Key Takeaways

- Structural shift in production capacity and unique resource profile position Kenmare for sustained margin expansion and revenue outperformance versus market expectations.

- Flexible expansion options and ESG leadership enable superior market share gains and premium pricing amid tightening global minerals supply.

- Heavy reliance on a single asset, rising costs, uncertain fiscal terms, soft markets, and regulatory risks threaten long-term earnings consistency and financial flexibility.

Catalysts

About Kenmare Resources- Engages in the production and sale of mineral sand products in China, rest of Asia, Europe, the United States, and internationally.

- While analyst consensus expects the WCP A move to simply restore or marginally lift production and efficiency, the reality is the project is setting up a structural step-change, soon boosting ilmenite and zircon output to new record levels with a permanent shift in capacity, likely driving multi-year revenue and EBITDA growth well ahead of current forecasts.

- While the consensus narrative values Kenmare's long mine life as a backdrop, it severely understates the strategic value emerging from the world's longest-life, high-grade, non-Chinese mineral sands deposit as resource scarcity bites and supply chains increasingly prize reliability, which should support structurally higher future price realizations and sector-leading margins.

- The upcoming commissioning of multiple selective mining units provides Kenmare with highly flexible, capital-light levers to further expand capacity, quickly respond to demand surges from infrastructure and green technology markets, and push volumes higher at industry-low marginal costs, amplifying marginal earnings potential during upcycles.

- Kenmare's imminent inclusion in key global ESG and sustainability indices-supported by its safety record and responsible mining practices-positions it to attract large-scale institutional capital and premium contracts, setting the stage for both lower cost of capital and higher long-term contract pricing, which enhances future net margins.

- Persistent global supply bottlenecks outside China and Australia, combined with a sector-wide slowdown in new mineral sands project approvals, mean Kenmare is set to command growing market share in serving surging urbanization and clean-tech industries, translating to above-consensus growth in both sales volumes and unit price over the next decade.

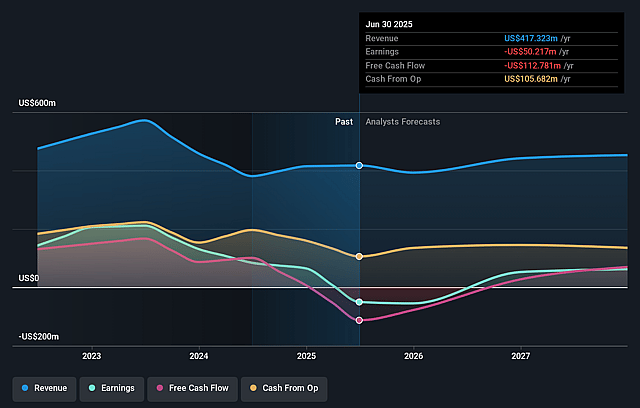

Kenmare Resources Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Kenmare Resources compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Kenmare Resources's revenue will grow by 7.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -12.0% today to 24.9% in 3 years time.

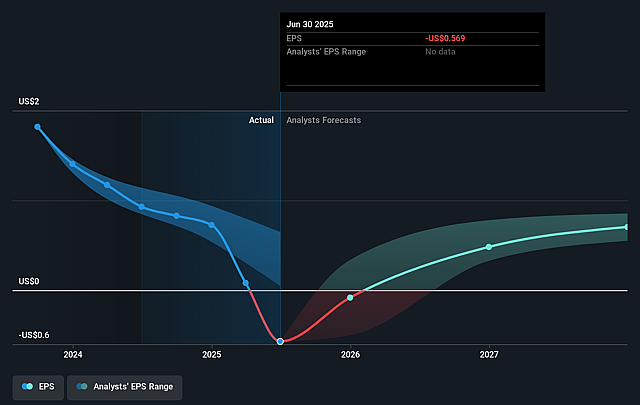

- The bullish analysts expect earnings to reach $127.2 million (and earnings per share of $1.35) by about September 2028, up from $-50.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 10.3x on those 2028 earnings, up from -7.6x today. This future PE is lower than the current PE for the GB Metals and Mining industry at 11.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.39%, as per the Simply Wall St company report.

Kenmare Resources Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company remains dependent on a single asset (the Moma mine in Mozambique), which heightens operational risk; any disruption due to local unrest, resource grade decline, or technical failures could cause significant revenue volatility and potential reductions to net margins in the long term.

- Kenmare's profitability and earnings are threatened by persistently high capital expenditure requirements-such as the ongoing $341 million WCP A project and future investments needed for resource development and shipping upgrades-placing pressure on free cash flow and potentially limiting its capacity to return capital to shareholders or reduce debt.

- The prolonged and uncertain negotiations over the renewal of the implementation agreement with the Mozambique government, including royalty rates rising from 1% toward 3.5% plus new withholding taxes, risk increasing ongoing costs and compressing net margins if harsher fiscal terms are imposed.

- Softening and volatile global markets for mineral sands, driven by rising supply from new and existing producers (especially in Africa and China) and only muted long-term demand outlook due to potential materials substitution and decarbonization trends, could result in sustained lower product prices, pressuring future revenues and earnings.

- Kenmare is exposed to intensifying regulatory scrutiny, environmental standards, and potential new mining laws in Mozambique, along with rising social and political activism across the industry and region, which could raise compliance costs and disrupt future project approvals, thereby reducing long-term profitability and investor confidence in earnings consistency.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Kenmare Resources is £8.51, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Kenmare Resources's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £8.51, and the most bearish reporting a price target of just £3.7.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $511.4 million, earnings will come to $127.2 million, and it would be trading on a PE ratio of 10.3x, assuming you use a discount rate of 8.4%.

- Given the current share price of £3.14, the bullish analyst price target of £8.51 is 63.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.