- South Africa

- /

- REITS

- /

- JSE:GRT

Some Analysts Just Cut Their Growthpoint Properties Limited (JSE:GRT) Estimates

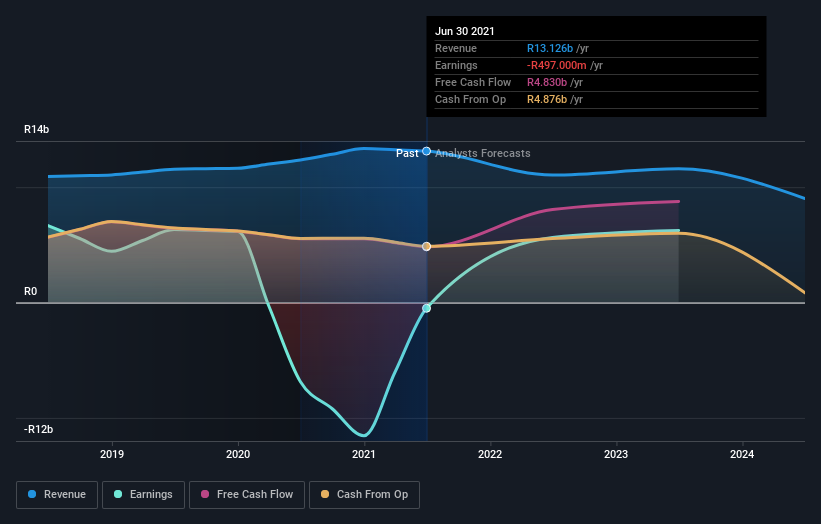

The latest analyst coverage could presage a bad day for Growthpoint Properties Limited (JSE:GRT), with the analysts making across-the-board cuts to their statutory estimates that might leave shareholders a little shell-shocked. There was a fairly draconian cut to their revenue estimates, perhaps an implicit admission that previous forecasts were much too optimistic.

Following the latest downgrade, the current consensus, from the twin analysts covering Growthpoint Properties, is for revenues of R11b in 2022, which would reflect a definite 16% reduction in Growthpoint Properties' sales over the past 12 months. Before the latest update, the analysts were foreseeing R13b of revenue in 2022. It looks like forecasts have become a fair bit less optimistic on Growthpoint Properties, given the substantial drop in revenue estimates.

View our latest analysis for Growthpoint Properties

There was no particular change to the consensus price target of R14.65, with Growthpoint Properties' latest outlook seemingly not enough to result in a change of valuation. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. There are some variant perceptions on Growthpoint Properties, with the most bullish analyst valuing it at R17.50 and the most bearish at R13.00 per share. Analysts definitely have varying views on the business, but the spread of estimates is not wide enough in our view to suggest that extreme outcomes could await Growthpoint Properties shareholders.

Of course, another way to look at these forecasts is to place them into context against the industry itself. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 16% by the end of 2022. This indicates a significant reduction from annual growth of 5.0% over the last five years. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 2.0% per year. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Growthpoint Properties is expected to lag the wider industry.

The Bottom Line

The clear low-light was that analysts slashing their revenue forecasts for Growthpoint Properties this year. They also expect company revenue to perform worse than the wider market. Overall, given the drastic downgrade to this year's forecasts, we'd be feeling a little more wary of Growthpoint Properties going forwards.

Thirsting for more data? We have estimates for Growthpoint Properties from its twin analysts out until 2024, and you can see them free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About JSE:GRT

Growthpoint Properties

Growthpoint is a Real Estate Investment Trust (REIT) and is the largest South African listed property company which owns a property portfolio of 369 directly owned properties in South Africa valued at R64.1bn, 58 properties valued at R61.8bn through its 63.7% investment in Growthpoint Properties Australia Limited (GOZ), five properties valued at R8.5bn through a 62.4% investment in Capital & Regional Plc (C&R), a 50% interest in the properties of the V&A Waterfront, valued at R10.1bn, a 29.5% interest in the properties of Globalworth Real Estate Investment Limited (GWI), valued at R17.4bn, a 39.1% interest in the properties of Growthpoint Healthcare Property Holdings (RF) Limited (GHPH) valued at R3.7bn, a 14.3% interest in the properties of Growthpoint Student Accommodation Holdings (RF) Limited (GSAH) valued at R2.7bn and a 18.4% interest in the properties of Lango Real Estate Limited (Lango) valued at R2.1bn.

Moderate second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives