Last Update 26 Nov 25

Fair value Decreased 7.11%KMR: Long-Term Ore Zone Transition Will Drive Sustained Value Ahead

Kenmare Resources’ analyst price target has been revised downward from 330 GBp to 300 GBp. Analysts cite reduced revenue growth forecasts, lower profit margins, and a higher discount rate in their updated assessments.

Analyst Commentary

Recent research activity has resulted in both upward and downward revisions for Kenmare Resources, reflecting varying sentiments regarding the company's outlook and share valuation.

Bullish Takeaways

- Bullish analysts point to Kenmare Resources’ ability to maintain steady production levels. This supports its underlying value despite market volatility.

- There is continued confidence in the company’s long-term position within its sector and this suggests resilience to short-term pricing pressures.

- Some note that the company's cost discipline can support margins if demand recovers in key markets.

Bearish Takeaways

- Bearish analysts remain cautious on short-term revenue prospects and cite downgrades driven by reduced growth forecasts and tighter profit margins.

- Higher discount rates are putting pressure on equity valuations. This is resulting in lowered price targets for the company.

- Uncertainty around demand recovery increases the risk of further downward adjustments in estimates.

- Execution risks, particularly in cost management, may limit the company’s ability to meet profitability targets in a challenging market environment.

What's in the News

- Kenmare Resources has upgraded its largest mining plant, WCP A, and has begun transitioning it to the Nataka ore zone. This zone holds approximately 70% of the company's mineral resources and is expected to secure production for over 20 years (Key Developments).

- The capital cost estimate for WCP A’s upgrade and transition to Nataka remains unchanged at $341 million. Commissioning is underway and most upgrade components are already operating to design (Key Developments).

- The company reported lowered production results for the third quarter of 2025 compared to the previous year, with declines in excavated ore, HMC, ilmenite, primary zircon, and rutile. However, concentrates increased (Key Developments).

- Kenmare has issued updated production guidance for 2025, lowering expectations for ilmenite and rutile output while maintaining previous targets for primary zircon and concentrates (Key Developments).

- Further optimisation is underway to resolve throughput restrictions at WCP A’s upgraded on-plant tailings management component. Resolution efforts may possibly extend into 2026 (Key Developments).

Valuation Changes

- Fair Value Estimate has fallen slightly, moving from 5.93 to 5.51.

- Discount Rate has risen from 8.23% to 9.48%, reflecting increased risk assumptions.

- Revenue Growth Forecast has decreased, dropping from 4.21% to 3.66%.

- Net Profit Margin is now significantly lower, reduced from 23.51% to 15.68%.

- Future P/E Ratio has increased from 8.10x to 11.63x, indicating higher valuation multiples in light of reduced earnings expectations.

Key Takeaways

- Expanded mining capacity and flexible operations are set to boost production, reduce costs, and support higher revenues and resilient margins.

- Elevated demand and critical mineral status position Kenmare to gain market share and pricing power, strengthening long-term growth and shareholder returns.

- Rising costs, market oversupply, political risks, high debt, and revenue concentration expose Kenmare to margin pressure, cash flow volatility, and uncertainty in shareholder returns.

Catalysts

About Kenmare Resources- Engages in the production and sale of mineral sand products in China, rest of Asia, Europe, the United States, and internationally.

- The upcoming completion and commissioning of expanded mining capacity at Nataka, supported by new high-capacity dredges and processing equipment, is expected to significantly grow Kenmare's production volumes and lower unit costs, which should drive higher revenues and improved net margins from 2025 onward.

- Execution of the selective mining operation (SMO) projects-low-capex, flexible mining solutions-adds incremental capacity and operational flexibility, enabling Kenmare to respond to demand spikes or market opportunities more efficiently, supporting both revenue and margin resilience.

- Growing global demand for titanium feedstocks and zircon, driven by ongoing urbanization, infrastructure buildout in emerging markets, and increased use of these minerals in renewable energy technologies, underpins robust long-term sales volume and pricing potential.

- Accelerating resource security concerns and the critical minerals designation for Kenmare's products in the EU, UK, and US are likely to increase customer preference for reliable suppliers outside China, potentially allowing Kenmare to capture market share and command price premiums, benefiting top-line growth.

- As the company transitions past its peak capex and the majority of operational/development project risk is behind it, Kenmare's strong balance sheet and established dividend/buyback policy position it for higher future distributions and enhanced total shareholder return when free cash flow rises.

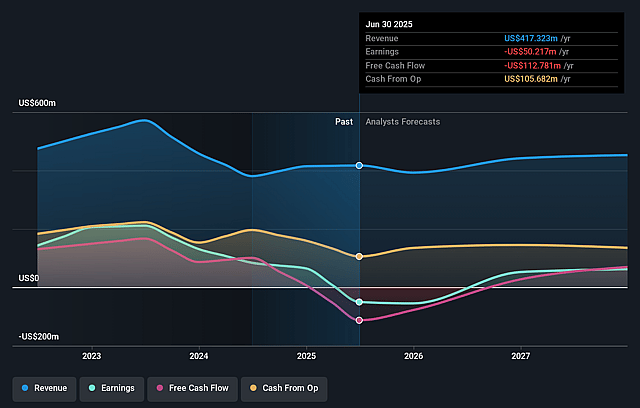

Kenmare Resources Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Kenmare Resources's revenue will grow by 4.2% annually over the next 3 years.

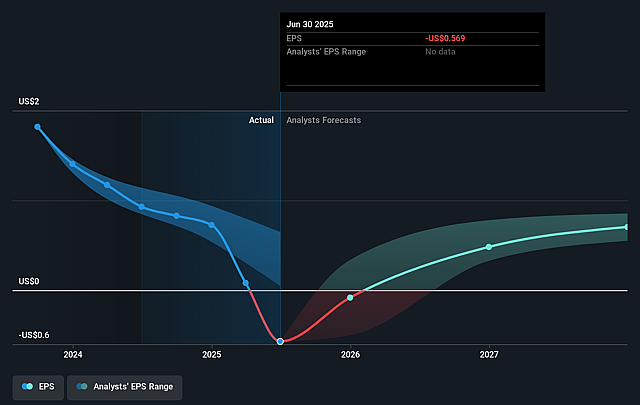

- Analysts assume that profit margins will increase from -12.0% today to 23.5% in 3 years time.

- Analysts expect earnings to reach $111.0 million (and earnings per share of $0.7) by about September 2028, up from $-50.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 8.1x on those 2028 earnings, up from -7.7x today. This future PE is lower than the current PE for the GB Metals and Mining industry at 11.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.23%, as per the Simply Wall St company report.

Kenmare Resources Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The protracted and uncertain negotiations over the renewal of the implementation agreement with the Mozambican government, particularly regarding a rising royalty rate (potentially up to nearly 5% of revenue), could significantly increase the company's future cost base and reduce net margins if terms become less favorable.

- Elevated supply of ilmenite and concentrates from artisanal and low-cost producers in Africa, especially in Mozambique, is contributing to structural oversupply in global markets; this ongoing dynamic is delaying price recovery and has already resulted in a $100 million impairment at Kenmare, posing a risk to future revenue growth and profitability.

- Operations in Mozambique face heightened political risk, security concerns, and have recently experienced disruptions (e.g., due to social unrest around elections), contributing to rising operating and compliance costs and potential for volatility or interruptions in cash flows.

- The company's large, capital-intensive projects-while almost complete-have caused a spike in net debt (from $25m to $85m) and increased dependency on future earnings improvements and successful ramp-up; if product pricing remains soft for an extended period or the ramp-up faces delays, servicing debt and maintaining dividends may become more challenging, impacting free cash flow and total shareholder return.

- Kenmare's reliance on a concentrated customer base, with strong but potentially limited long-term contracts, creates revenue concentration risk should a key customer reduce orders or renegotiate, especially in a soft market environment, which could directly impact top-line revenue.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £5.934 for Kenmare Resources based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £8.49, and the most bearish reporting a price target of just £3.7.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $472.2 million, earnings will come to $111.0 million, and it would be trading on a PE ratio of 8.1x, assuming you use a discount rate of 8.2%.

- Given the current share price of £3.23, the analyst price target of £5.93 is 45.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.