Key Takeaways

- Declining production from mature assets and reserve challenges threaten long-term profitability and cash flow, despite current strong margins and robust sector demand.

- Exposure to regulatory, environmental, and scale-related risks could increase costs and hinder growth, leaving the company vulnerable to competitive pressures and legislative changes.

- Declining resource quality, rising costs, geographic concentration, and industry headwinds threaten growth, profitability, and cash flow, highlighting the need for successful new asset development.

Catalysts

About Central Asia Metals- Operates as a base metals producer.

- While Central Asia Metals is poised to benefit from persistent global demand for copper and zinc driven by the energy transition and ongoing infrastructure development, the company's production outlook reveals that copper output from Kounrad is expected to gradually tail off as waste dumps mature, indicating a reducing contribution to revenue and EBITDA over the longer term.

- Although technological improvements and waste-heap leaching continue to offer some cost and sustainability advantages, Central Asia Metals faces increased exposure to tightening global environmental and sustainability regulations, which could potentially increase compliance costs and delay project developments, squeezing net margins.

- While management's disciplined capital allocation and acquisition strategy could expand and diversify the asset base in step with long-term sector demand, the company's current reliance on two maturing assets, both in regions with significant local regulatory and permitting risks, suggests sustained vulnerability to adverse operational or legislative shifts that could destabilize future earnings.

- Despite the high EBITDA margins and consistent free cash flow generation, ongoing ore grade declines, rising operational costs from inflation and reagent use, and challenges in fully replacing reserves at both Kounrad and Sasa may progressively erode profitability and constrain long-term growth in free cash flow.

- Even as strong ESG credentials currently position the company well for investor interest and access to capital, increased industry consolidation and the rise of larger, more diversified players with greater ability to invest in low-carbon technologies could leave Central Asia Metals at a scale disadvantage, potentially compressing valuation multiples and limiting future revenue growth opportunities.

Central Asia Metals Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Central Asia Metals compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Central Asia Metals's revenue will decrease by 0.9% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 23.8% today to 17.9% in 3 years time.

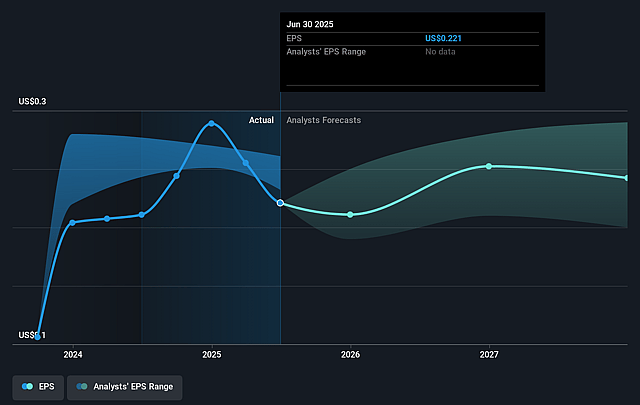

- The bearish analysts expect earnings to reach $37.5 million (and earnings per share of $0.21) by about August 2028, down from $51.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 12.4x on those 2028 earnings, up from 7.4x today. This future PE is greater than the current PE for the GB Metals and Mining industry at 10.1x.

- Analysts expect the number of shares outstanding to decline by 4.02% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.41%, as per the Simply Wall St company report.

Central Asia Metals Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The maturing dumps at Kounrad and the finite nature of existing resources indicate that copper production at this key asset will decline in future years, potentially leading to lower revenue and reduced cash flow unless significant new resources are identified or acquired.

- Rising cost pressures, including persistent inflation in Kazakhstan and North Macedonia, increases in key reagent consumption, and higher payroll expenses, could erode net margins over time, especially if commodity prices soften or production volumes lag.

- The company relies heavily on its two core assets located in Kazakhstan and North Macedonia, making it vulnerable to single-region political and regulatory risks such as taxation changes, nationalization initiatives, or operational permit challenges, which could negatively impact long-term earnings stability.

- Central Asia Metals' ability to sustain current production and dividends hinges on the successful identification, acquisition, or development of new assets, which carries execution risk and potentially higher capital expenditure requirements that might reduce free cash flow and shareholder returns if projects underperform or face delays.

- The secular global trend towards greater recycling and the circular economy, coupled with tightening ESG regulations, could dampen growth in demand for newly mined base metals and increase compliance costs, limiting long-term revenue growth and putting added pressure on profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Central Asia Metals is £1.8, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Central Asia Metals's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £2.19, and the most bearish reporting a price target of just £1.8.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $208.9 million, earnings will come to $37.5 million, and it would be trading on a PE ratio of 12.4x, assuming you use a discount rate of 7.4%.

- Given the current share price of £1.6, the bearish analyst price target of £1.8 is 11.0% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.