- South Africa

- /

- Insurance

- /

- JSE:OUT

Should You Be Adding OUTsurance Group (JSE:OUT) To Your Watchlist Today?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like OUTsurance Group (JSE:OUT). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

How Fast Is OUTsurance Group Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. OUTsurance Group's shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 57%. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. OUTsurance Group shareholders can take confidence from the fact that EBIT margins are up from 18% to 20%, and revenue is growing. Both of which are great metrics to check off for potential growth.

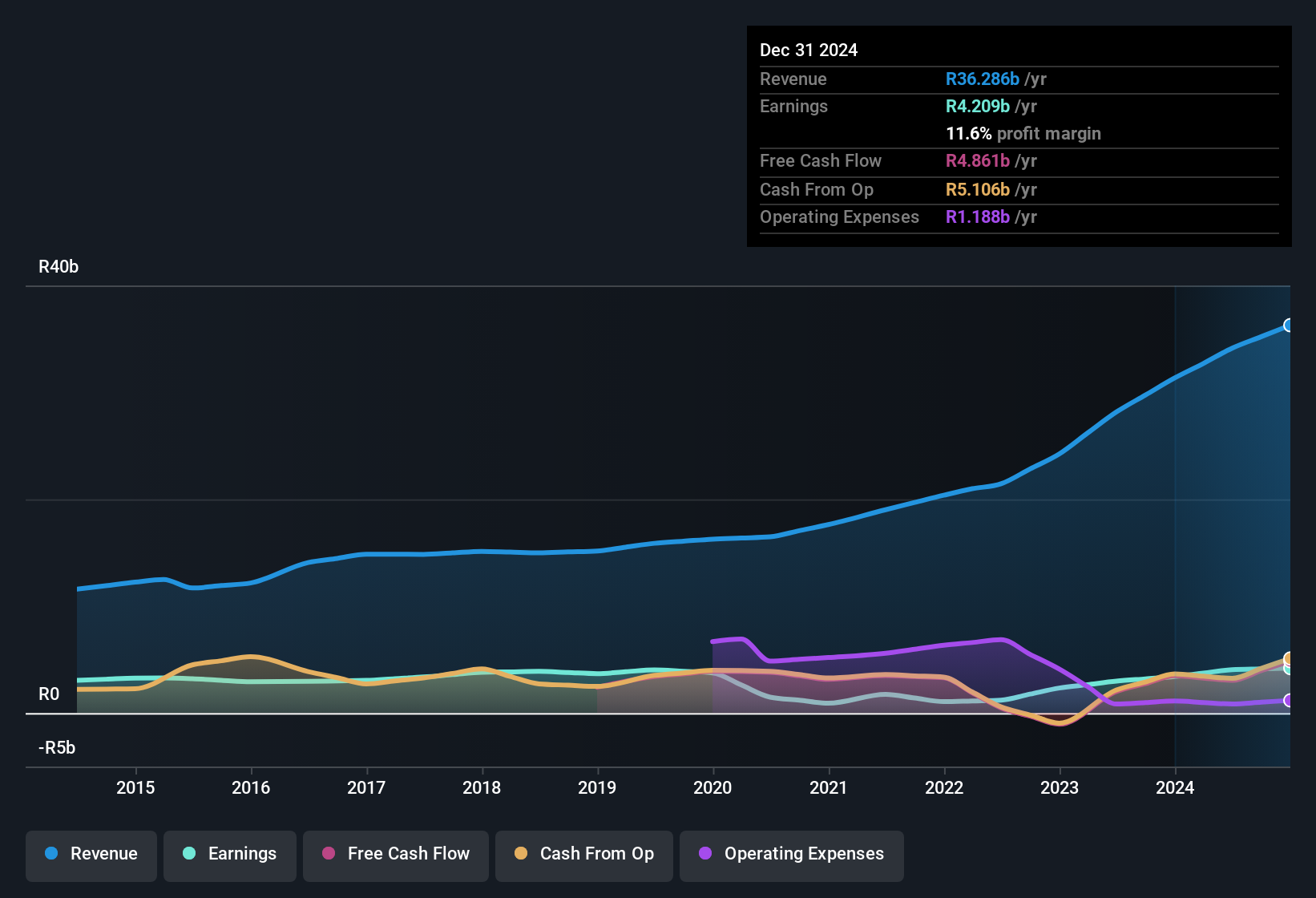

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Check out our latest analysis for OUTsurance Group

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for OUTsurance Group's future profits.

Are OUTsurance Group Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The real kicker here is that OUTsurance Group insiders spent a staggering R51m on acquiring shares in just one year, without single share being sold in the meantime. Buying like that is a fantastic look for the company and should rouse the market in anticipation for the future. Zooming in, we can see that the biggest insider purchase was by CFO & Executive Director Jan Hofmeyr for R20m worth of shares, at about R42.27 per share.

Does OUTsurance Group Deserve A Spot On Your Watchlist?

OUTsurance Group's earnings per share growth have been climbing higher at an appreciable rate. Growth-minded people will be intrigued by the incredible movement in EPS growth. And indeed, it could be a sign that the business is at an inflection point. If this these factors intrigue you, then an addition of OUTsurance Group to your watchlist won't go amiss. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if OUTsurance Group is trading on a high P/E or a low P/E, relative to its industry.

The good news is that OUTsurance Group is not the only stock with insider buying. Here's a list of small cap, undervalued companies in ZA with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:OUT

OUTsurance Group

A financial services company, provides insurance and investment products in South Africa, Australia, and Ireland.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives