Key Takeaways

- Strong premium growth and untapped market potential in Central and Eastern Europe position the company for sustained revenue and earnings expansion.

- Digital transformation, health ecosystem innovation, and ESG focus are driving margin improvements, operational leverage, and elevated long-term growth prospects.

- Exposure to rising catastrophe risks, declining investment returns, stalled regional growth, lagging digital transformation, and greater reinsurance volatility threaten UNIQA's profitability and long-term competitiveness.

Catalysts

About UNIQA Insurance Group- Operates as an insurance company in Austria and Central and Eastern Europe.

- While analyst consensus acknowledges robust premium growth in Central and Eastern Europe, the potential here is still significantly understated, as untapped insurance penetration and ongoing economic convergence in these markets could sustain double-digit premium growth and translate into substantially higher revenue and earnings for many years ahead.

- Analysts broadly agree on stable technical profitability showcased by a strong combined ratio, but continued digitalization and AI-driven process optimization are likely to drive this ratio lower, resulting in persistent margin expansion and higher long-term net income than currently expected.

- UNIQA's integrated health ecosystem approach, including Mavie Med and hospital services, uniquely positions the company to capitalize on accelerating demand for comprehensive health solutions as populations age-unlocking high-margin growth opportunities and recurring fee-based income outside of traditional insurance.

- The accelerating rollout of digital platforms and automation is reducing administrative cost ratios year after year, signaling structurally higher operational leverage that will drive sustained improvements in net margins.

- Increased regulatory and societal emphasis on sustainability is attracting new institutional capital and ESG-conscious customers, enabling UNIQA to win market share in both existing and cross-border EU markets-which will amplify top line growth and further improve long-term earnings visibility.

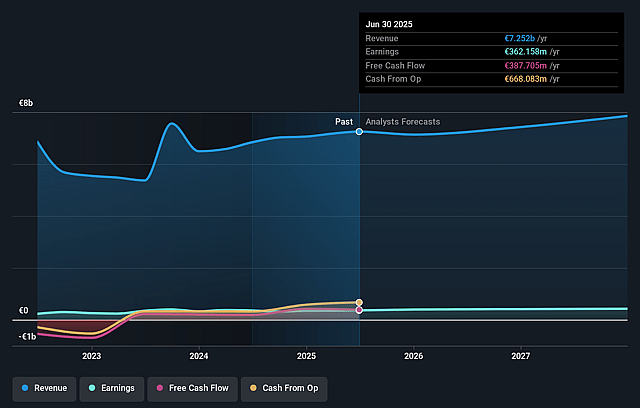

UNIQA Insurance Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on UNIQA Insurance Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming UNIQA Insurance Group's revenue will grow by 5.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 4.9% today to 5.5% in 3 years time.

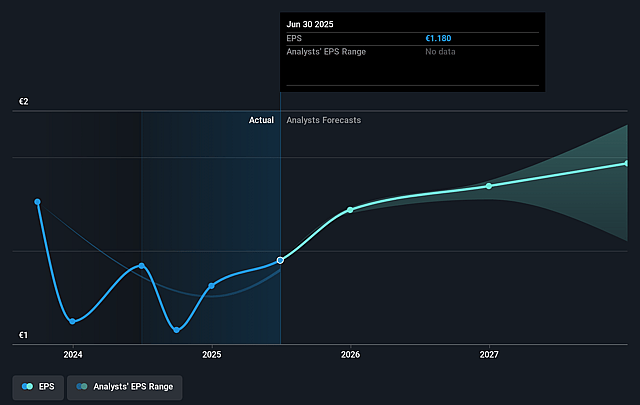

- The bullish analysts expect earnings to reach €457.0 million (and earnings per share of €1.49) by about August 2028, up from €351.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 12.3x on those 2028 earnings, up from 11.4x today. This future PE is greater than the current PE for the GB Insurance industry at 10.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.7%, as per the Simply Wall St company report.

UNIQA Insurance Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- UNIQA's first-quarter technical performance in property and casualty was boosted by the absence of natural catastrophe claims, but management explicitly warned that the upcoming "NatCat season" is expected to bring significant loss events, which-given the heightened frequency and severity of climate-related disasters-could negatively impact the combined ratio and earnings in subsequent quarters.

- The company experienced a substantial drop in net investment income, with a minus 70 percent in financial result and minus 54 percent in net investment income, in part due to unrealized losses in the equity portfolio and global market volatility; a prolonged environment of low or negative interest rates in the Eurozone could continue to suppress yields and pressure net income.

- UNIQA's growth in key Central and Eastern European markets is showing early signs of stalling, with management referencing lower volumes in countries such as the Czech Republic, Slovakia, Poland and Romania, which could signal market saturation and a long-term risk to premium growth and top-line revenue expansion.

- While management highlights efforts to reduce administrative costs and pursue efficiencies, there is limited discussion of substantial investments in digitalization or insurtech adoption, exposing UNIQA to the broader risk of increasing competition from digital-first insurers and the potential loss of younger, tech-savvy customers-ultimately pressuring net margins and revenue over time.

- The significant increase in inward reinsurance business, growing from sixty million euro to one hundred ninety million euro in a year, amplifies UNIQA's exposure to earnings volatility and the rising cost and complexity of reinsurance across the industry, potentially leading to less predictable profitability and impacting both earnings and competitiveness.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for UNIQA Insurance Group is €15.5, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of UNIQA Insurance Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €15.5, and the most bearish reporting a price target of just €11.6.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €8.4 billion, earnings will come to €457.0 million, and it would be trading on a PE ratio of 12.3x, assuming you use a discount rate of 5.7%.

- Given the current share price of €13.02, the bullish analyst price target of €15.5 is 16.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.