- South Africa

- /

- Diversified Financial

- /

- JSE:REM

Remgro Limited's (JSE:REM) Price Is Out Of Tune With Revenues

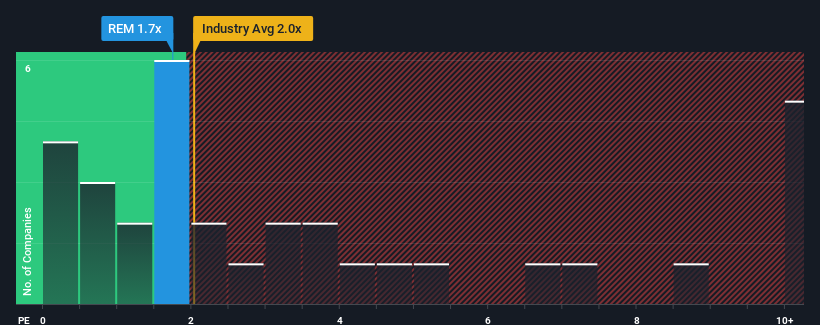

With a median price-to-sales (or "P/S") ratio of close to 1.7x in the Diversified Financial industry in South Africa, you could be forgiven for feeling indifferent about Remgro Limited's (JSE:REM) P/S ratio, which comes in at about the same. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Remgro

What Does Remgro's P/S Mean For Shareholders?

There hasn't been much to differentiate Remgro's and the industry's revenue growth lately. Perhaps the market is expecting future revenue performance to show no drastic signs of changing, justifying the P/S being at current levels. Those who are bullish on Remgro will be hoping that revenue performance can pick up, so that they can pick up the stock at a slightly lower valuation.

Want the full picture on analyst estimates for the company? Then our free report on Remgro will help you uncover what's on the horizon.How Is Remgro's Revenue Growth Trending?

In order to justify its P/S ratio, Remgro would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a decent 4.7% gain to the company's revenues. Still, lamentably revenue has fallen 23% in aggregate from three years ago, which is disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 0.1% as estimated by the only analyst watching the company. That's not great when the rest of the industry is expected to grow by 16%.

With this information, we find it concerning that Remgro is trading at a fairly similar P/S compared to the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

What We Can Learn From Remgro's P/S?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It appears that Remgro currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If the declining revenues were to materialize in the form of a declining share price, shareholders will be feeling the pinch.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Remgro you should know about.

If these risks are making you reconsider your opinion on Remgro, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:REM

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives