Key Takeaways

- Accelerated platform consolidation, improved sales teams, and strong financial flexibility position EML for faster-than-expected revenue growth and enhanced margins.

- Regulatory and technological shifts in digital payments allow EML to swiftly capture high-margin verticals, enter new markets, and drive sustained earnings growth.

- Heavy reliance on low-margin products, operational disruptions, regulatory challenges, and rising competition threaten EML Payments' growth, profitability, and long-term market relevance.

Catalysts

About EML Payments- Provides payment solutions platform in Australia, Europe, and North America.

- While analyst consensus sees Project Arlo as a path to operational efficiency and margin expansion, EML's accelerated platform consolidation and early MVP deployment signal a much faster realization of both cost synergies and expanded product rollout globally, potentially enabling above-market revenue growth and a step-change in net margins well ahead of current market expectations.

- Analysts broadly agree on the growing pipeline and increased customer win-rate, but these views may understate the impact of EML's transformed commercial and B2B sales teams, which are already delivering stronger than projected new customer wins and renewals, setting the stage for a faster reacceleration of top-line growth and recurring revenues, likely driving rapid EBITDA and earnings leverage.

- The ongoing global transition to digital payments is not only expanding EML's addressable market, but, due to the rapid digitization of B2B payments and embedded finance, EML stands to capture extraordinary transaction flow growth, with high-margin verticals such as salary packaging, mobility, and digital wallets poised to unlock compound revenue gains.

- EML's strengthened balance sheet, increased net cash position, and extended, enlarged credit facilities grant significant dry powder for swift opportunistic M&A or reinvestment in product innovation, allowing the company to capture emerging trends, accelerate cross-border expansion, and further boost long-term earnings growth and stability.

- Regulatory shifts toward real-time payments and open banking create a unique opportunity for EML to rapidly introduce new high-value products and enter untapped market segments ahead of less agile competitors, enabling outsized fee and transaction revenue growth, with sustained positive impacts on both gross profit margin and long-term operating leverage.

EML Payments Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on EML Payments compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming EML Payments's revenue will grow by 6.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -23.3% today to 16.8% in 3 years time.

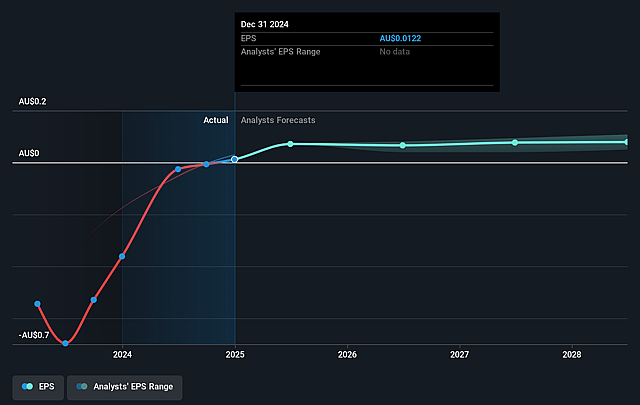

- The bullish analysts expect earnings to reach A$45.6 million (and earnings per share of A$0.12) by about September 2028, up from A$-53.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 19.0x on those 2028 earnings, up from -7.3x today. This future PE is lower than the current PE for the AU Diversified Financial industry at 19.9x.

- Analysts expect the number of shares outstanding to grow by 0.56% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.31%, as per the Simply Wall St company report.

EML Payments Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company is undergoing a multi-year technology transformation and restructuring program (EML 2.0 and Project Arlo), and management acknowledges there are risks around the organization's ability to digest the change while also driving growth. If operational disruption, integration challenges, or delays in platform migration occur, this could exacerbate costs and reduce operational efficiency, ultimately undermining earnings and net margins.

- The business maintains a heavy reliance on lower-margin, high-volume prepaid, gift, and incentive card products, against a backdrop where transaction volumes in core segments are growing only modestly and the margin uplift mainly stems from interest income rather than underlying client activity. This structural dependence may cap the company's ability to achieve material net margin improvements and creates earnings risk if float-driven interest income softens.

- EML Payments' recent financial performance still reflects the lingering impact of historical regulatory and reputational issues, including a sizeable statutory loss following class action settlements and provision costs. Persistent reputational overhang could limit enterprise contract wins, inhibit expansion in new markets, and constrain customer revenue growth over the long term.

- Intensifying competition from fintech disruptors and global payment behemoths may erode EML's market share, especially as larger players scale more quickly and regulatory harmonization in key markets further lowers barriers to entry. This threatens EML's ability to sustain topline revenue growth and compresses profitability in its core segments.

- Dependence on traditional payment models exposes the business to both secular industry risks-such as the rising adoption of more efficient blockchain-based and DeFi solutions-and mounting compliance costs due to tightening AML and KYC regulations, which may reduce EML Payments' relevance and raise operating costs, negatively impacting both revenue and net margins over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for EML Payments is A$1.8, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of EML Payments's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$1.8, and the most bearish reporting a price target of just A$1.1.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be A$271.2 million, earnings will come to A$45.6 million, and it would be trading on a PE ratio of 19.0x, assuming you use a discount rate of 7.3%.

- Given the current share price of A$1.01, the bullish analyst price target of A$1.8 is 43.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on EML Payments?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.