- South Africa

- /

- Oil and Gas

- /

- JSE:REN

Strong week for Renergen (JSE:REN) shareholders doesn't alleviate pain of three-year loss

Renergen Limited (JSE:REN) shareholders are doubtless heartened to see the share price bounce 83% in just one week. But the last three years have seen a terrible decline. In that time the share price has melted like a snowball in the desert, down 82%. Arguably, the recent bounce is to be expected after such a bad drop. The thing to think about is whether the business has really turned around. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

While the last three years has been tough for Renergen shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

See our latest analysis for Renergen

With just R30,804,000 worth of revenue in twelve months, we don't think the market considers Renergen to have proven its business plan. We can't help wondering why it's publicly listed so early in its journey. Are venture capitalists not interested? So it seems that the investors focused more on what could be, than paying attention to the current revenues (or lack thereof). It seems likely some shareholders believe that Renergen will discover or develop fossil fuel before too long.

Companies that lack both meaningful revenue and profits are usually considered high risk. There is usually a significant chance that they will need more money for business development, putting them at the mercy of capital markets to raise equity. So the share price itself impacts the value of the shares (as it determines the cost of capital). While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. Renergen has already given some investors a taste of the bitter losses that high risk investing can cause.

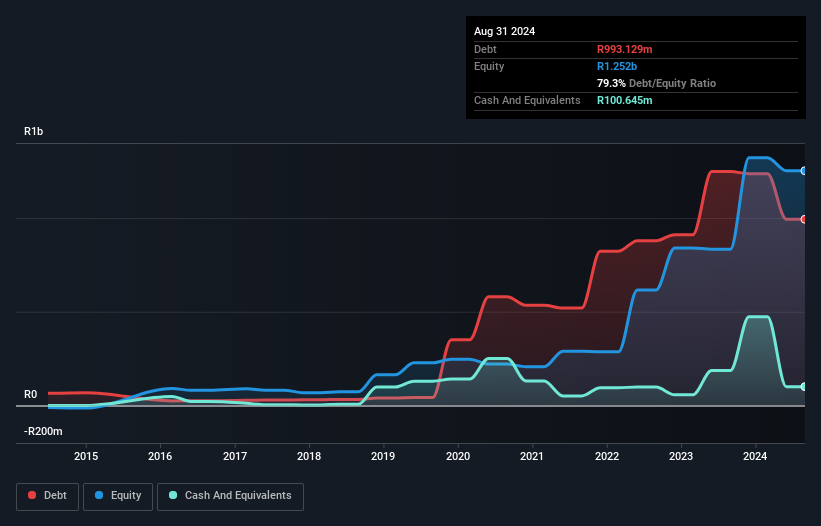

Our data indicates that Renergen had R1.1b more in total liabilities than it had cash, when it last reported in August 2024. That puts it in the highest risk category, according to our analysis. But with the share price diving 22% per year, over 3 years , it's probably fair to say that some shareholders no longer believe the company will succeed. You can see in the image below, how Renergen's cash levels have changed over time (click to see the values).

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. Given that situation, would you be concerned if it turned out insiders were relentlessly selling stock? I'd like that just about as much as I like to drink milk and fruit juice mixed together. It costs nothing but a moment of your time to see if we are picking up on any insider selling.

A Different Perspective

Investors in Renergen had a tough year, with a total loss of 34%, against a market gain of about 25%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 7% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 5 warning signs for Renergen (2 are a bit unpleasant) that you should be aware of.

We will like Renergen better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South African exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:REN

Renergen

An investment holding company, engages in the alternative and renewable energy businesses in South Africa and sub-Saharan Africa.

Moderate risk with worrying balance sheet.

Market Insights

Community Narratives