Key Takeaways

- Ongoing investment in digital platforms and omnichannel operations is strengthening customer retention, operational efficiency, and the company's overall risk profile.

- Strategic expansion into new destinations and industry consolidation efforts are set to diversify revenue streams and enhance profitability.

- Reluctance to embrace digital transformation, combined with industry shifts and external pressures, threatens Helloworld Travel's market relevance, margins, and long-term revenue stability.

Catalysts

About Helloworld Travel- Operates as a travel distribution company in Australia, New Zealand, and internationally.

- Ongoing recovery and strong forward bookings in international travel-backed by resilient demand for long-haul destinations, rising global leisure travel, and the expansion of the middle class-are set to drive top-line growth and improve total transaction value (TTV) and revenues in FY '26.

- Significant, sustained investment in proprietary booking and automation technology-including AI integration and ReadyRooms platform upgrades-positions Helloworld to capture greater market share from digital-savvy consumers while reducing operational costs, supporting higher earnings and net margin expansion over the long term.

- The unique blend of omnichannel operations (physical franchise stores and online platforms), coupled with very high franchise renewal rates and a growing branded network, enhances cross-selling opportunities and customer retention, underpinning stable recurring revenues and a stronger risk profile.

- Strategic wholesale and acquisition-driven growth-including new destination launches (e.g., Japan, Indochina), strong performance in cruise and land packages, and the impending consolidation of high-margin businesses like MTA-will meaningfully diversify and augment revenue streams.

- Persistent structural industry trends-such as consolidation among travel agencies and growing consumer preference for curated, experiential travel offerings-are expected to increase Helloworld's bargaining power with suppliers and improve economies of scale, further bolstering profitability and future earnings.

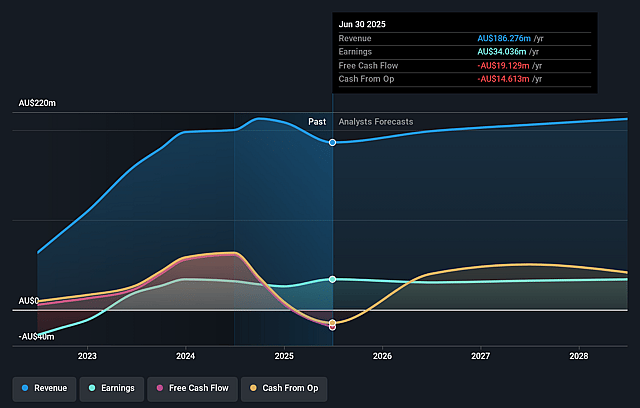

Helloworld Travel Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Helloworld Travel's revenue will grow by 4.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 18.3% today to 15.9% in 3 years time.

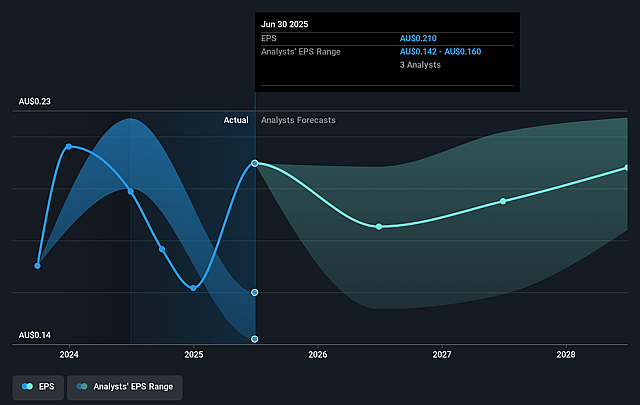

- Analysts expect earnings to reach A$33.9 million (and earnings per share of A$0.21) by about September 2028, down from A$34.0 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as A$30.1 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.6x on those 2028 earnings, up from 8.4x today. This future PE is lower than the current PE for the AU Hospitality industry at 35.2x.

- Analysts expect the number of shares outstanding to grow by 0.31% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.31%, as per the Simply Wall St company report.

Helloworld Travel Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Helloworld Travel's Total Transaction Value (TTV) and revenues both fell by 8.6%–8.7% year-on-year, reflecting not just macro fluctuations but persistent declines in premium fare volume and a structural consumer shift to lower-value, short-haul travel; sustained lower TTV over the long term would directly limit revenue growth and earnings leverage.

- The company remains heavily reliant on a large network of franchise agents and physical stores, despite industry-wide secular trends of digital disintermediation and direct online bookings, which may erode its addressable market, depress net margin, and eventually cause revenue contraction as more consumers shift away from legacy agency channels.

- Helloworld's continued belief in the long-term value of "trusted adviser" agents-while investing in technology at a slow, methodical pace-could leave the company lagging better-funded, pure-play online travel competitors, leading to chronic underinvestment in digital platforms and loss of market share, undermining both revenue and net margin.

- The company's commission-based business model remains vulnerable to supplier margin compression, especially as airlines and cruise operators increasingly incentivize direct bookings; this model risk could squeeze net margins over time, increasing profit volatility even in periods of strong travel demand.

- Geopolitical and regulatory pressures-including regional conflicts, heightened climate-driven travel regulation, and rising consumer preference for sustainable travel-present ongoing risks of demand disruption and increased compliance costs, putting long-term pressure on both top-line revenue and operating profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$2.302 for Helloworld Travel based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$2.8, and the most bearish reporting a price target of just A$1.79.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$212.5 million, earnings will come to A$33.9 million, and it would be trading on a PE ratio of 14.6x, assuming you use a discount rate of 9.3%.

- Given the current share price of A$1.74, the analyst price target of A$2.3 is 24.2% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Helloworld Travel?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.