The board of Sygnia Limited (JSE:SYG) has announced that it will be increasing its dividend on the 28th of June to R0.55. The announced payment will take the dividend yield to 6.8%, which is in line with the average for the industry.

View our latest analysis for Sygnia

Sygnia's Earnings Easily Cover the Distributions

While it is always good to see a solid dividend yield, we should also consider whether the payment is feasible. Before this announcement, Sygnia was paying out 75% of earnings, but a comparatively small 49% of free cash flows. In general, cash flows are more important than earnings, so we are comfortable that the dividend will be sustainable going forward, especially with so much cash left over for reinvestment.

Over the next year, EPS could expand by 21.5% if the company continues along the path it has been on recently. If the dividend continues growing along recent trends, we estimate the payout ratio could reach 83%, which is on the higher side, but certainly still feasible.

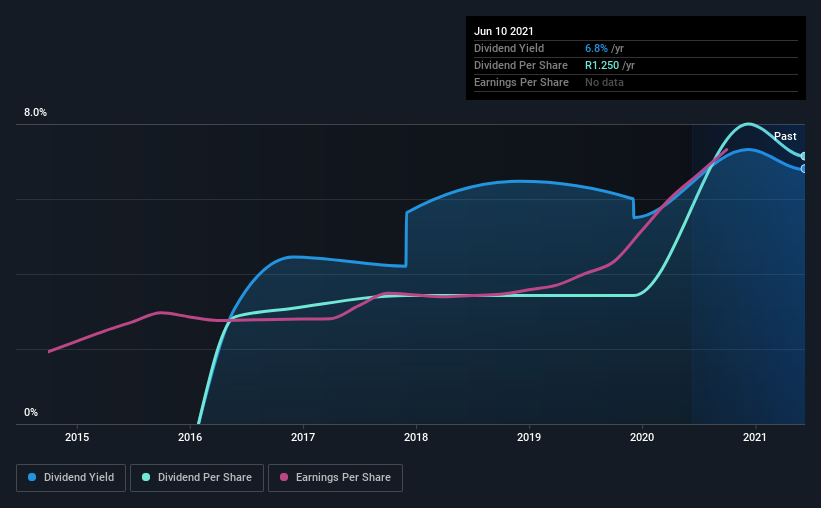

Sygnia's Dividend Has Lacked Consistency

Looking back, Sygnia's dividend hasn't been particularly consistent. If the company cuts once, it definitely isn't argument against the possibility of it cutting in the future. The dividend has gone from R0.50 in 2016 to the most recent annual payment of R1.25. This implies that the company grew its distributions at a yearly rate of about 20% over that duration. Sygnia has grown distributions at a rapid rate despite cutting the dividend at least once in the past. Companies that cut once often cut again, so we would be cautious about buying this stock solely for the dividend income.

Sygnia's Dividend Might Lack Growth

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. Sygnia has impressed us by growing EPS at 22% per year over the past five years. However, Sygnia isn't reinvesting a lot back into the business, so we wonder how quickly it will be able to grow in the future.

Our Thoughts On Sygnia's Dividend

Overall, we always like to see the dividend being raised, but we don't think Sygnia will make a great income stock. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. This company is not in the top tier of income providing stocks.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For example, we've picked out 2 warning signs for Sygnia that investors should know about before committing capital to this stock. If you are a dividend investor, you might also want to look at our curated list of high performing dividend stock.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About JSE:SYG

Sygnia

A financial services group, provides investment management and administration services to institutional and retail clients primarily in South Africa.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives