Key Takeaways

- Adoption of advanced mining methods and process optimizations is expected to drive sustained margin expansion, robust free cash flow, and improved long-term earnings power.

- Strong cost structure, sustainable production, and a solid balance sheet allow for premium pricing, strategic growth, and high shareholder returns without dilution risk.

- Concentration on aging assets, high payouts, rising regulatory and cost pressures, and geopolitical risks threaten long-term growth, profitability, and reserve replacement prospects.

Catalysts

About Central Asia Metals- Operates as a base metals producer.

- While analysts broadly agree that new selective mining methods and paste backfill at Sasa will extend mine life and boost ore recovery, the rapid and nearly seamless ramp-up suggests production throughput could surpass pre-transition levels, driving a step-change in revenue growth and sustained margin expansion well into the 2030s-not just stabilizing, but materially improving earnings power.

- Analyst consensus expects continued copper production at Kounrad due to better-than-expected leach curves, but this likely understates the potential: with western dump recoveries repeatedly exceeding theoretical models and ongoing process optimization, Kounrad could deliver stable or even higher copper output for significantly longer than modeled, supporting both higher revenues and robust free cash flow well past 2034.

- Central Asia Metals' top-quartile cost structure and industry-leading EBITDA margins strongly position it to capture outsized upside from ongoing structural increases in copper and zinc prices as global electrification, renewable energy installations, and infrastructure buildouts drive demand, translating directly into substantial margin expansion and superior earnings growth.

- The company's excellence in low-carbon, sustainable production and fast progress on emission reductions places it at the forefront of "green premium" metals markets, unlocking potential for price premiums, greater customer stickiness, and enhanced access to ESG-driven institutional capital, with long-term benefits to revenue quality and valuation.

- With a near debt-free balance sheet, abundant cash flow, and a proven commitment to high dividend payouts, Central Asia Metals is uniquely placed to self-fund accretive acquisitions or large-scale organic growth, meaning any future deal or internal expansion could be highly EBITDA accretive without shareholder dilution-fueling upgraded earnings forecasts and higher valuation multiples.

Central Asia Metals Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Central Asia Metals compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Central Asia Metals's revenue will grow by 1.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 23.8% today to 23.5% in 3 years time.

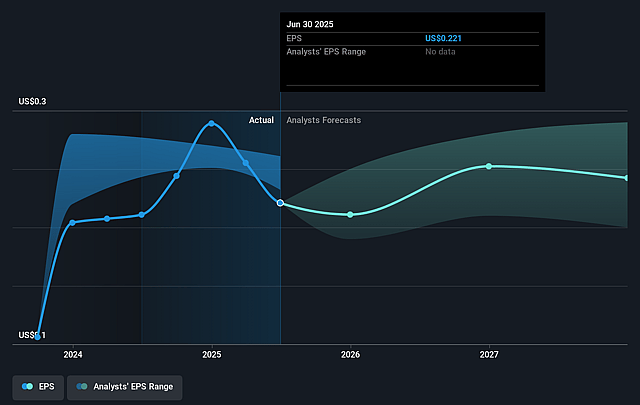

- The bullish analysts expect earnings to reach $52.5 million (and earnings per share of $0.29) by about September 2028, up from $51.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 12.0x on those 2028 earnings, up from 7.9x today. This future PE is greater than the current PE for the GB Metals and Mining industry at 11.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.39%, as per the Simply Wall St company report.

Central Asia Metals Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's core Kounrad asset faces a declining production profile over its remaining nine-year license, and although actual copper recoveries have temporarily exceeded forecasts, the long-term exhaustion of waste dumps will ultimately lead to lower output, constraining future revenue and free cash flow.

- Sustained high dividend payouts-such as distributing 63 percent of free cash flow-may limit available capital for reinvestment in new discoveries, acquisitions, and organic growth, potentially hampering the company's ability to replace depleting reserves and maintain earnings growth over time.

- Increasing global ESG scrutiny and the transition to stricter environmental regulations may force further retrofitting of processing plants and tailings management, driving up capital expenditures and eroding operating margins as compliance costs rise.

- The company's exposure to persistent cost inflation, especially for energy, labor, and reagents, could continue to outpace incremental revenue growth if commodity prices stagnate or decline, compressing net margins and overall profitability.

- Heavy reliance on existing assets in Kazakhstan and North Macedonia exposes the business to geopolitical, regulatory, and single-asset operational risks that could result in sudden disruptions, punitive taxation, or resource underperformance, leading to earnings volatility and deteriorating investor confidence.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Central Asia Metals is £2.17, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Central Asia Metals's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £2.17, and the most bearish reporting a price target of just £1.75.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $223.8 million, earnings will come to $52.5 million, and it would be trading on a PE ratio of 12.0x, assuming you use a discount rate of 7.4%.

- Given the current share price of £1.72, the bullish analyst price target of £2.17 is 20.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.