Last Update16 Sep 25Fair value Increased 2.23%

The consensus price target for UNIQA Insurance Group has increased slightly as analysts factor in a higher future P/E ratio despite a modest decline in net profit margin, raising fair value from €13.48 to €13.78.

Valuation Changes

Summary of Valuation Changes for UNIQA Insurance Group

- The Consensus Analyst Price Target has risen slightly from €13.48 to €13.78.

- The Future P/E for UNIQA Insurance Group has risen from 10.01x to 10.85x.

- The Net Profit Margin for UNIQA Insurance Group has fallen from 5.87% to 5.54%.

Key Takeaways

- Expanding digitalization, bancassurance partnerships, and demographic trends fuel growth in premiums, customer base, and operating margin, especially in Central and Eastern Europe.

- Strengthened sustainability focus and improved capital flexibility enable differentiated offerings, enhanced brand value, and consistent revenue through long-term partnerships.

- Expansion into Central and Eastern Europe, rising climate risks, regulatory pressures, and slow digital transformation could threaten profitability, asset quality, and competitive positioning.

Catalysts

About UNIQA Insurance Group- Operates as an insurance company in Austria and Central and Eastern Europe.

- Strong customer and premium growth in Central and Eastern Europe, especially Poland (outpacing market growth with 15% vs. market's 2%, expansion of bancassurance partnership with mBank), positions UNIQA to capture rising insurance demand as populations age and disposable incomes increase. This is likely to support sustained revenue and earnings growth.

- Accelerated investments and progress in digitalization, automation, and direct distribution (with ongoing rollout of UNIQA 3.0), are expected to drive future cost efficiencies and improved customer acquisition, translating to higher operating margins and lower expense ratios over the next several years.

- Increasing demand for health and retirement insurance products, driven by demographic shifts and public welfare constraints, provides a tailwind for UNIQA's Life and Health segments (evidenced by stable high new business margins and technical results), supporting future revenue and technical margin expansion.

- Growing focus on sustainability (ESG) at consumer and investor levels, along with improved Solvency II ratios and capital flexibility, positions UNIQA favorably for access to sustainable investment flows and differentiated product offerings, which can reinforce brand value and financial strength.

- Strategic partnerships, particularly long-term bancassurance agreements and new contracts (such as with mBank), are set to deliver recurring premium streams and stable distribution, underpinning predictable revenue and earnings contributions across cycles.

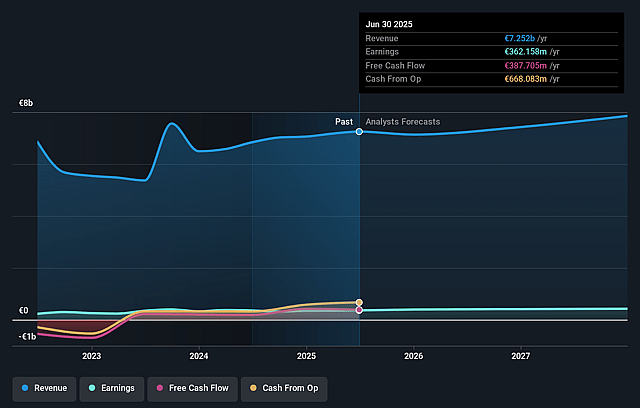

UNIQA Insurance Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming UNIQA Insurance Group's revenue will grow by 4.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.0% today to 5.9% in 3 years time.

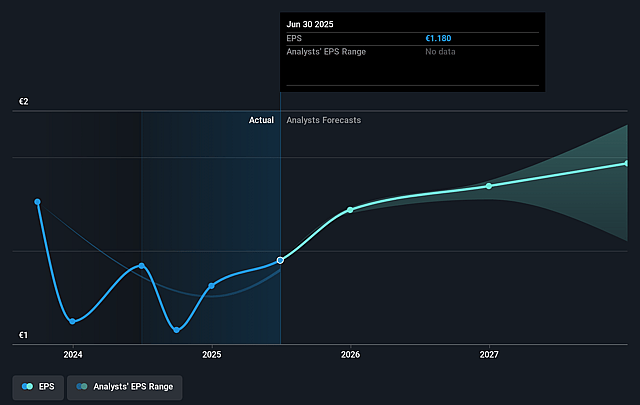

- Analysts expect earnings to reach €487.0 million (and earnings per share of €1.46) by about September 2028, up from €362.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.0x on those 2028 earnings, down from 10.3x today. This future PE is greater than the current PE for the GB Insurance industry at 9.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.74%, as per the Simply Wall St company report.

UNIQA Insurance Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- UNIQA's rapid growth in Central and Eastern Europe, particularly Poland, increases exposure to geopolitical and macroeconomic risks in these regions, which could undermine revenue growth and compromise asset quality if market conditions deteriorate.

- The company's profitability remains sensitive to the frequency and severity of natural catastrophes and large claims (NatCat), which are rising due to climate change

- future adverse events could lead to significantly higher claims payouts, eroding net margins and pressuring overall earnings.

- Persistently low or volatile interest rates, especially if long-dated yields decline, may negatively impact investment income and lead to adverse assumption changes in the Life and Health portfolios, reducing earnings growth and solvency ratios.

- Slowdown or underperformance in digital transformation versus global peers could result in higher operating costs and hinder UNIQA's ability to offer competitive, personalized insurance products, impacting future revenue and net margins as insurtech competitors expand.

- Increased regulatory scrutiny, higher capital requirements, and potential changes from Solvency II could force UNIQA to hold larger reserves and incur higher compliance costs, limiting capital flexibility, reducing return on equity, and constraining dividend growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €13.475 for UNIQA Insurance Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €16.1, and the most bearish reporting a price target of just €12.3.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €8.3 billion, earnings will come to €487.0 million, and it would be trading on a PE ratio of 10.0x, assuming you use a discount rate of 5.7%.

- Given the current share price of €12.14, the analyst price target of €13.48 is 9.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.