Key Takeaways

- Rising inflation, saturated competition, and cost-of-living concerns may limit revenue growth and squeeze margins despite improvements in order value and operational efficiency.

- Regulatory shifts and escalating sustainability demands could increase operating expenses, potentially offsetting gains from Marley Spoon's eco-friendly initiatives and supply chain optimizations.

- Persistent revenue contraction, declining subscribers, high leverage, and heavy reliance on cost-cutting heighten risks to liquidity, growth, and long-term profitability.

Catalysts

About Marley Spoon Group- Through its subsidiary, Marley Spoon SE, operates as a direct-to-consumer meal-kit company.

- While Marley Spoon is benefitting from increased consumer demand for convenient meal solutions and a broader product offering which has boosted average order value and customer order frequency, it still faces pressure from rising inflation and cost-of-living concerns that may suppress discretionary spending on meal kits, potentially limiting top-line revenue growth.

- Despite the company's progress in expanding ESG-friendly initiatives and sustainable packaging, further regulatory tightening or escalating consumer expectations around eco-friendly practices could increase operating costs and impact net margins, offsetting some of the gains driven by Marley Spoon's sustainability efforts.

- Although Marley Spoon has improved marketing efficiency and reduced reliance on unsustainable promotional discounts, the ongoing threat of high customer acquisition costs-amid market saturation and limited differentiation from larger, tech-enabled competitors-remains a risk to sustained profitability and could ultimately erode margins.

- While the shift toward supply chain optimization, automation, and a more asset-light business model is showing margin improvements, persistent supply chain complexities or rising logistics costs-especially given global uncertainties-could stall further net margin expansion and delay a return to consistently positive cash flow.

- While the acquisition of BistroMD and strategic focus on health-oriented, ready-to-eat meals position Marley Spoon to capitalize on broader adoption of online grocery and healthier eating trends, intensified competition from well-capitalized multinational food delivery players and potential price wars may exert downward pressure on average order value and sector-wide earnings growth.

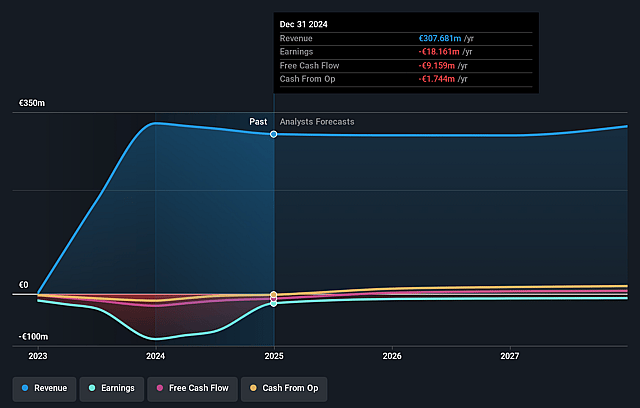

Marley Spoon Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Marley Spoon Group compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Marley Spoon Group's revenue will decrease by 6.1% annually over the next 3 years.

- The bearish analysts are not forecasting that Marley Spoon Group will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Marley Spoon Group's profit margin will increase from -5.9% to the average DE Hospitality industry of 14.3% in 3 years.

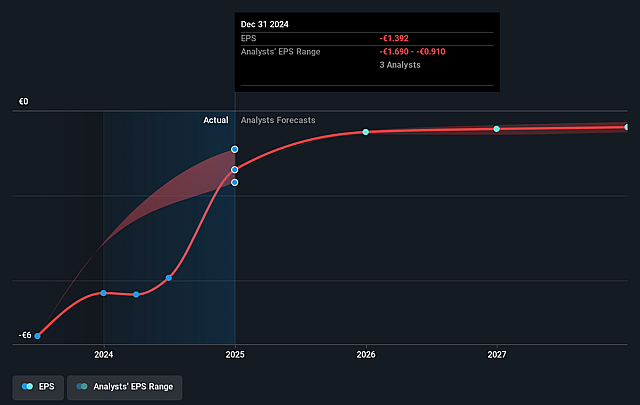

- If Marley Spoon Group's profit margin were to converge on the industry average, you could expect earnings to reach €36.4 million (and earnings per share of €2.02) by about September 2028, up from €-18.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 0.3x on those 2028 earnings, up from -0.5x today. This future PE is lower than the current PE for the DE Hospitality industry at 22.6x.

- Analysts expect the number of shares outstanding to decline by 0.23% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.81%, as per the Simply Wall St company report.

Marley Spoon Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Marley Spoon is guiding for a single-digit revenue decline in 2025, following stagnant or slightly declining sales in several regions during 2024; persistent revenue contraction could signal that the company's current strategic changes may not be translating into sustainable top-line growth.

- The company's end-of-2024 cash position stood at only €6 million, with net debt at €66.2 million, and management repeatedly declined to offer clear guidance on when it will achieve cash flow positivity; ongoing cash burn and high leverage raise concerns about liquidity risk and may pressure future earnings or necessitate dilutive capital raises.

- Active subscriber numbers declined year-over-year, particularly in the U.S., as marketing investments and voucher-based customer acquisition were curtailed; if order frequency and average order value gains stall, this limits revenue scalability and may erode net margins over time.

- Revenue declines in Australia and Europe, attributed to a deliberate reduction in marketing spend, suggest that efforts to optimize profitability could further suppress growth if not offset by meaningful new customer or product acquisition, impacting both revenue and long-term earnings prospects.

- The company's reliance on improved operational efficiency and ongoing cost-cutting to drive contribution margin and EBITDA gains may have diminishing returns, and risks undermining service quality or innovation, thereby threatening customer retention and future profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Marley Spoon Group is €0.5, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Marley Spoon Group's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €1.0, and the most bearish reporting a price target of just €0.5.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €254.7 million, earnings will come to €36.4 million, and it would be trading on a PE ratio of 0.3x, assuming you use a discount rate of 9.8%.

- Given the current share price of €0.48, the bearish analyst price target of €0.5 is 4.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.