- South Africa

- /

- Oil and Gas

- /

- JSE:EXX

Lacklustre Performance Is Driving Exxaro Resources Limited's (JSE:EXX) Low P/E

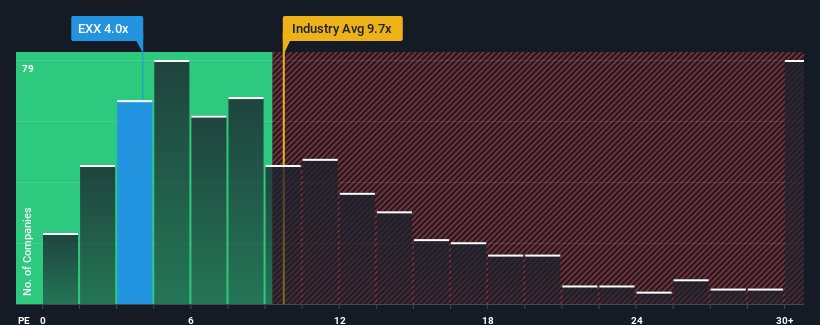

When close to half the companies in South Africa have price-to-earnings ratios (or "P/E's") above 10x, you may consider Exxaro Resources Limited (JSE:EXX) as a highly attractive investment with its 4x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

While the market has experienced earnings growth lately, Exxaro Resources' earnings have gone into reverse gear, which is not great. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for Exxaro Resources

Is There Any Growth For Exxaro Resources?

In order to justify its P/E ratio, Exxaro Resources would need to produce anemic growth that's substantially trailing the market.

Retrospectively, the last year delivered a frustrating 18% decrease to the company's bottom line. However, a few very strong years before that means that it was still able to grow EPS by an impressive 66% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Looking ahead now, EPS is anticipated to slump, contracting by 6.9% each year during the coming three years according to the seven analysts following the company. Meanwhile, the broader market is forecast to expand by 12% each year, which paints a poor picture.

With this information, we are not surprised that Exxaro Resources is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Exxaro Resources maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Exxaro Resources (at least 1 which makes us a bit uncomfortable), and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on Exxaro Resources, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Exxaro Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About JSE:EXX

Exxaro Resources

Engages in coal, pigment manufacturing, and renewable energy businesses in South Africa, Europe, Asia, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives