Key Takeaways

- Stricter environmental regulations and shifting market trends threaten core business models and may raise operational costs, eroding long-term revenue and margin potential.

- Heavy reliance on acquisitions, regulatory challenges, and intensified competition could impede integration, limit expansion, and pressure long-term profitability.

- SigmaRoc's focused acquisition strategy, cost discipline, and sustainability leadership position it to capitalize on long-term construction trends and growing demand for green materials.

Catalysts

About SigmaRoc- Through its subsidiaries, invests in and/or acquires projects in the quarried materials sector.

- The accelerating transition to low-carbon and alternative building materials presents a structural threat to SigmaRoc's core aggregates and lime businesses, as stricter European emissions regulations may require significant additional investment or risk faster market share erosion, resulting in long-term revenue pressure and higher operating costs.

- Demographic changes, including declining population growth and urbanisation rates in mature European markets, are expected to stagnate or reduce aggregate long-term construction material demand, undermining SigmaRoc's ability to grow revenues organically and potentially depressing future earnings.

- The company's heavy dependence on major M&A for expansion exposes it to continued integration risks, potential operational underperformance, and balance sheet complexity, making it increasingly difficult to sustain net margin expansion and high-quality earnings as bolt-on synergies diminish over time.

- With increased scrutiny on resource extraction and environmental impact, SigmaRoc faces the prospect of more frequent delays or denials in permitting, as well as higher regulatory compliance costs, which could impede capacity expansion and erode future cash flows.

- Intensifying competition from larger, consolidated industry players and disruptive sustainable technologies is likely to compress pricing power for mid-cap firms like SigmaRoc, threatening both market share and net margins over the longer term, even as input costs, including energy and labour, remain elevated.

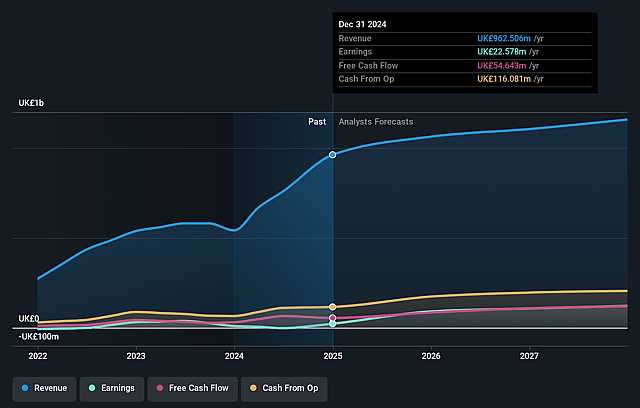

SigmaRoc Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on SigmaRoc compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming SigmaRoc's revenue will grow by 6.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 2.3% today to 11.8% in 3 years time.

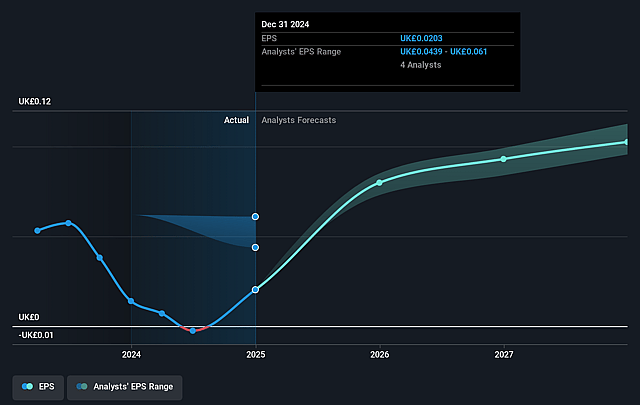

- The bearish analysts expect earnings to reach £135.7 million (and earnings per share of £0.12) by about September 2028, up from £22.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 11.1x on those 2028 earnings, down from 56.9x today. This future PE is lower than the current PE for the GB Basic Materials industry at 24.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.69%, as per the Simply Wall St company report.

SigmaRoc Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Robust secular trends such as urbanisation, infrastructure renewal and the increasing European focus on green construction are likely to provide steady long-term demand for lime, limestone, and aggregates, supporting SigmaRoc's revenue growth over time.

- SigmaRoc's consistent bolt-on acquisition strategy and successful integration track record have historically driven double-digit EBITDA and earnings growth, signaling the potential for continued margin expansion and earnings improvement as synergies are realized.

- Operational efficiency, process automation, and a Company-wide focus on variable cost structures have enabled SigmaRoc to improve EBITDA margins even during challenging economic periods, suggesting the potential for further net margin and cash flow gains.

- The company's leadership as a major supplier to the industrial, environmental, and infrastructure sectors positions it to benefit disproportionately from government stimulus packages and structural recovery in European construction, directly supporting both revenue and profits.

- Strong ESG achievements, including significant reductions in emissions and energy intensity and a clear net zero 2040 target, position SigmaRoc to capture rising demand for sustainable building materials, securing preferred supplier status and supporting long-term cash flow and earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for SigmaRoc is £1.05, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of SigmaRoc's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £1.98, and the most bearish reporting a price target of just £1.05.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be £1.2 billion, earnings will come to £135.7 million, and it would be trading on a PE ratio of 11.1x, assuming you use a discount rate of 8.7%.

- Given the current share price of £1.15, the bearish analyst price target of £1.05 is 9.7% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.