- United States

- /

- Software

- /

- NasdaqGS:API

Agora, Inc. (NASDAQ:API) Looks Inexpensive But Perhaps Not Attractive Enough

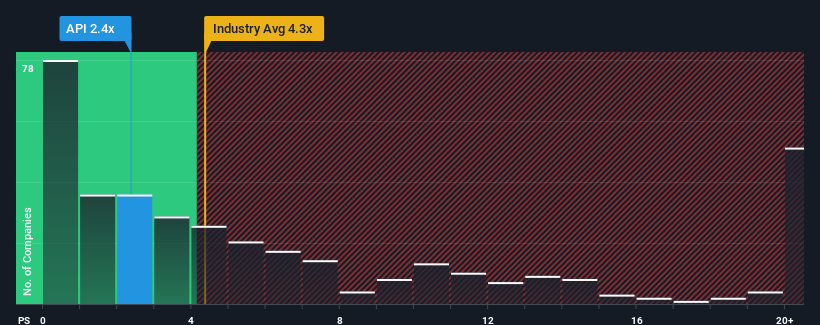

With a price-to-sales (or "P/S") ratio of 2.4x Agora, Inc. (NASDAQ:API) may be sending bullish signals at the moment, given that almost half of all the Software companies in the United States have P/S ratios greater than 4.3x and even P/S higher than 12x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Agora

How Has Agora Performed Recently?

Agora hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Agora's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Agora?

Agora's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 12%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 6.0% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 10% per annum during the coming three years according to the three analysts following the company. With the industry predicted to deliver 15% growth each year, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Agora's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Agora's P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As expected, our analysis of Agora's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Plus, you should also learn about this 1 warning sign we've spotted with Agora.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:API

Agora

Through its subsidiaries, engages in the operation of a real-time engagement platform-as-a-service in the United States, the People’s Republic of China, and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Amazon - A Fundamental and Historical Valuation

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

The "Sleeping Giant" Stumbles, Then Wakes Up

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Trending Discussion