- South Africa

- /

- REITS

- /

- JSE:IAP

Here's What We Think About Investec Australia Property Fund's (JSE:IAP) CEO Pay

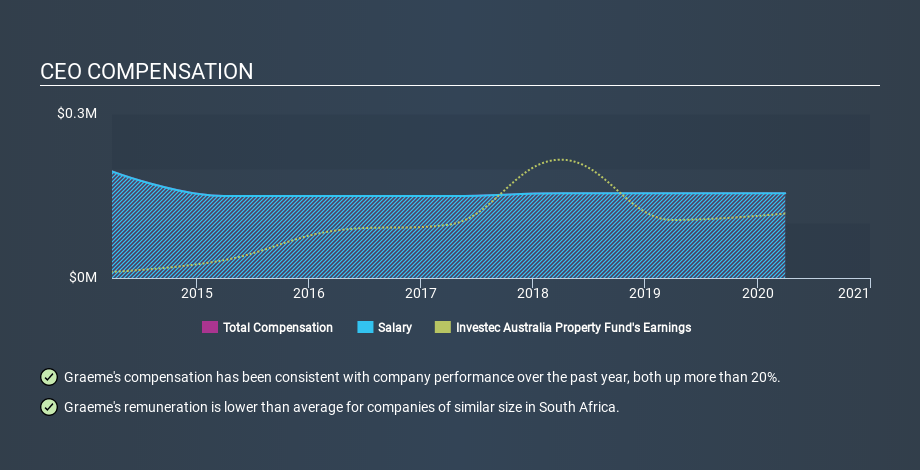

The CEO of Investec Australia Property Fund (JSE:IAP) is Graeme Katz. This report will, first, examine the CEO compensation levels in comparison to CEO compensation at companies of similar size. After that, we will consider the growth in the business. And finally we will reflect on how common stockholders have fared in the last few years, as a secondary measure of performance. This method should give us information to assess how appropriately the company pays the CEO.

View our latest analysis for Investec Australia Property Fund

How Does Graeme Katz's Compensation Compare With Similar Sized Companies?

Our data indicates that Investec Australia Property Fund is worth SAR8.6b, and total annual CEO compensation was reported as AU$155k for the year to March 2020. Notably, the salary of AU$155k is the vast majority of the CEO compensation. We examined companies with market caps from AU$304m to AU$1.2b, and discovered that the median CEO total compensation of that group was AU$1.0m.

Now let's take a look at the pay mix on an industry and company level to gain a better understanding of where Investec Australia Property Fund stands. On an industry level, roughly 58% of total compensation represents salary and 42% is other remuneration. Speaking on a company level, Investec Australia Property Fund prefers to tread along a traditional path, disbursing all compensation through a salary.

This would give shareholders a good impression of the company, since most similar size companies have to pay more, leaving less for shareholders. However, before we heap on the praise, we should delve deeper to understand business performance. You can see, below, how CEO compensation at Investec Australia Property Fund has changed over time.

Is Investec Australia Property Fund Growing?

Investec Australia Property Fund has reduced its earnings per share by an average of 21% a year, over the last three years (measured with a line of best fit). It achieved revenue growth of 13% over the last year.

Few shareholders would be pleased to read that earnings per share are lower over three years. There's no doubt that the silver lining is that revenue is up. But it isn't sufficiently fast growth to overlook the fact that earnings per share has gone backwards over three years. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Shareholders might be interested in this free visualization of analyst forecasts.

Has Investec Australia Property Fund Been A Good Investment?

I think that the total shareholder return of 39%, over three years, would leave most Investec Australia Property Fund shareholders smiling. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

It looks like Investec Australia Property Fund pays its CEO less than similar sized companies.

Graeme Katz is paid less than CEOs of similar size companies. While the company isn't growing on our analysis, shareholder returns have been good in recent years. We would like to see EPS growth, but in our view it seems the CEO is remunerated reasonably. CEO compensation is an important area to keep your eyes on, but we've also identified 4 warning signs for Investec Australia Property Fund (1 can't be ignored!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About JSE:IAP

Irongate Group

Irongate Group has its origins as the Investec Group’s Australian and New Zealand property investment and asset management business.

Second-rate dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives