Key Takeaways

- Overreliance on traditional distribution and regional markets heightens vulnerability to tech disruptors and local economic instability.

- Rising climate risks and stricter regulations threaten profitability and restrict future investment opportunities.

- Strong premium growth, pricing power, regional expansion, cost efficiency, and strategic reinsurance support sustained profitability and an optimistic long-term earnings outlook.

Catalysts

About UNIQA Insurance Group- Operates as an insurance company in Austria and Central and Eastern Europe.

- Sustained low or volatile interest rates across Europe continue to threaten UNIQA's investment portfolio returns, undermining its ability to generate profitable net investment income and suppressing long-term earnings growth as traditional sources of yield remain under pressure.

- Greater adoption of digital insurance distribution models by nimble insurtech competitors exposes UNIQA's traditional broker-centric and less agile distribution channels to structural customer erosion, which will weigh on revenue growth as younger, tech-savvy demographics bypass incumbents.

- Heavy reliance on Central and Eastern European markets leaves UNIQA acutely vulnerable to ongoing macroeconomic instability and slower real GDP growth in these regions, significantly amplifying claims volatility and exerting persistent pressure on premium growth and net margins.

- The accelerating frequency and severity of climate-related natural catastrophes is projected to drive structural increases in claims costs and reinsurance expenses, leading to a sustained deterioration in UNIQA's combined ratio and further constraining net profit margins over the medium and long term.

- Increased regulatory burdens, including potential future Solvency II revisions, are anticipated to impose higher compliance costs and stringent capital requirements, curbing UNIQA's capacity to invest for future growth and ultimately restricting its long-term earnings trajectory.

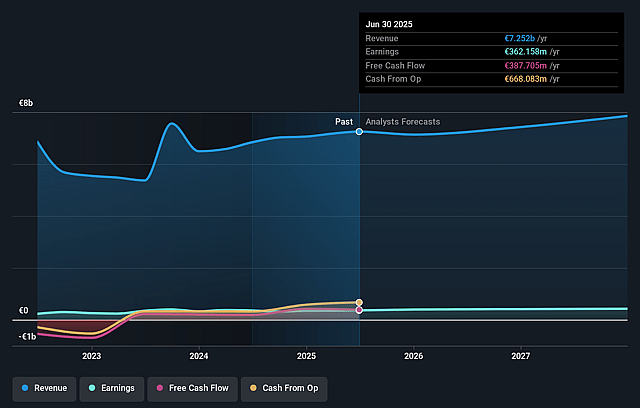

UNIQA Insurance Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on UNIQA Insurance Group compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming UNIQA Insurance Group's revenue will grow by 2.7% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 4.9% today to 5.0% in 3 years time.

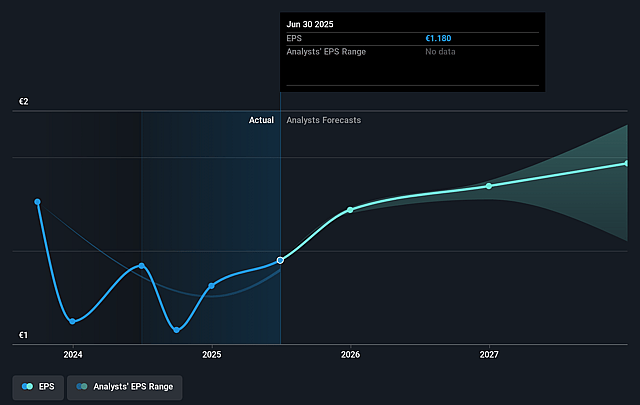

- The bearish analysts expect earnings to reach €389.9 million (and earnings per share of €1.27) by about August 2028, up from €351.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 10.8x on those 2028 earnings, down from 11.4x today. This future PE is greater than the current PE for the GB Insurance industry at 10.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.7%, as per the Simply Wall St company report.

UNIQA Insurance Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- UNIQA continues to achieve robust top-line growth, with gross written premiums up 13% year-on-year in Q1 2025 and management indicating potential to exceed its 5% CAGR target if favorable trends persist, which could drive higher revenues and improved earnings in the coming years.

- The company's pricing power remains strong, as management reported that premium increases are running above inflation across all markets, helping to maintain or improve net margins even in inflationary environments.

- UNIQA maintains a significant and stable presence in both Austria and Central and Eastern Europe, where insurance penetration is still comparatively low; this provides a long runway for sustained premium growth and supports future revenue expansion.

- The administrative cost ratio continues to decline, dropping from 15.6% to 15.4%, reflecting ongoing efficiency gains from digitalization and operational optimization initiatives, which could translate into higher net margins and stronger profitability.

- Strategic growth in reinsurance-with targeted expansion of third-party business and stable profit contributions-positions UNIQA to diversify earnings streams and enhance overall earnings quality, while management's guidance of 6% EPS growth (and potential top-line upgrades) underpins an optimistic long-term earnings outlook.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for UNIQA Insurance Group is €11.6, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of UNIQA Insurance Group's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €15.5, and the most bearish reporting a price target of just €11.6.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €7.8 billion, earnings will come to €389.9 million, and it would be trading on a PE ratio of 10.8x, assuming you use a discount rate of 5.7%.

- Given the current share price of €13.02, the bearish analyst price target of €11.6 is 12.2% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.