financing capabilities showcase its ability to access capital markets affordably, enabling the funding of large-scale future projects without straining current financial resources. (Net margins)

- Continued growth in local and cross-boundary railway services, coupled with technological innovations and improvements in infrastructure, is contributing to a gradual recovery in patronage post-pandemic and sustaining long-term revenue growth. (Revenue)

- The Rail plus Property development model remains a robust method for generating funds while supporting housing supply and patronage, allowing MTR to maintain financial stability and credibility amid significant capital investment phases. (Earnings)

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of HK$27.838 for MTR based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of HK$32.0, and the most bearish reporting a price target of just HK$21.6.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be HK$63.1 billion, earnings will come to HK$13.1 billion, and it would be trading on a PE ratio of 17.1x, assuming you use a discount rate of 8.8%.

- Given the current share price of HK$27.84, the analyst price target of HK$27.84 is 0.0% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.