Key Takeaways

- Early and impactful integration of acquisitions, combined with a sharp focus on high-value segments, positions SigmaRoc for significant margin and earnings quality improvements.

- Strategic exposure to European infrastructure investment, green products, and digitalisation initiatives provides strong tailwinds for sustained revenue, margin, and cash flow growth.

- Increased regulatory costs, weak construction demand, limited product diversification, and high debt levels threaten SigmaRoc's earnings stability and long-term growth prospects.

Catalysts

About SigmaRoc- Through its subsidiaries, invests in and/or acquires projects in the quarried materials sector.

- While analyst consensus expects EUR 40 million of synergies from the CRH acquisition by 2027, SigmaRoc's early integration success and rapid synergy delivery-already reaching EUR 9 million in 2024-strongly suggest that management could materially exceed the stated target and achieve accelerated margin expansion, with the potential to push EBITDA margins well beyond 25% much sooner, transforming profitability.

- Analysts broadly agree that divesting non-core concrete operations will improve net margins, but the scale and discipline of SigmaRoc's portfolio focus-targeting only highly profitable, acyclical minerals and value-added segments-could trigger a dramatic uplift in return on invested capital and earnings quality, resulting in outsized improvements in both cash conversion and long-term earnings resilience.

- The unprecedented underinvestment in European infrastructure, combined with the company's dominant positions in ten countries and multi-decade reserves, means SigmaRoc is poised to benefit massively from an incoming, multi-year wave of government-driven infrastructure spend and green transition projects, potentially translating to high single-digit or even double-digit top-line growth for multiple years.

- SigmaRoc's rapid advancement in low-carbon and sustainable building products is set to secure premium pricing and privileged access to green infrastructure projects and regulatory-driven markets, allowing for both price-led revenue expansion and structural margin gains as environmental standards tighten and demand for circular economy materials accelerates.

- The company's digitalisation and automation initiatives across recently acquired assets, alongside its proven ability to consolidate fragmented regional markets, will enable structurally lower unit costs and operating leverage as volumes ramp up, resulting in earnings growth far in excess of volume growth and positioning SigmaRoc as the most profitable consolidator in a sector facing increasing competitive and regulatory barriers.

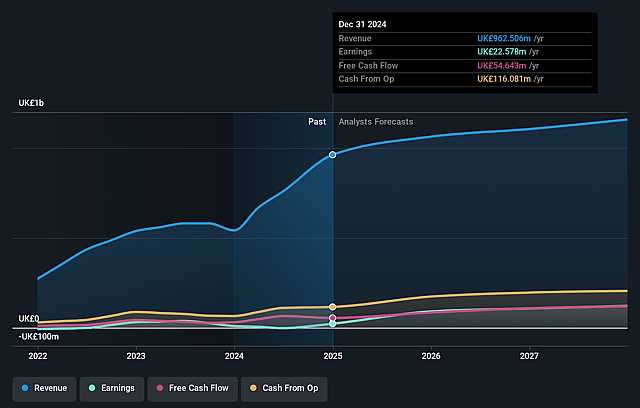

SigmaRoc Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on SigmaRoc compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming SigmaRoc's revenue will grow by 7.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 4.4% today to 12.8% in 3 years time.

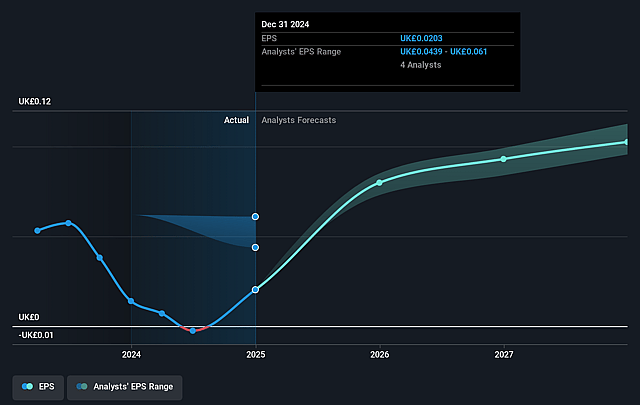

- The bullish analysts expect earnings to reach £161.3 million (and earnings per share of £0.14) by about September 2028, up from £44.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 17.1x on those 2028 earnings, down from 29.3x today. This future PE is lower than the current PE for the GB Basic Materials industry at 25.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.83%, as per the Simply Wall St company report.

SigmaRoc Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The acceleration of decarbonization and sustainability policies across Europe may result in higher regulatory and production costs for SigmaRoc's carbon-intensive lime and limestone operations, which could compress net margins and limit growth in long-term earnings even with ongoing efficiency programs.

- Slowing population growth and weaker rates of urbanization in Europe, especially in mature markets like Germany, the UK, and Benelux, threaten long-term demand for construction materials; management itself reported flat or declining construction volumes and noted reliance on government stimulus for any volume uplift, signaling structural pressure on future revenues.

- Rising adoption of alternative, lower-carbon building materials such as engineered timber and recycled products poses a threat to traditional aggregates and cement products, undermining SigmaRoc's core product lines, which could erode the company's market share and long-term revenue base.

- High debt levels following recent large acquisitions and an ongoing acquisition-focused strategy increase the company's vulnerability to interest rate fluctuations and economic downturns; finance costs account for a sizable chunk of profits, and persistent leverage could constrain future investment and weigh on net earnings in slower markets.

- The company's focus remains concentrated in traditional aggregates, lime, and construction products with limited diversification into other sectors, and exposure to fragmented regional markets with varying performance, which may amplify revenue and earnings volatility during periods of construction sector weakness or regulatory shifts, impeding stable long-term growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for SigmaRoc is £1.92, which represents two standard deviations above the consensus price target of £1.4. This valuation is based on what can be assumed as the expectations of SigmaRoc's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £1.98, and the most bearish reporting a price target of just £1.05.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be £1.3 billion, earnings will come to £161.3 million, and it would be trading on a PE ratio of 17.1x, assuming you use a discount rate of 8.8%.

- Given the current share price of £1.17, the bullish analyst price target of £1.92 is 38.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.