- United States

- /

- Consumer Services

- /

- NasdaqGM:HERE

QuantaSing Group Limited (NASDAQ:QSG) Looks Inexpensive After Falling 48% But Perhaps Not Attractive Enough

The QuantaSing Group Limited (NASDAQ:QSG) share price has fared very poorly over the last month, falling by a substantial 48%. For any long-term shareholders, the last month ends a year to forget by locking in a 82% share price decline.

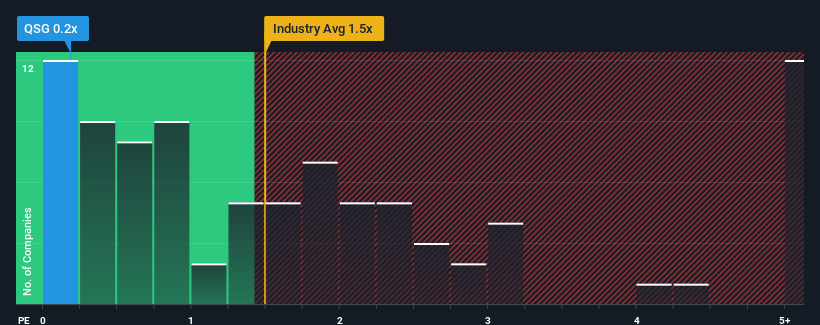

Since its price has dipped substantially, considering around half the companies operating in the United States' Consumer Services industry have price-to-sales ratios (or "P/S") above 1.5x, you may consider QuantaSing Group as an solid investment opportunity with its 0.2x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for QuantaSing Group

How Has QuantaSing Group Performed Recently?

QuantaSing Group certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on QuantaSing Group will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as QuantaSing Group's is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company grew revenue by an impressive 26% last year. The latest three year period has also seen an excellent 106% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 12% over the next year. With the industry predicted to deliver 15% growth, the company is positioned for a weaker revenue result.

With this information, we can see why QuantaSing Group is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From QuantaSing Group's P/S?

QuantaSing Group's recently weak share price has pulled its P/S back below other Consumer Services companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that QuantaSing Group maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

We don't want to rain on the parade too much, but we did also find 3 warning signs for QuantaSing Group that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Here Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:HERE

Undervalued with excellent balance sheet.

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Investing in the future with RGYAS as fair value hits 228.23

The global leader in cash handling

Wolters Kluwer - A Fundamental and Historical Valuation

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

I'm exiting the positions at great return! WRLG got great competent management. But, 100k oz gold too small in today environment. They might looking for M/A opportunity in the future, or they might get take over by Aris Mining, I don't know. But, Frank Giustra stated he's believed in multi-assets, so that's my speculation. Anyhow, I want to be aggressive in today's gold price. I'm buying Lahontan Gold LG with this as exchange. Higher upside, more leverage. WRLG CEO is BOD's of LG, that's something. This will be my last update on WRLG, good luck!

Thanks for your post but some of your calculations are wrong. It is only the actual silver that should be priced at 100/oz, not the zink and lead. The actual silver is about 5 million ounces and the rest is biproducts which cannot be calculated as 100/oz per silver equivalent. Since it would now require alot more zink and lead to create 1 AgEq with the current silver price which means their AgEq would become lower even if the production remains the same. I am still very bullish on the stock and I own it.