Key Takeaways

- Oversupply in key markets and shifting regulatory environments threaten pricing power and margins, despite operational improvements and efficiency gains.

- High capital requirements and global trends toward recycling may limit future cash flow and constrain long-term dividend growth.

- Rising regulatory risk, single-mine dependence, sustained capital outflows, weak pricing, and uncertain demand outlook threaten Kenmare's earnings stability and long-term cash generation.

Catalysts

About Kenmare Resources- Engages in the production and sale of mineral sand products in China, rest of Asia, Europe, the United States, and internationally.

- While Kenmare is well positioned to benefit from the wave of global infrastructure development and clean energy investment, recent oversupply in the Chinese mineral sands sector could depress ilmenite and zircon prices, potentially leading to lower revenue growth and diminished pricing power over the medium term.

- Although advancements in mine optimization, capacity expansion projects, and the commissioning of new dredges and selective mining units should improve production scale and cost efficiency, the escalating royalty rates and withholding taxes in Mozambique threaten to counteract margin gains and could place sustained pressure on net income.

- Despite the company's track record of disciplined capital allocation and announced reductions in capital spending post-2025, persistently high capital expenditure requirements-compounded by the drawn-out renewal of the implementation agreement-risk diverting cash flow away from shareholder returns and restraining future dividend growth.

- While ongoing industry consolidation and supply chain security concerns favor established producers like Kenmare, the continued focus on resource nationalism in host countries raises the potential for further regulatory restrictions or higher fiscal burdens, which may affect long-term earnings stability.

- Even as Kenmare's product portfolio is supported by industrial demand for advanced materials and growing middle classes in emerging markets, accelerating trends toward recycling and resource efficiency could structurally erode primary mineral demand over time, limiting future revenue growth regardless of operational excellence.

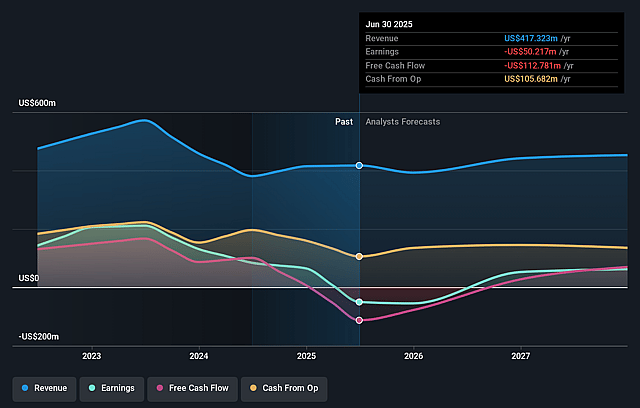

Kenmare Resources Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Kenmare Resources compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Kenmare Resources's revenue will decrease by 0.5% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -12.0% today to 17.8% in 3 years time.

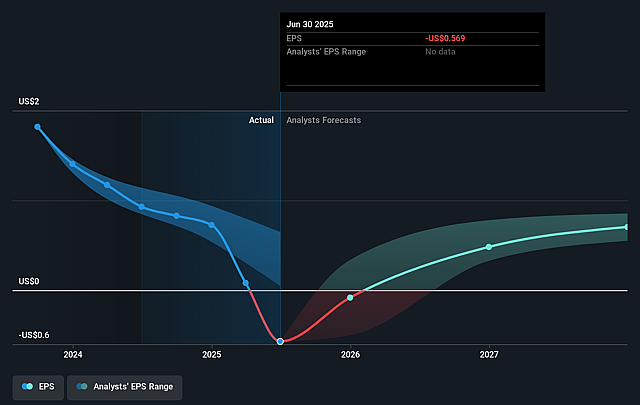

- The bearish analysts expect earnings to reach $75.2 million (and earnings per share of $0.89) by about September 2028, up from $-50.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 7.4x on those 2028 earnings, up from -7.7x today. This future PE is lower than the current PE for the GB Metals and Mining industry at 11.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.24%, as per the Simply Wall St company report.

Kenmare Resources Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Accelerating resource nationalism and regulatory tightening in Mozambique raises the risk of higher royalties, withholding taxes, and possibly new mining laws, which could erode Kenmare's net margins and reduce free cash flow over the long term.

- The company's heavy reliance on a single mine in Mozambique makes its production and revenues extremely vulnerable to local political instability, civil unrest, and changes in government, directly jeopardizing the predictability of Kenmare's future earnings.

- Persistently high capital expenditure requirements for mine upgrades and expansion, as well as potential future expenditures for sustaining and replacing aging infrastructure, may suppress free cash flow and constrain dividend growth despite temporary boosts to production capacity.

- The oversupply of mineral sands from Chinese producers and increased feedstock exports from Africa are contributing to muted global pricing for ilmenite, zircon, and rutile, which, if persistent, could structurally depress revenues and profit margins for Kenmare in the years ahead.

- Potential increases in global recycling rates for titanium and zircon, coupled with slower-than-expected recoveries in key demand drivers like Chinese real estate and infrastructure, may dampen long-term end-market demand, limiting Kenmare's ability to grow revenues and sustain profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Kenmare Resources is £3.7, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Kenmare Resources's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £8.49, and the most bearish reporting a price target of just £3.7.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $423.0 million, earnings will come to $75.2 million, and it would be trading on a PE ratio of 7.4x, assuming you use a discount rate of 8.2%.

- Given the current share price of £3.23, the bearish analyst price target of £3.7 is 12.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.