- Philippines

- /

- Renewable Energy

- /

- PSE:VVT

d'Amico International Shipping Leads Three Prime Dividend Stocks

Reviewed by Simply Wall St

As global markets exhibit mixed signals with the S&P 500 reaching all-time highs and technology stocks showing modest gains, investors are navigating through a landscape marked by cautious optimism and shifting economic indicators. In this context, dividend stocks like d'Amico International Shipping offer a compelling consideration for those looking to potentially enhance portfolio stability amidst fluctuating market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Ping An Bank (SZSE:000001) | 7.10% | ★★★★★★ |

| Allianz (XTRA:ALV) | 5.33% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.47% | ★★★★★★ |

| Globeride (TSE:7990) | 3.66% | ★★★★★★ |

| Huntington Bancshares (NasdaqGS:HBAN) | 4.88% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 5.90% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.04% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.45% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.69% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.05% | ★★★★★★ |

Click here to see the full list of 1975 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

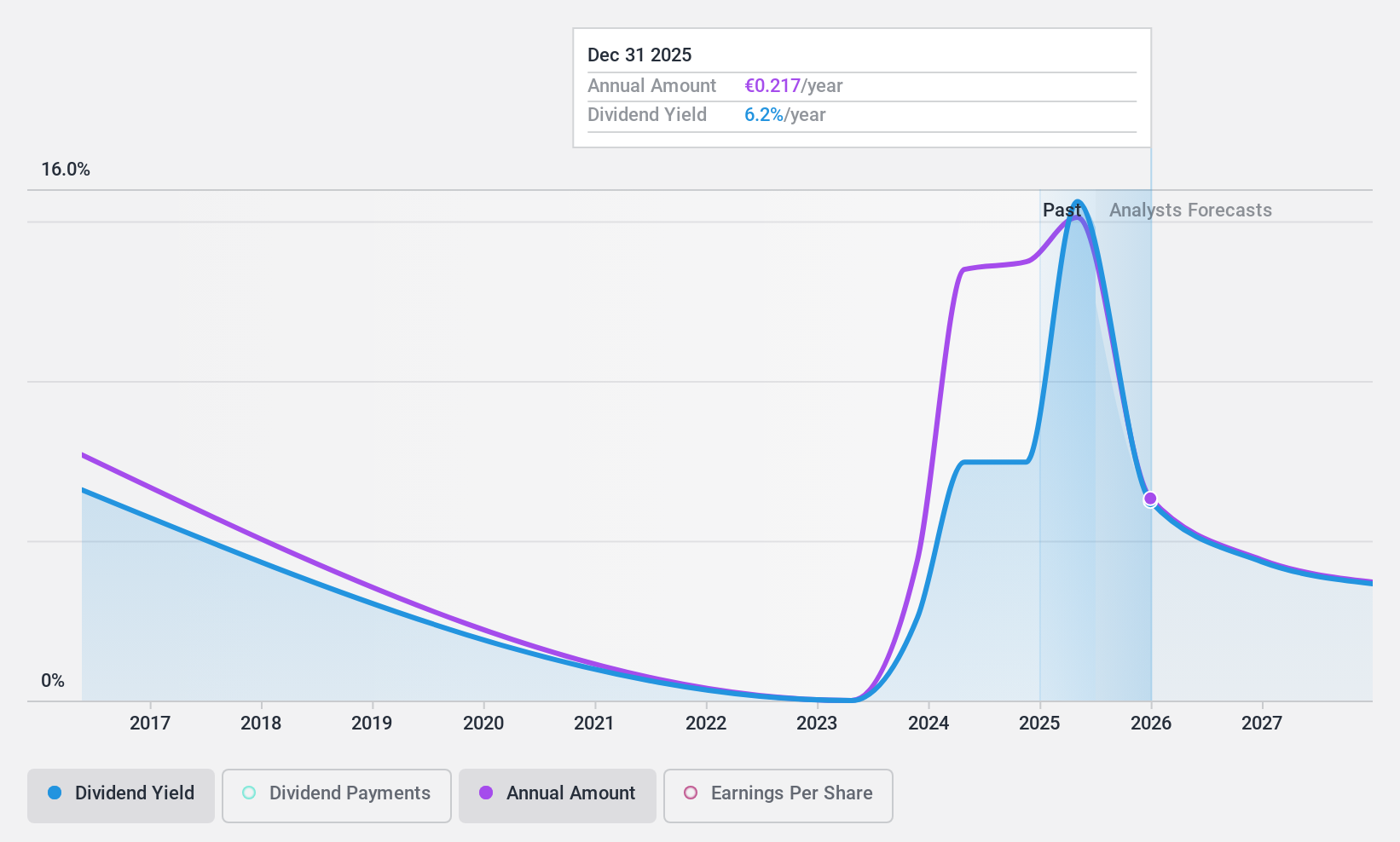

d'Amico International Shipping (BIT:DIS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: d'Amico International Shipping S.A. operates globally as a marine transportation company, with a market capitalization of approximately €858.82 million.

Operations: d'Amico International Shipping S.A. generates its revenue primarily from the product tankers segment, which brought in $530.88 million.

Dividend Yield: 6.5%

d'Amico International Shipping has demonstrated a mixed performance as a dividend stock. Despite its high yield of 6.54%, ranking in the top 25% of Italian dividend payers, the company's dividend history is marked by volatility and unreliability over the past decade. However, both earnings and cash flow adequately cover its dividends, with payout ratios standing at 26.3% and 26.2% respectively, suggesting sustainability from a financial perspective. Recent activities include a €40.3 million follow-on equity offering and stable quarterly earnings growth, indicating some level of financial activity and corporate development.

- Click to explore a detailed breakdown of our findings in d'Amico International Shipping's dividend report.

- Our valuation report here indicates d'Amico International Shipping may be undervalued.

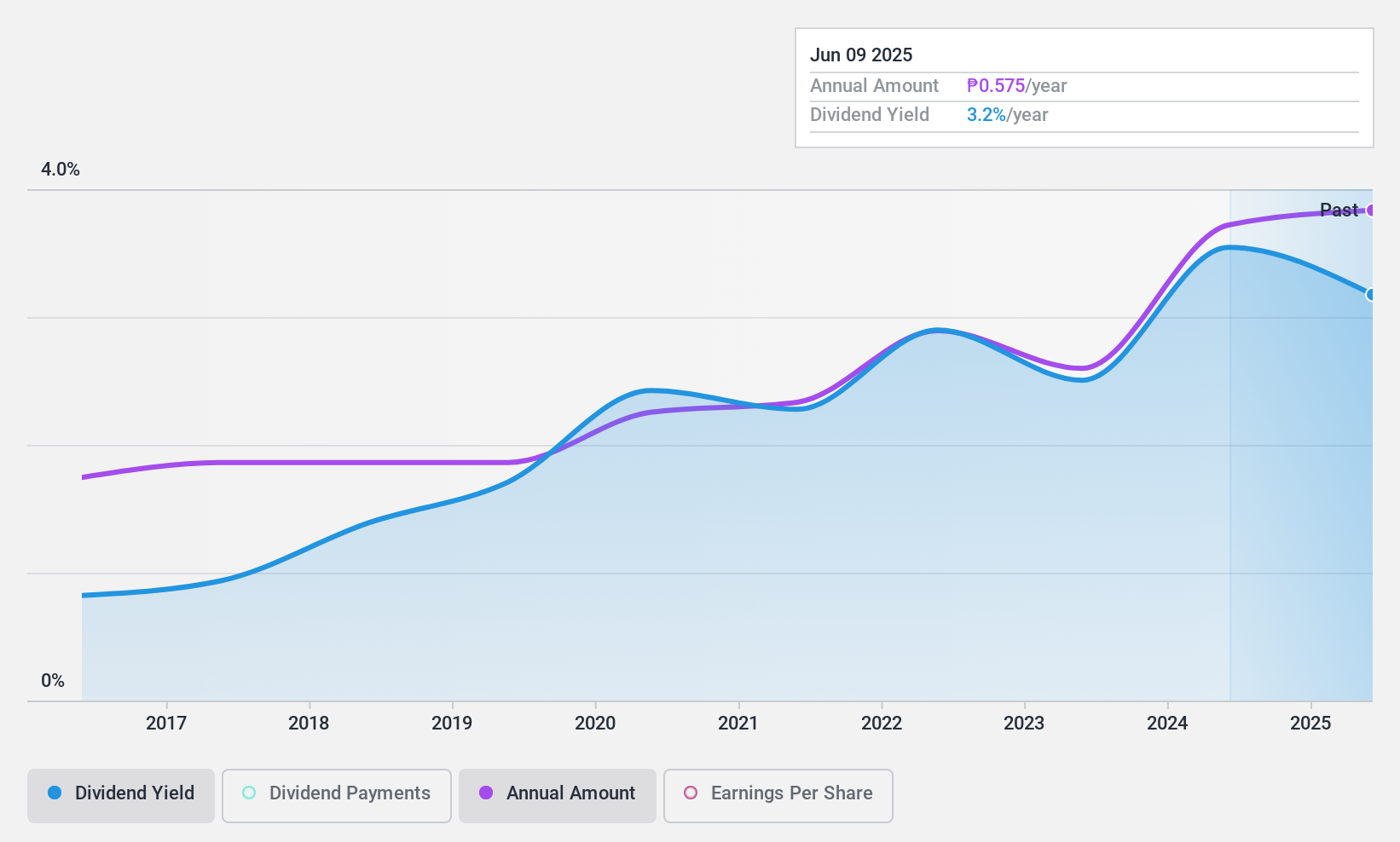

Vivant (PSE:VVT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Vivant Corporation operates in the Philippines, focusing on generating, distributing, and retailing electric power through its subsidiaries, with a market capitalization of approximately ₱16.38 billion.

Operations: Vivant Corporation's revenue is primarily derived from generating, distributing, and retailing electric power in the Philippines.

Dividend Yield: 3.5%

Vivant Corporation exhibits a complex profile for dividend investors. Its dividends, while growing over the past decade and reliably distributed, are not well-supported by free cash flows or earnings, with recent financials indicating dividend payments exceeding cash flows. The company's Price-To-Earnings ratio stands at 8.5x, below the Philippine market average of 9.2x, suggesting some value potential despite its challenges in sustaining dividends from operational cash flow alone. Recent board changes could influence future financial strategies and dividend policies.

- Unlock comprehensive insights into our analysis of Vivant stock in this dividend report.

- The valuation report we've compiled suggests that Vivant's current price could be inflated.

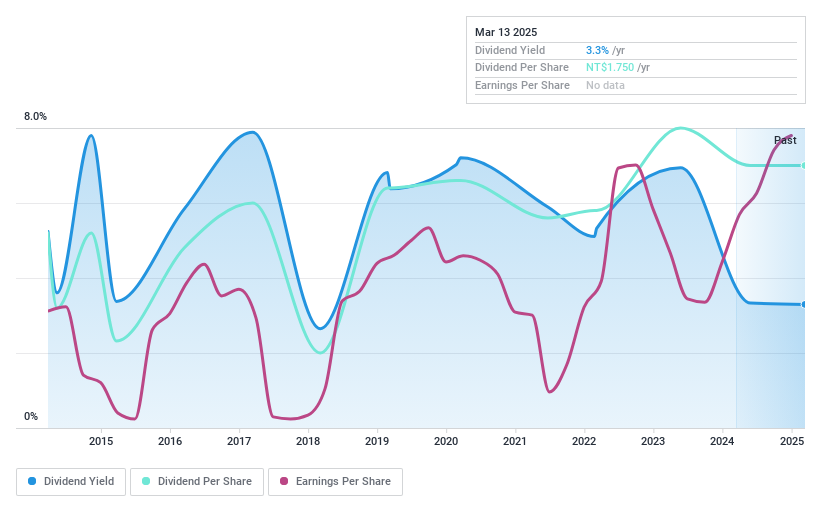

Univacco Technology (TPEX:3303)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Univacco Technology Inc., operating under the UNIVACCO brand, engages in the stamping foil industry both in Taiwan and internationally, with a market capitalization of approximately NT$4.54 billion.

Operations: Univacco Technology Inc. generates revenue primarily from its Vacuum-Evaporated Thin Films and Optoelectronic Materials segment, totaling approximately NT$2.55 billion.

Dividend Yield: 3.6%

Univacco Technology's dividend history shows inconsistency, with significant fluctuations over the past decade, despite a recent increase in dividends. The company's dividend yield at 3.63% is below the top quartile in its market. Financially, Univacco is trading at 57% below estimated fair value, and its dividends are well-covered by both earnings and cash flows, with payout ratios of 61.5% and 45.5%, respectively. Recent corporate actions include a share buyback program and a decrease in annual dividend payout announced on May 23, indicating potential shifts in capital allocation strategies.

- Delve into the full analysis dividend report here for a deeper understanding of Univacco Technology.

- According our valuation report, there's an indication that Univacco Technology's share price might be on the cheaper side.

Taking Advantage

- Navigate through the entire inventory of 1975 Top Dividend Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:VVT

Vivant

Through its subsidiaries, generates, distributes, and retails electric power in the Philippines.

Proven track record with adequate balance sheet and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)