- South Africa

- /

- Diversified Financial

- /

- JSE:SBP

Is Now The Time To Put Sabvest Capital (JSE:SBP) On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

So if you're like me, you might be more interested in profitable, growing companies, like Sabvest Capital (JSE:SBP). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for Sabvest Capital

Sabvest Capital's Improving Profits

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So EPS growth can certainly encourage an investor to take note of a stock. You can imagine, then, that it almost knocked my socks off when I realized that Sabvest Capital grew its EPS from R4.07 to R19.27, in one short year. Even though that growth rate is unlikely to be repeated, that looks like a breakout improvement. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. I note that Sabvest Capital's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. The good news is that Sabvest Capital is growing revenues, and EBIT margins improved by 30.6 percentage points to 92%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

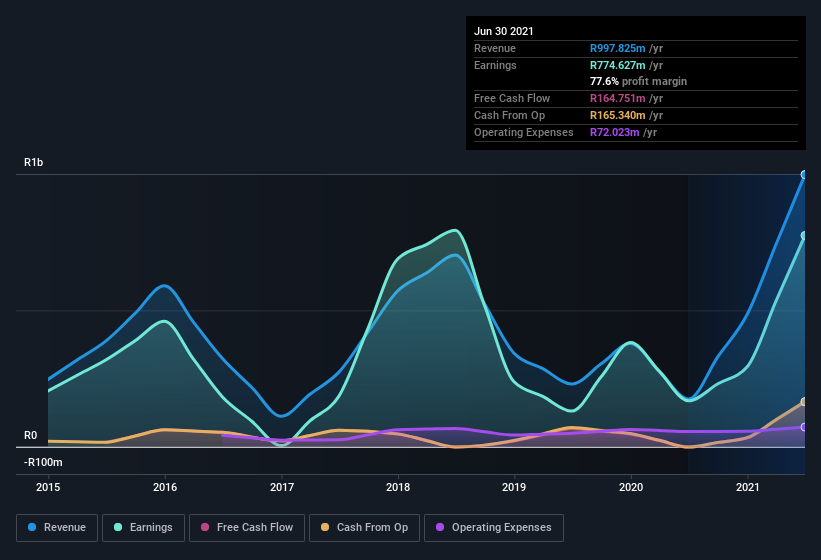

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Since Sabvest Capital is no giant, with a market capitalization of R2.4b, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Sabvest Capital Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

First things first; I didn't see insiders sell Sabvest Capital shares in the last year. But the really good news is that Executive Director Leon Rood spent R5.6m buying stock stock, at an average price of around R43.98. To me that means at least one insider thinks that the company is doing well - and they are backing that view with cash.

Should You Add Sabvest Capital To Your Watchlist?

Sabvest Capital's earnings have taken off like any random crypto-currency did, back in 2017. If you're like me, you'll find it hard to ignore that sort of explosive EPS growth. And in fact, it could well signal a fundamental shift in the business economics. For me, this situation certainly piques my interest. Another important measure of business quality not discussed here, is return on equity (ROE). Click on this link to see how Sabvest Capital shapes up to industry peers, when it comes to ROE.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Sabvest Capital, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About JSE:SBP

Sabvest Capital

A private equity and venture capital firm specializing in early venture, mid venture, late venture, emerging growth, growth capital, special situation and management buyouts.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives