Naspers Limited's (JSE:NPN) Prospects Need A Boost To Lift Shares

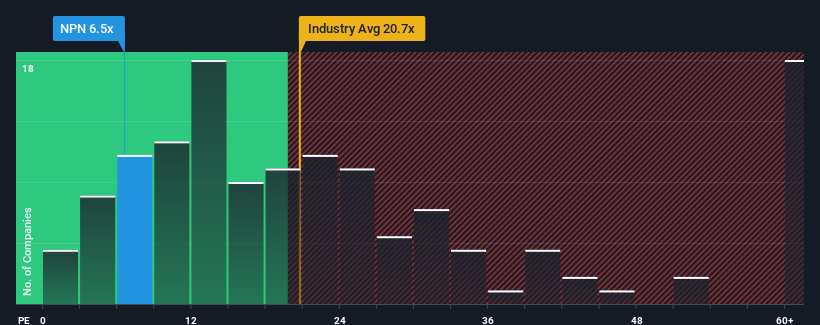

With a price-to-earnings (or "P/E") ratio of 6.5x Naspers Limited (JSE:NPN) may be sending bullish signals at the moment, given that almost half of all companies in South Africa have P/E ratios greater than 9x and even P/E's higher than 14x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Recent times have been advantageous for Naspers as its earnings have been rising faster than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Naspers

What Are Growth Metrics Telling Us About The Low P/E?

Naspers' P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 107% last year. Pleasingly, EPS has also lifted 255% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Shifting to the future, estimates from the nine analysts covering the company suggest earnings growth is heading into negative territory, declining 5.7% each year over the next three years. With the market predicted to deliver 11% growth per annum, that's a disappointing outcome.

With this information, we are not surprised that Naspers is trading at a P/E lower than the market. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Naspers' P/E

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Naspers maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you take the next step, you should know about the 3 warning signs for Naspers (1 can't be ignored!) that we have uncovered.

If these risks are making you reconsider your opinion on Naspers, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Naspers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:NPN

Naspers

Operates in the consumer internet industry in Africa, Asia, Europe, Latin America, North America, and internationally.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives