As global markets navigate through a period of mixed performances and anticipatory adjustments ahead of key economic events, investors are closely monitoring various sectors for stability and growth opportunities. In this context, dividend stocks like Positivo Tecnologia often attract attention for their potential to offer regular income streams during uncertain times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.74% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.62% | ★★★★★★ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.01% | ★★★★★★ |

| Ping An Bank (SZSE:000001) | 7.21% | ★★★★★★ |

| Allianz (XTRA:ALV) | 5.28% | ★★★★★★ |

| Globeride (TSE:7990) | 3.89% | ★★★★★★ |

| HITO-Communications HoldingsInc (TSE:4433) | 3.39% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.25% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.54% | ★★★★★★ |

| Innotech (TSE:9880) | 3.99% | ★★★★★★ |

Click here to see the full list of 1989 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Positivo Tecnologia (BOVESPA:POSI3)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Positivo Tecnologia S.A. is a company based in Brazil that specializes in developing, trading, and industrializing information technology solutions both domestically and internationally, with a market capitalization of approximately R$1.22 billion.

Operations: Positivo Tecnologia S.A. generates revenue through three primary segments: Consumer (R$901.62 million), Corporate (R$828.86 million), and Public Institutions (R$2.40 billion).

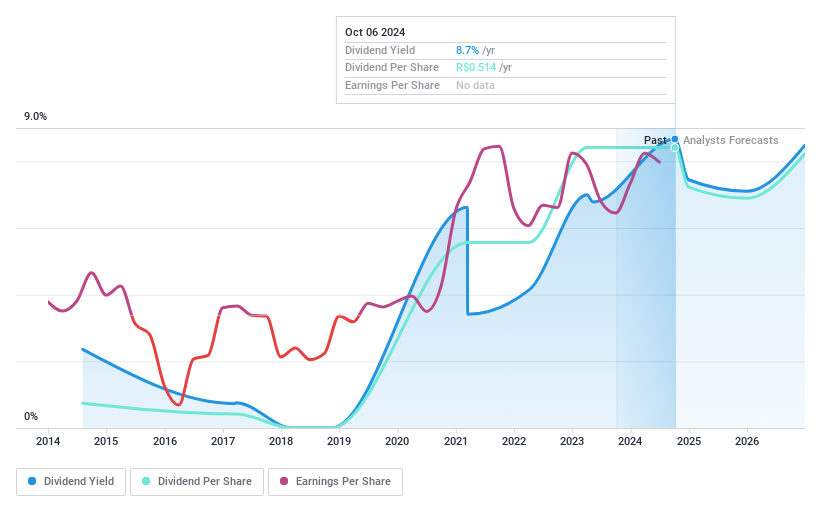

Dividend Yield: 5.9%

Positivo Tecnologia has demonstrated a robust financial performance with its Q1 earnings soaring to BRL 63.96 million from BRL 7.54 million year-over-year, driven by significant sales growth. While the company's dividend yield at 5.91% trails behind the top Brazilian market payers, it maintains a sustainable payout with low payout ratios (37.7% earnings and 25.2% cash flow). However, dividends have shown volatility over the past decade, raising concerns about their reliability despite recent positive financial outcomes and strategic moves like mergers and acquisitions signaled in June 2024.

- Take a closer look at Positivo Tecnologia's potential here in our dividend report.

- The analysis detailed in our Positivo Tecnologia valuation report hints at an deflated share price compared to its estimated value.

Italtile (JSE:ITE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Italtile Limited is a South African company that manufactures and retails tiles, bathroom ware, and related products, with a market capitalization of approximately ZAR 14.57 billion.

Operations: Italtile Limited generates revenue through its retail operations with ZAR 5.22 billion, manufacturing activities amounting to ZAR 5.20 billion, and supply and support services contributing ZAR 2.34 billion.

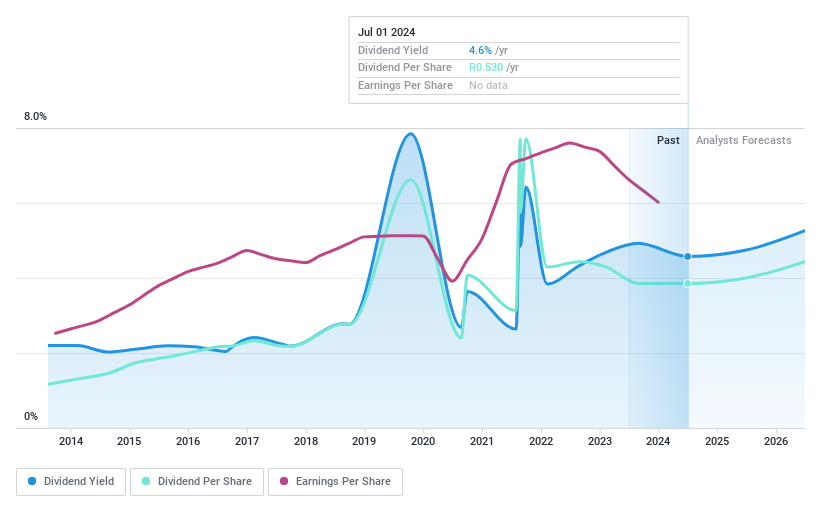

Dividend Yield: 4.4%

Italtile's dividend yield at 4.36% is lower than the top quartile of South African dividend stocks, which stands at 8.61%. Despite this, the company maintains a sustainable approach to dividends with payout ratios well-supported by earnings (39.8%) and cash flows (42.2%). However, its dividend history over the past decade has been marked by instability and unreliability. Recent executive changes, including CFO Brandon Wood's shift to COO and Lamar Booysen’s promotion to CFO, align with Italtile’s strategy for management depth enhancement but do not directly impact these financial metrics.

- Dive into the specifics of Italtile here with our thorough dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Italtile shares in the market.

Text (WSE:TXT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Text S.A. is a global company that develops and distributes communication software for businesses, with a market capitalization of PLN 2.24 billion.

Operations: Text S.A. generates its revenues primarily from the development and distribution of communication software for businesses globally.

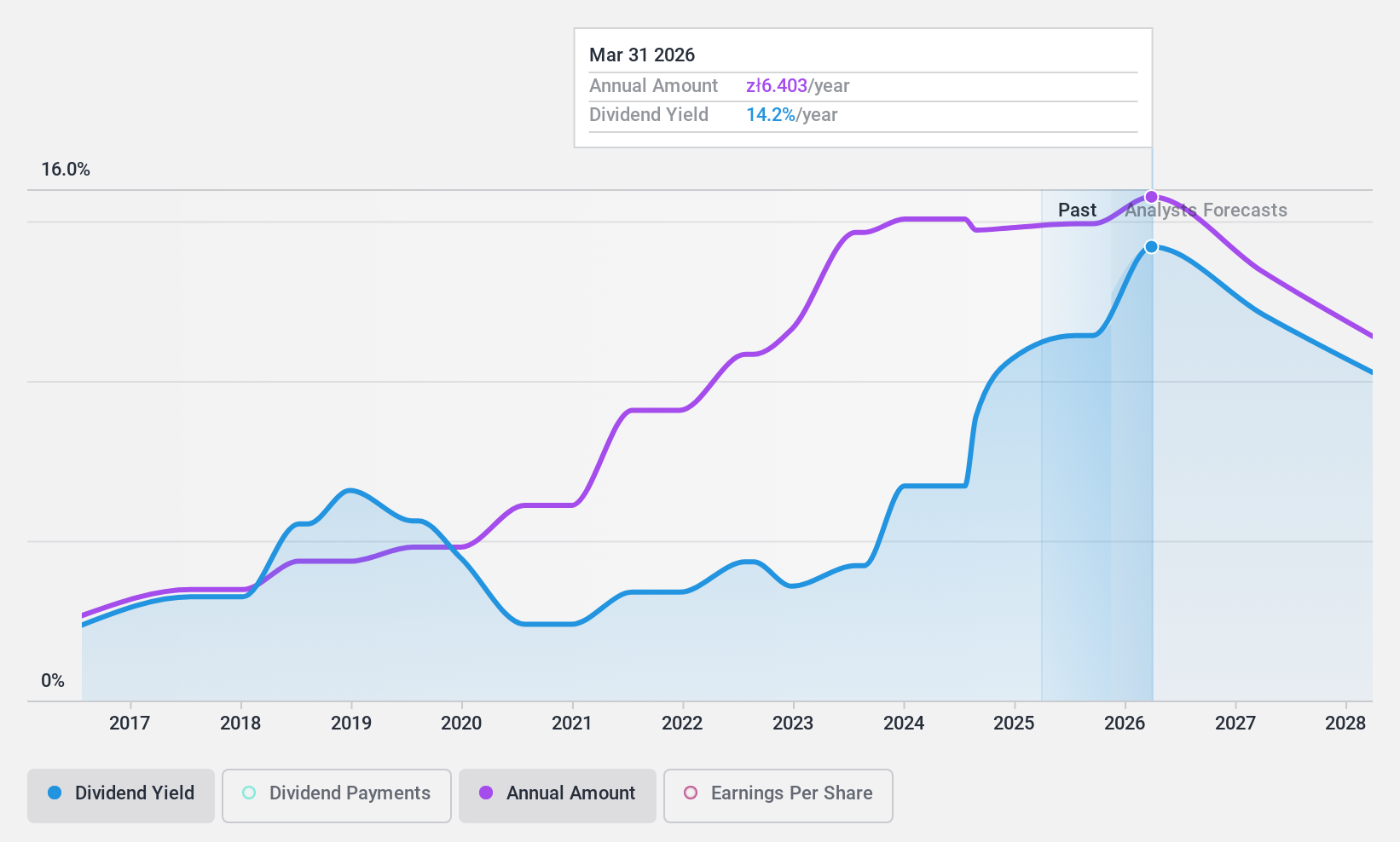

Dividend Yield: 7.1%

Text S.A. reported a positive earnings trend with sales increasing to PLN 335.35 million and net income rising to PLN 165.87 million in 2024, reflecting a steady financial growth. Despite a dividend yield of 7.05%, which is slightly below the top Polish payers, Text's dividends have shown reliability and stability over the past decade but face challenges due to a high cash payout ratio of 100.2%, indicating potential pressure on future payments from available cash flows.

- Unlock comprehensive insights into our analysis of Text stock in this dividend report.

- Our expertly prepared valuation report Text implies its share price may be lower than expected.

Summing It All Up

- Get an in-depth perspective on all 1989 Top Dividend Stocks by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Text might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:TXT

Text

Develops and distributes online text communication software for businesses worldwide.

Flawless balance sheet, undervalued and pays a dividend.