Key Takeaways

- Transition to a unified global platform and strategic partnerships will enhance scalability, innovation, and long-term profitability.

- Strengthened leadership, regulatory clean-up, and focus on digital payments position the company for sustained growth and improved financial stability.

- EML faces regulatory and compliance risks, earnings pressure from falling interest rates and rising costs, disruption from transformation projects, and intensified competition in payment services.

Catalysts

About EML Payments- Provides payment solutions platform in Australia, Europe, and North America.

- The company's investment in Project Arlo-a transition to a single global technology platform with strong integration into best-in-class partners like Visa Pismo-is expected to enhance operational scalability, reduce manual workloads, support rapid product innovation, and expand EML's addressable market, positioning the company to capture higher long-term revenue growth and drive improved net margins.

- Growing customer demand for cashless, embedded, and digital payment solutions, highlighted by new client wins, strong customer renewal rates, and a growing pipeline (targeting $90 million by December 2025), reflects broadening adoption of EML's offerings in verticals aligned with the global shift toward cashless payments and embedded finance, providing a sustained tailwind for top-line revenue expansion.

- EML's strategic focus on building a robust, experienced commercial and executive team, along with investments in global operations and go-to-market capabilities, is expected to structurally improve client acquisition and retention, translating into higher recurring revenues and stronger EBITDA over the coming years.

- The completion of legacy regulatory clean-up, settlement of class actions, and divestiture of non-core operations have resulted in a much healthier balance sheet and increased financial flexibility, positioning EML to reinvest in technology and growth initiatives without near-term margin or earnings dilution.

- Locking in attractive yields on a significant proportion of float balances (~45% of interest income fixed for 3 years) provides medium-term earnings visibility and risk mitigation, giving EML time and certainty to benefit from industry secular growth trends before further rate changes materially affect net interest revenue.

EML Payments Future Earnings and Revenue Growth

Assumptions

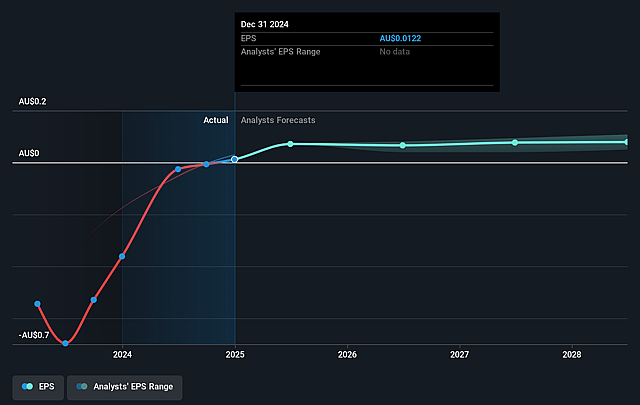

How have these above catalysts been quantified?- Analysts are assuming EML Payments's revenue will grow by 4.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from -23.3% today to 10.6% in 3 years time.

- Analysts expect earnings to reach A$27.5 million (and earnings per share of A$0.07) by about September 2028, up from A$-53.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting A$42 million in earnings, and the most bearish expecting A$13.3 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 24.9x on those 2028 earnings, up from -7.4x today. This future PE is greater than the current PE for the AU Diversified Financial industry at 19.9x.

- Analysts expect the number of shares outstanding to grow by 0.56% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.34%, as per the Simply Wall St company report.

EML Payments Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- EML faces ongoing risks from regulatory scrutiny and legacy compliance issues (e.g., its recent class action settlement and historic regulatory remediation in Europe and Ireland), meaning further regulatory tightening could increase compliance costs, restrict access to new markets, and impact net margins and earnings.

- The company's reliance on interest income (which contributed 40%+ growth in Europe and provided a significant portion of EBITDA uplift) exposes it to downside risk from falling global interest rates-already evident with recent central bank cuts and expectations of further rate moderation-potentially reducing a key revenue pillar.

- Margin pressures remain due to rising operational and headcount costs (up 8% YoY in underlying overheads), investments in compliance, and a multi-year technology transformation (Project Arlo) with significant one-off and recurring costs, which could keep net earnings subdued if revenue growth underwhelms.

- EML is amid a complex and disruptive multi-year transformation (EML 2.0, Project Arlo) with ongoing platform migration risks and organisational "change fatigue", raising execution risks that could lead to client churn, onboarding delays, or integration mishaps, directly impacting revenue and cashflows.

- Intensifying competition from global payments giants and continued commoditization of payment services, especially in embedded finance and digitized card programs, threatens EML's ability to defend fee levels and retain market share, which could constrain both revenue growth and profitability over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$1.42 for EML Payments based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$1.8, and the most bearish reporting a price target of just A$1.1.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$259.6 million, earnings will come to A$27.5 million, and it would be trading on a PE ratio of 24.9x, assuming you use a discount rate of 7.3%.

- Given the current share price of A$1.03, the analyst price target of A$1.42 is 27.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on EML Payments?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.