Key Takeaways

- Regulatory pressures, legal costs, and security risks threaten to compress margins and constrain earnings growth for EML Payments over time.

- Evolving digital payments, aggressive competition, and adoption of central bank digital currencies could erode EML's market share and undermine its revenue base.

- Technology upgrades, strengthened leadership, and expansion into new verticals position the company for improved risk management, diversified growth, and enhanced long-term profitability.

Catalysts

About EML Payments- Provides payment solutions platform in Australia, Europe, and North America.

- Elevated regulatory scrutiny and legacy issues from EML Payments' history-particularly in Europe-could result in future restrictions on operating licenses, increased compliance requirements, and ongoing legal costs, directly impacting margins and limiting long-term earnings growth.

- The rapid evolution and adoption of alternative payment methods such as Buy-Now-Pay-Later, digital wallets, and direct bank transfers threaten to cannibalize prepaid card and legacy payment product demand, reducing addressable market size and leading to sustained revenue decline for EML.

- Intensifying competition from larger integrated payments processors and embedded finance platforms will likely erode EML's market share over time while compressing margins, making it increasingly difficult to sustain top-line growth or reach targeted double-digit revenue increases through 2028.

- Central bank digital currencies (CBDCs), when widely adopted, may bypass traditional payments intermediaries like EML entirely, leading to significant structural declines in transaction volume and associated fee income, undermining both revenue and earnings predictability.

- Persistent cyber threats and data privacy risks present substantial ongoing security costs, and any major breach could further damage customer trust, resulting in lost clients and heavier investments in compliance, further compressing net margins over the long term.

EML Payments Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on EML Payments compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming EML Payments's revenue will decrease by 0.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -23.3% today to 6.1% in 3 years time.

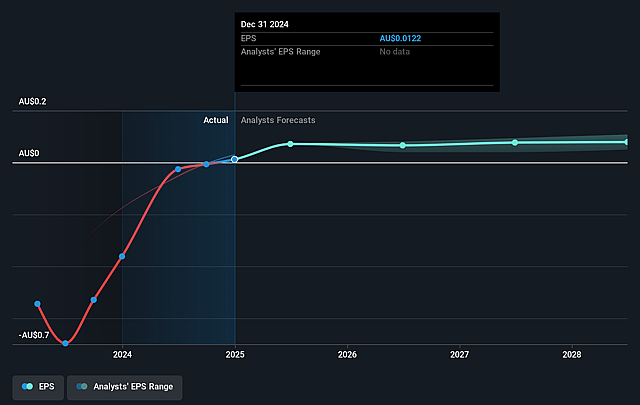

- The bearish analysts expect earnings to reach A$14.2 million (and earnings per share of A$0.03) by about August 2028, up from A$-53.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 37.1x on those 2028 earnings, up from -8.2x today. This future PE is greater than the current PE for the AU Diversified Financial industry at 19.9x.

- Analysts expect the number of shares outstanding to grow by 0.56% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.33%, as per the Simply Wall St company report.

EML Payments Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The global transition from cash to digital payments continues to expand EML's addressable market and supports transaction volume growth, which could drive higher revenue and sustainable long-term earnings for the company.

- Project Arlo, EML's single-platform technology upgrade with Visa Pismo, is designed to unlock operational efficiencies, enable faster scaling and innovation, and lower overall technology costs, potentially increasing net margins and supporting long-term profitability.

- The rebuild of EML's commercial and sales teams, along with strong customer renewal rates and a rapidly expanding pipeline, provides evidence of strengthening business development, which may lead to renewed revenue growth and improved cash flow over time.

- Regulatory remediation and balance sheet repair have been largely completed, and EML now benefits from an improved global leadership team with expertise in regulated businesses, indicating better risk management and the potential for more stable earnings and margin expansion.

- Continued investment in compliance, fraud prevention, and platform scalability, coupled with opportunities in new verticals such as government, travel, mobility, and embedded e-commerce, may diversify and increase revenue streams, mitigating risk and enhancing future earnings resilience.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for EML Payments is A$1.1, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of EML Payments's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$1.8, and the most bearish reporting a price target of just A$1.1.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be A$231.7 million, earnings will come to A$14.2 million, and it would be trading on a PE ratio of 37.1x, assuming you use a discount rate of 7.3%.

- Given the current share price of A$1.13, the bearish analyst price target of A$1.1 is 2.7% lower. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on EML Payments?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.