- South Africa

- /

- Diversified Financial

- /

- JSE:CTA

Why Dividend Hunters Love Capital Appreciation Limited (JSE:CTA)

Today we'll take a closer look at Capital Appreciation Limited (JSE:CTA) from a dividend investor's perspective. Owning a strong business and reinvesting the dividends is widely seen as an attractive way of growing your wealth. If you are hoping to live on the income from dividends, it's important to be a lot more stringent with your investments than the average punter.

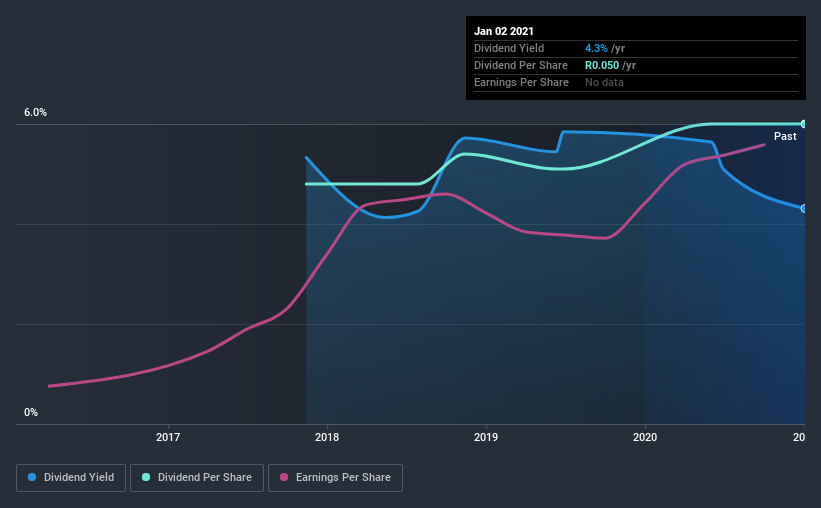

In this case, Capital Appreciation pays a decent-sized 4.3% dividend yield, and has been distributing cash to shareholders for the past three years. A high yield probably looks enticing, but investors are likely wondering about the short payment history. The company also bought back stock during the year, equivalent to approximately 2.3% of the company's market capitalisation at the time. Some simple analysis can offer a lot of insights when buying a company for its dividend, and we'll go through this below.

Explore this interactive chart for our latest analysis on Capital Appreciation!

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. Capital Appreciation paid out 43% of its profit as dividends, over the trailing twelve month period. This is a medium payout level that leaves enough capital in the business to fund opportunities that might arise, while also rewarding shareholders. Plus, there is room to increase the payout ratio over time.

Another important check we do is to see if the free cash flow generated is sufficient to pay the dividend. Capital Appreciation paid out a conservative 32% of its free cash flow as dividends last year. It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

With a strong net cash balance, Capital Appreciation investors may not have much to worry about in the near term from a dividend perspective.

We update our data on Capital Appreciation every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. The dividend has not fluctuated much, but with a relatively short payment history, we can't be sure this is sustainable across a full market cycle. During the past three-year period, the first annual payment was R0.04 in 2018, compared to R0.05 last year. Dividends per share have grown at approximately 7.7% per year over this time.

Capital Appreciation has been growing its dividend at a decent rate, and the payments have been stable despite the short payment history. This is a positive start.

Dividend Growth Potential

While dividend payments have been relatively reliable, it would also be nice if earnings per share (EPS) were growing, as this is essential to maintaining the dividend's purchasing power over the long term. Strong earnings per share (EPS) growth might encourage our interest in the company despite fluctuating dividends, which is why it's great to see Capital Appreciation has grown its earnings per share at 49% per annum over the past five years. With high earnings per share growth in recent times and a modest payout ratio, we think this is an attractive combination if earnings can be reinvested to generate further growth.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. Firstly, we like that Capital Appreciation has low and conservative payout ratios. Next, earnings growth has been good, but unfortunately the company has not been paying dividends as long as we'd like. Capital Appreciation performs highly under this analysis, although it falls slightly short of our exacting standards. At the right valuation, it could be a solid dividend prospect.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Taking the debate a bit further, we've identified 2 warning signs for Capital Appreciation that investors need to be conscious of moving forward.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

If you’re looking to trade Capital Appreciation, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Capital Appreciation, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About JSE:CTA

Capital Appreciation

Operates as a financial technology company in South Africa, the Asia Pacific, the United States, the United Kingdom, Europe, the rest of Africa, and the Indian Ocean Islands.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives