Key Takeaways

- Reliance on traditional franchise and brick-and-mortar models threatens scalability as digital competitors erode margins and customer loyalty.

- Regulatory and societal pressures, alongside slow digital transformation, constrain growth in premium segments and expose the company to operational risks.

- Strong agent network renewals, technology investment, segment growth, recovery in travel demand, and targeted acquisitions strengthen operational resilience and support diversified long-term revenue expansion.

Catalysts

About Helloworld Travel- Operates as a travel distribution company in Australia, New Zealand, and internationally.

- The accelerating global shift toward direct online bookings and AI-powered self-serve travel planning tools is expected to continue reducing reliance on traditional travel agent networks, eroding Helloworld Travel's transaction volumes and undermining the core revenue base in the medium to long term.

- Societal and regulatory pressures surrounding climate change and carbon emissions are anticipated to dampen long-haul international travel demand, constraining the company's ability to grow its higher-margin premium travel packages and leading to a persistent headwind for revenue and earnings growth.

- Helloworld Travel's heavy reliance on franchising and brick-and-mortar agency models limits scalability, flexibility, and cost efficiency, especially as consumer behavior increasingly favors fully digital, global-first travel platforms-putting long-term pressure on net margins and diminishing the advantage of their branded network.

- Intensifying competition from global online travel aggregators and digital-first market entrants will likely drive up customer acquisition costs, increase customer churn, and place downward pressure on commission and fee structures, resulting in ongoing margin compression and weaker earnings quality.

- The company's moderate pace of digital transformation and measured adoption of advanced technologies like AI leaves it exposed to faster-moving competitors, risking higher operational costs, reduced operating leverage, and an erosion of the historical EBITDA margin advantage over time.

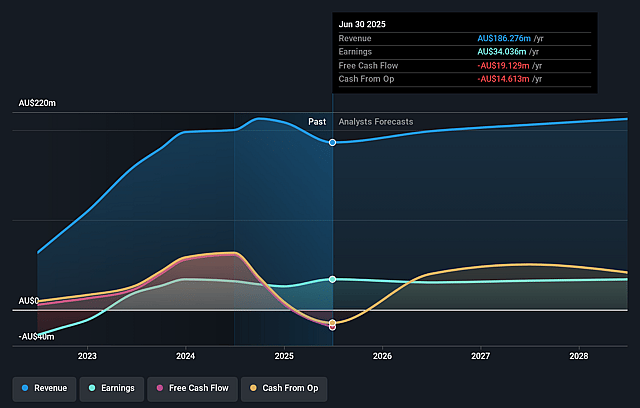

Helloworld Travel Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Helloworld Travel compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Helloworld Travel's revenue will grow by 2.8% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 18.3% today to 14.9% in 3 years time.

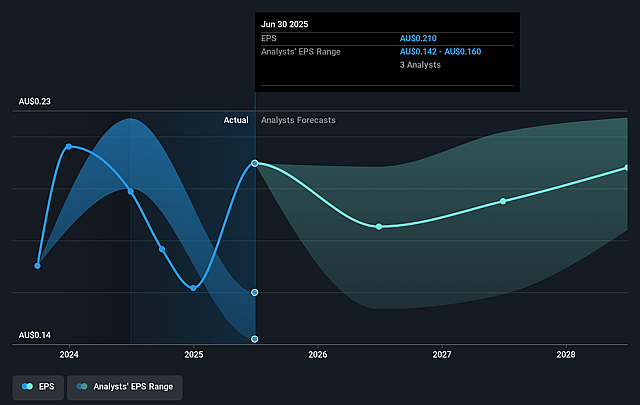

- The bearish analysts expect earnings to reach A$30.1 million (and earnings per share of A$0.18) by about September 2028, down from A$34.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 12.7x on those 2028 earnings, up from 8.4x today. This future PE is lower than the current PE for the AU Hospitality industry at 35.2x.

- Analysts expect the number of shares outstanding to grow by 0.31% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.31%, as per the Simply Wall St company report.

Helloworld Travel Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Strong franchise and branded agent renewal rates with 98% of First Travel Group agents in New Zealand and 96% of Branded and Associate networks in Australia renewing create a solid platform for recurring revenue and underpin network stability, supporting future earnings consistency.

- Significant investment in proprietary technology, including $95 million over eight years and the growth of digital platforms like ReadyRooms, enhances operational efficiency and retention of agent business, providing margin resilience and potential for revenue expansion as digital adoption grows.

- Continued growth in core segments such as wholesale (VIVA Holidays, GO Holidays), inbound, and cruise, with retail cruise TTV up 27% and ReadyRooms bookings up 110% year-on-year, signals robust demand and the ability to drive top-line revenue growth.

- Indications of a cyclical rebound in long-haul and international travel, with air bookings for FY '26 already up 11% on the previous year, position the business to benefit from recovery trends, increasing transaction volume and supporting revenue and EBITDA growth.

- The company's ongoing strategy of bolt-on acquisitions (such as Barlow Travel Group and planned full acquisition of MTA), as well as a substantial stake in Webjet, could create synergies, increase scale, and diversify revenue streams, supporting long-term earnings and improving shareholder returns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Helloworld Travel is A$1.79, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Helloworld Travel's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$2.8, and the most bearish reporting a price target of just A$1.79.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be A$202.2 million, earnings will come to A$30.1 million, and it would be trading on a PE ratio of 12.7x, assuming you use a discount rate of 9.3%.

- Given the current share price of A$1.74, the bearish analyst price target of A$1.79 is 2.5% higher. The relatively low difference between the current share price and the analyst bearish price target indicates that the bearish analysts believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.