Key Takeaways

- Integrated platform, expanded product range, and technology-driven efficiencies could drive significantly stronger revenue and margin growth than currently expected.

- Strategic focus on health trends, international reach, and data-driven customer engagement positions it as a potential leader in the global online meal market.

- Persistent cost pressures, competitive threats, and uncertain transition strategies risk ongoing revenue instability and margin compression, with limited transparency amplifying concerns around organic growth and geographic vulnerabilities.

Catalysts

About Marley Spoon Group- Through its subsidiary, Marley Spoon SE, operates as a direct-to-consumer meal-kit company.

- Analyst consensus already sees margin expansion from the transition to an integrated food platform, but this likely understates the true upside: Marley Spoon's expanded offerings, cross-selling of adjacent categories, and rapid launch cadence enable a multi-year compounding effect on both revenue and net margins well above current forecasts as the product catalog, cross-category loyalty, and average order values grow at an accelerating pace.

- Analysts broadly expect marketing and cost discipline to drive incremental improvement, but the company's rigorous, data-driven approach and demonstrable success in improving customer quality and cohort LTV suggest structural changes that could deliver operating leverage and net margin inflection far beyond consensus, as fixed costs decline as a percentage of sales and repeat order rates climb sharply.

- The company is positioned to capture a significant share of the growing shift toward health and wellness-focused, convenient meal solutions, and its early leadership in fresh, ready-to-heat, and specialty product lines can spur outsized revenue growth as these secular trends accelerate and mainstream adoption deepens.

- Marley Spoon's commitment to technology investment-including AI-driven personalization and ongoing automation-can generate sustained operational efficiencies, not only protecting margins but also unlocking new customer segments and boosting lifetime values, supporting both top-line growth and expanded profitability.

- The group's single-platform, international expansion strategy and ability to rapidly roll out new branded solutions or partnerships positions it to become the dominant online nutrition destination globally, mitigating geographic concentration risk and driving robust, diversified long-term revenue growth.

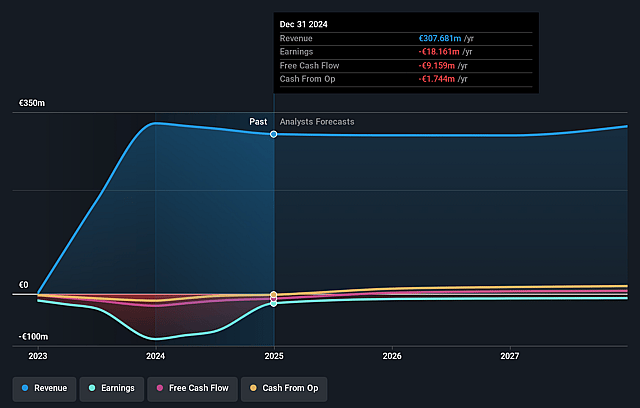

Marley Spoon Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Marley Spoon Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Marley Spoon Group's revenue will decrease by 2.3% annually over the next 3 years.

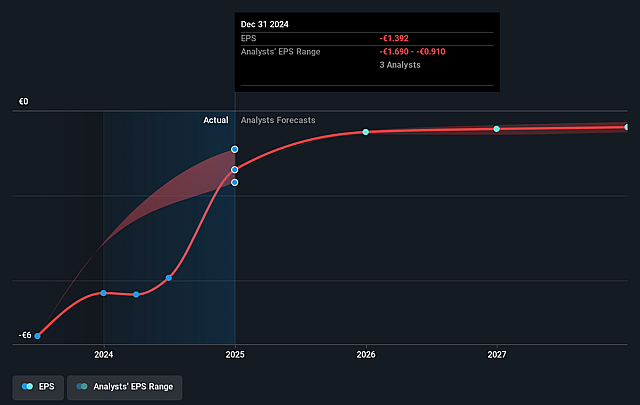

- Even the bullish analysts are not forecasting that Marley Spoon Group will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Marley Spoon Group's profit margin will increase from -5.9% to the average DE Hospitality industry of 14.3% in 3 years.

- If Marley Spoon Group's profit margin were to converge on the industry average, you could expect earnings to reach €41.0 million (and earnings per share of €2.28) by about September 2028, up from €-18.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 0.6x on those 2028 earnings, up from -0.4x today. This future PE is lower than the current PE for the DE Hospitality industry at 26.7x.

- Analysts expect the number of shares outstanding to decline by 0.23% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.81%, as per the Simply Wall St company report.

Marley Spoon Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Net revenue declined by over 21 percent year-over-year in Q2 2025, primarily due to a sharp reduction in marketing spend and the divestiture of Chefgood, raising concerns about the company's ability to sustain organic revenue growth when facing cost pressures or constrained marketing budgets.

- Consumer sensitivity to cost pressures was evident in the company's strategy to cut marketing spending and prioritize higher-value, higher-frequency customers, signaling heightened risk that persistent inflation and economic pressures could further erode discretionary spending and ultimately hinder top-line revenue growth.

- The transition away from the traditional meal kit business towards an integrated food solutions platform remains in progress, and management has not yet provided long-term guidance for when subscriber declines will level off or return to growth, suggesting ongoing risk to both revenue stability and the customer base.

- The meal kit industry's high level of competition, including from larger, more capitalized competitors like HelloFresh and emerging direct-to-consumer brands, poses a persistent threat of downward pricing pressure and increased discounting, which could compress Marley Spoon's net margins over the long term despite recent contribution margin improvements.

- Limited disclosure on organic growth versus inorganic factors, as well as region-specific shocks such as weather disruptions in Australia and ongoing challenges with regional diversification, suggest Marley Spoon remains vulnerable to geographic and operational risks that could drive revenue volatility and impair asset values.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Marley Spoon Group is €1.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Marley Spoon Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €1.0, and the most bearish reporting a price target of just €0.5.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €286.8 million, earnings will come to €41.0 million, and it would be trading on a PE ratio of 0.6x, assuming you use a discount rate of 9.8%.

- Given the current share price of €0.36, the bullish analyst price target of €1.0 is 63.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.