Key Takeaways

- Proprietary technology adoption, automation, and acquisitions uniquely position Helloworld for higher margins and significant earnings growth beyond consensus expectations.

- Robust demand from Asia-Pacific middle class and younger travelers, combined with a scalable franchise model, positions the company to outperform in recurring earnings.

- Heavy reliance on traditional models and slow digital adaptation leaves the business exposed to shifting consumer behavior, competitive threats, and unpredictable external shocks.

Catalysts

About Helloworld Travel- Operates as a travel distribution company in Australia, New Zealand, and internationally.

- Analysts broadly agree that Helloworld's forward bookings growth is healthy, but with air bookings already up 11% year-on-year on a substantial base-and the company explicitly stating that FY26 is shaping up materially ahead of FY25-there is significant potential for outsized revenue acceleration that could meaningfully exceed present forecasts.

- Analyst consensus generally expects a modest improvement in margins, yet Helloworld is now benefiting from increased high-margin wholesale product penetration, proprietary tech adoption, and better commercial terms with major carriers, suggesting a step-change higher in EBITDA margins and net profitability that could drive a sustained re-rating.

- Helloworld's heavy ongoing investment in proprietary tech and automation-including impending AI-powered solutions for itinerary planning-uniquely positions the company to capture a larger share of the emerging digital/personalized travel market, unlocking operating leverage and boosting net margins over the long term.

- The company's expansionary acquisition pipeline (such as the pending MTA purchase and strategic Webjet stake) offers a platform for non-linear network growth and vertical integration, enabling substantial increases in revenue per agent and incremental earnings upside that analyst consensus underappreciates.

- With the global middle class in Asia-Pacific and experience-hungry younger cohorts driving sustained secular growth in long-haul and packaged travel, Helloworld's trusted advisor model and scalable, franchise-driven distribution network are primed to convert this demand into recurring, higher-quality earnings growth well ahead of market expectations.

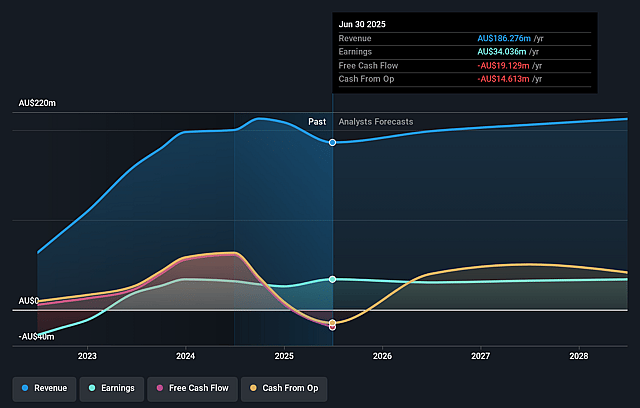

Helloworld Travel Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Helloworld Travel compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Helloworld Travel's revenue will grow by 5.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 18.3% today to 16.8% in 3 years time.

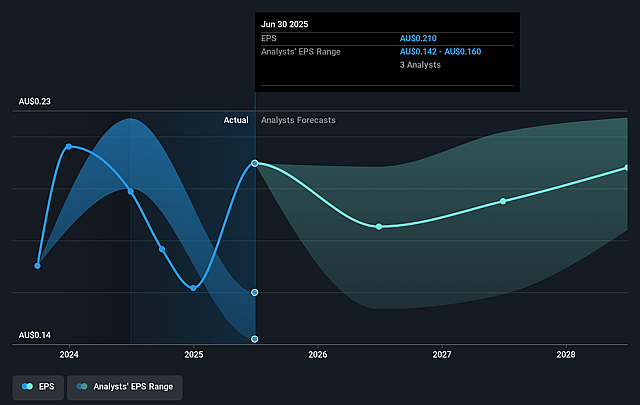

- The bullish analysts expect earnings to reach A$37.1 million (and earnings per share of A$0.23) by about September 2028, up from A$34.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 16.1x on those 2028 earnings, up from 8.0x today. This future PE is lower than the current PE for the AU Hospitality industry at 35.2x.

- Analysts expect the number of shares outstanding to grow by 0.31% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.18%, as per the Simply Wall St company report.

Helloworld Travel Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing decline in total transaction value, driven by a combination of lower premium airfares, a consumer shift to shorter and potentially lower-margin destinations, and agent attrition, suggests secular pressure on overall revenue growth in the face of changing travel patterns.

- Helloworld Travel's strategic emphasis on the value of the traditional travel agent and physical stores leaves it vulnerable to the long-term trend of increasing consumer preference for direct online booking and automation, which threatens to erode its core business model and potentially compress future earnings.

- While the company highlights a strong technology investment over the past years, the cautious and slow adoption of AI and digital innovation may hamper Helloworld's ability to compete effectively against more nimble, tech-centric rivals, resulting in market share loss and a negative impact on margins.

- Limited international brand recognition outside Australia and New Zealand continues to restrict the addressable market, capping the company's long-term revenue growth potential and hindering its ability to offset domestic market headwinds.

- The travel industry remains highly exposed to external shocks including climate-driven regulatory changes, geopolitical events, and persistent sector disruptions such as airline capacity issues, all of which could drive long-term volatility in bookings and create unpredictable fluctuations in both revenue and net earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Helloworld Travel is A$2.8, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Helloworld Travel's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$2.8, and the most bearish reporting a price target of just A$1.79.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be A$220.9 million, earnings will come to A$37.1 million, and it would be trading on a PE ratio of 16.1x, assuming you use a discount rate of 9.2%.

- Given the current share price of A$1.67, the bullish analyst price target of A$2.8 is 40.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.