Last Update01 Aug 25Fair value Increased 14%

SigmaRoc's consensus analyst price target has increased from £1.21 to £1.38, primarily reflecting a higher future P/E multiple, despite slightly lower revenue growth forecasts.

What's in the News

- SigmaRoc to report first half 2025 sales/trading statement results on July 24, 2025.

- Company provided 2030 earnings guidance, targeting 3%-5% organic revenue growth per annum.

Valuation Changes

Summary of Valuation Changes for SigmaRoc

- The Consensus Analyst Price Target has significantly risen from £1.21 to £1.38.

- The Future P/E for SigmaRoc has significantly risen from 13.81x to 16.14x.

- The Consensus Revenue Growth forecasts for SigmaRoc has fallen slightly from 6.5% per annum to 6.4% per annum.

Key Takeaways

- Strategic divestments and focus on profitable segments are set to enhance net margins and revenue quality through targeted asset sales.

- Synergies, efficient cash flow use, and sector positioning could drive earnings growth and margin improvements through internal efficiencies and cost savings.

- The company's significant debt from acquisitions and high finance expenses risk impacting net margins, especially with currency fluctuations and potential adverse effects from U.S. tariffs.

Catalysts

About SigmaRoc- Through its subsidiaries, invests in and/or acquires projects in the quarried materials sector.

- The integration of the new lime and limestone businesses purchased from CRH has accelerated synergies, increasing the synergy target from EUR 30 million to EUR 40 million by 2027, expected to positively impact earnings through cost savings and operational efficiencies.

- The divestment program, which includes selling non-core assets like the concrete operations in the Benelux, is set to refocus the group's footprint on more profitable segments, potentially improving net margins and revenue quality.

- Strategic positioning in attractive sectors such as environment, industrial, and infrastructure markets, alongside upcoming German fiscal stimulus and potential EU infrastructure projects, could lead to revenue growth.

- High cash flow conversion and a robust cash-generative nature enable SigmaRoc to self-fund further expansions and bolt-on acquisitions, which can increase earnings without diluting existing shareholders.

- The company's program to improve margins beyond the current 22.5% through internal efficiencies and synergies suggests potential for EBITDA margin enhancement, which would bolster profitability and contribute to future earnings growth.

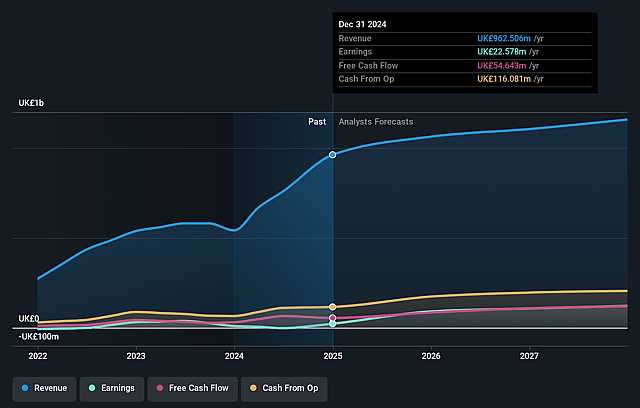

SigmaRoc Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming SigmaRoc's revenue will grow by 6.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.3% today to 10.5% in 3 years time.

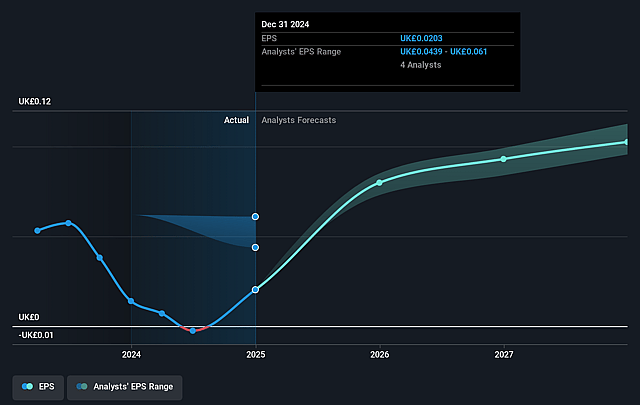

- Analysts expect earnings to reach £121.6 million (and earnings per share of £0.1) by about August 2028, up from £22.6 million today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as £134.8 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.2x on those 2028 earnings, down from 61.2x today. This future PE is lower than the current PE for the GB Basic Materials industry at 26.2x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.59%, as per the Simply Wall St company report.

SigmaRoc Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The significant debt increase to over £500 million due to acquisitions could impact net margins and earnings if the company struggles with repayment or if interest rates rise.

- Currency fluctuations, particularly with the euro weakening against the pound, could negatively affect revenue and EBITDA, adding uncertainty to financial performance forecasts.

- Any adverse effects from potential U.S. tariffs could disrupt sales in industries such as steel and automotive, impacting revenue and earnings growth.

- Residential construction exposure, particularly in the UK & Ireland and Western Europe, faced a tough year, suggesting risk to revenue from further declines in this market segment.

- High finance expenses at £45 million due to debt structure create a burden on net earnings and could reduce shareholder returns if not managed effectively.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £1.382 for SigmaRoc based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £1.98, and the most bearish reporting a price target of just £1.05.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £1.2 billion, earnings will come to £121.6 million, and it would be trading on a PE ratio of 16.2x, assuming you use a discount rate of 8.6%.

- Given the current share price of £1.24, the analyst price target of £1.38 is 10.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.